Yala (YALA) is a Bitcoin-native liquidity protocol that enables Bitcoin holders to earn yield from decentralized finance (DeFi) and real-world assets (RWA) without relinquishing control of their assets. Yala aims to overcome Bitcoin’s core challenges, such as its limited scripting capabilities and scalability constraints, by enhancing its programmability. Its modular architecture includes application, consensus, data availability, execution, and settlement layers, allowing complex financial transactions while preserving Bitcoin’s security model. The protocol leverages over-collateralized BTC-backed liquidity assets and atomic swaps for seamless cross-chain interoperability, transforming Bitcoin from a simple store of value into a foundation for sophisticated financial applications and yield-generating opportunities.

What Is Yala (YALA)?

Yala is a protocol designed to build a comprehensive DeFi infrastructure using Bitcoin’s native assets. By addressing Bitcoin’s limited scripting language and scalability issues, it enables complex transactions with native BTC assets. Yala’s architecture operates with application, consensus, data availability, execution, and settlement layers, maintaining the security of the Bitcoin network. Users deposit BTC into Yala’s Vault modules to mint $YU, a BTC-backed stablecoin. This stablecoin is directed to low-risk investment vehicles like real-world assets (RWA) to generate stable yields. Yala supports cross-chain transactions through atomic swaps and multisig bridges, enabling BTC to be used in Ethereum or other chains’ DeFi ecosystems.

Yala empowers both individual and institutional investors to earn yields without selling their Bitcoin. The $YU stablecoin, backed by BTC through an over-collateralization model, offers a stable value and generates consistent returns via real-world assets (RWA). The protocol ensures asset security with transparent risk management and reliable price data from oracles. Yala transforms Bitcoin from a passive asset into an active engine of global on-chain liquidity, shaping the future of DeFi.

Yala: Bitcoin-Native Liquidity Network

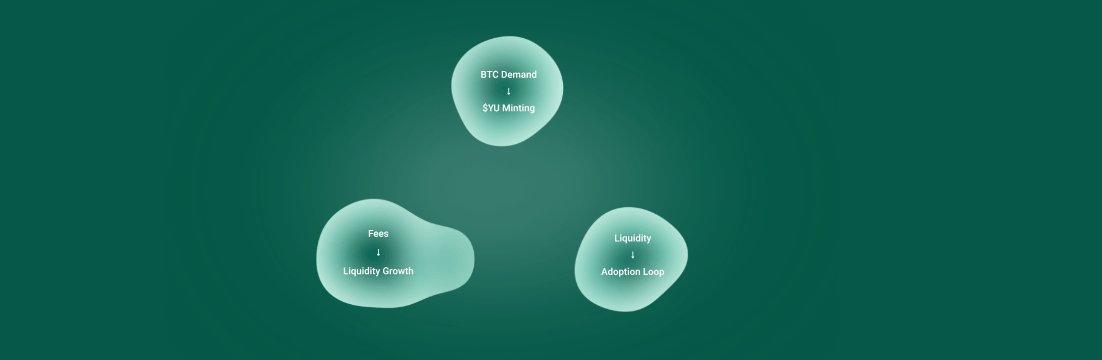

Yala delivers an innovative liquidity solution in DeFi by making Bitcoin’s native assets programmable. The BTC-backed $YU stablecoin provides access to low-risk investment vehicles like real-world assets (RWA). Yala democratizes access to high yields through collective bargaining and enhances capital efficiency with tokenized positions. Investors of all scales can leverage advanced DeFi strategies with Yala.

Liquidity Challenges

DeFi has grown with Bitcoin’s decentralized trust model and Ethereum’s smart contracts, but Bitcoin’s total locked value (TVL) in DeFi is only $2.8 billion compared to its $2.1 trillion market capitalization. This highlights the underutilized potential of Bitcoin in DeFi. Bitcoin’s limited scripting language, lack of Turing completeness, value-blindness, and statelessness hinder complex DeFi applications. Yala addresses these challenges with a modular approach.

Yala Solution

- Access to High Yields: Aggregates individual BTC deposits to unlock exclusive yield opportunities.

- Tokenized Positions: The $YU stablecoin offers liquid and programmable positions in DeFi.

- Cross-Chain Liquidity: Atomic swaps and multisig bridges make BTC usable on other chains.

Protocol Architecture

Yala operates with a state machine based on BTC’s UTXO model, encompassing the following processes:

- Deposit: Users deposit BTC into Yala Vaults to receive the $YU stablecoin.

- Execution: $YU is directed to yield-generating vehicles like real-world assets (RWA). Yala supports cross-chain transactions with atomic swaps and multisig.

- Settlement: Transactions are finalized on the BTC main chain, preserving security and consensus.

$YU Stablecoin

$YU is an over-collateralized stablecoin backed by BTC, maintaining a stable value pegged to the US dollar. Managed by TroveManager, BorrowerOperations, and DebtToken contracts, $YU ensures stability against BTC’s volatility. The Minimum Collateralization Ratio (110%) and other parameters safeguard the system. $YU is directed to low-risk real-world assets (RWA) to generate stable yields.

