One of the most fundamental problems in blockchain technology—scalability—has been a serious obstacle for both developers and institutional users for years. Zilliqa (ZIL) is a public and permissionless blockchain network that directly addresses this issue at the architectural level, aiming to provide high transaction capacity, low latency, and a structure suitable for institutional use.

Zilliqa’s core goal is to build an infrastructure where performance increases rather than decreases as the network grows, while achieving this without compromising security. In line with this objective, Zilliqa positions itself as one of the first projects to place sharding at the center of the blockchain.

How Did Zilliqa (ZIL) Come About?

The foundational ideas of Zilliqa were laid in 2016. Prateek Saxena and his team at the National University of Singapore (NUS) School of Computing published an academic paper demonstrating how a sharding-based blockchain could increase transaction efficiency.

Following this work, Zilliqa Research was officially established in June 2017. The project’s testnet went live in March 2018, and approximately one year later, in June 2019, the mainnet was launched. During this process, Zilliqa evolved from an academically rooted research project into an actively used blockchain network.

As of 2020, staking and yield farming mechanisms were introduced on the network, and the ZIL token began to play a significant role not only for transaction fees but also for network security and governance.

How Does Zilliqa Work? Sharding-Based Architecture

The most important feature that distinguishes Zilliqa from other Layer-1 projects is its fully sharded network architecture. The network is divided into different shards, and each shard processes its own transactions in parallel. This structure enables:

- Transaction capacity to increase as the network grows

- TPS (transactions per second) to scale linearly

- Transaction volume not to degrade performance

Since each shard operates independently, transactions are added to the blockchain as soon as they are processed, without requiring additional confirmation times. This approach makes Zilliqa particularly suitable for high-volume use cases.

Institutional Focus: EVM Compatibility and x-Shards

In recent years, Zilliqa has evolved its infrastructure toward an institutional and developer-friendly model. At the center of this transformation are two key elements: native EVM compatibility and x-Shards.

Native EVM Compatibility

Zilliqa has been updated to be fully compatible with the Ethereum Virtual Machine (EVM). This allows developers to:

- Use popular languages such as