MetaVault Security Design

MetaVault features a multi-layered security architecture to ensure secure BTC storage. Threshold signature schemes, hardware security modules (HSM), and Cubist’s innovative hardware-based smart contract technology eliminate single points of failure. Transaction validation requires six-block confirmations, and TRM Labs integration ensures regulatory compliance.

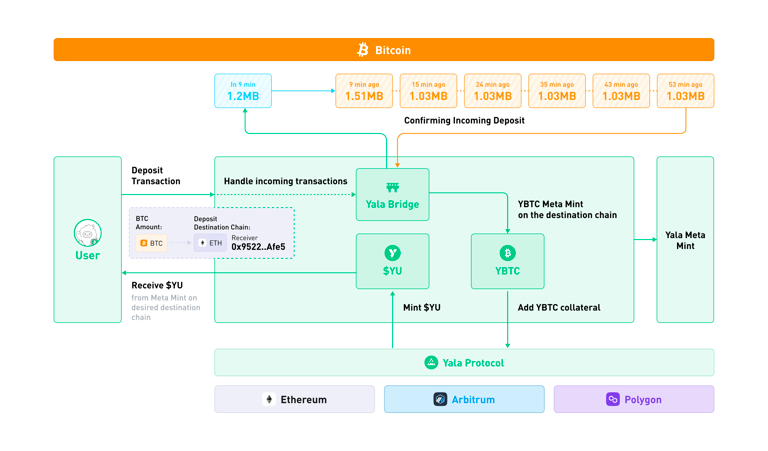

Yala Bridge

The Yala Bridge uses a decentralized notary system and threshold cryptography to transfer BTC to EVM-compatible chains like Ethereum. Users deposit BTC to a P2WSH address and receive yBTC on the target chain. Time-locked recovery paths secure user assets. The bridge supports secure cross-chain transactions via atomic swaps and multisig.

What Is MetaMint and How Does It Work?

MetaMint is a cross-chain protocol that directly converts BTC into the $YU stablecoin on EVM-compatible chains without intermediary steps. With a single click, users transform their BTC into $YU, accessing DeFi opportunities seamlessly. This simplifies Bitcoin holders’ participation in the DeFi ecosystem.

$YALA Tokenomics

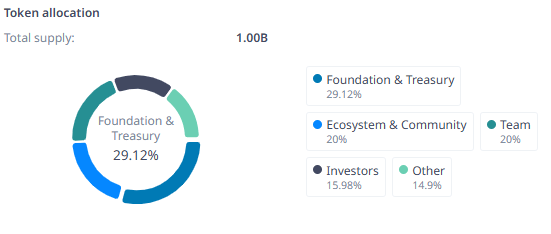

The $YALA token incentivizes participation, secures infrastructure, and enables governance. The total supply distribution is as follows:

- Investors: 15.98% (1-year lock, 18-month quarterly vesting)

- Ecosystem and Community: 20% (45% at TGE, 24-month linear vesting)

- Foundation and Treasury: 29.12% (30% at TGE, 1-year lock, 36-month linear vesting)

- Marketing: 10% (20% at TGE, 1-year lock, 24-month linear vesting)

- Team: 20% (1-year lock, 24-month monthly linear vesting)

- Airdrop: 3.4% (Fully unlocked at TGE)

- Market Makers: 1.5% (Subject to market-making agreements)

Token Utility

- Stability Pool Rewards: Users depositing $YU into the Stability Pool earn $YALA rewards and liquidation collateral shares.

- Cryptoeconomic Security: $YALA secures the notary bridge and LayerZero-based verifier networks.

- Governance: $YALA holders vote on protocol parameters and improvement proposals.

Liquidation Mechanism

Yala’s liquidation system automatically manages vaults with a collateralization ratio below 110%. The Stability Pool absorbs liquidated debt and collateral. Liquidation initiators receive 200 $YU + 0.5% of YBTC as gas compensation. Remaining collateral is returned to the vault owner.

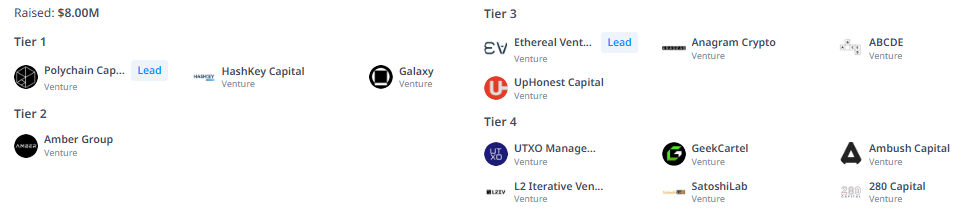

Yala Finance (YALA) Investors

Yala Finance raised $8 million. Investors include Polychain Capital, HashKey Capital, Galaxy, Amber Group, Ethereal Ventures, Anagram Crypto, ABCDE, UpHonest Capital, UTXO Management, GeekCartel, Ambush Capital, L2 Iterative Ventures (L2IV), SatoshiLab, and 280 Capital.

Yala Finance Team

Yala Finance’s founding team, led by Kaitai Chang (Co-Founder) and Vicky Fu (Co-Founder), comprises experts in DeFi and traditional finance. The team brings experience from MakerDAO’s collateral systems, Circle’s stablecoin reserve management, Microsoft’s cloud security, and Capital One’s derivatives trading.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.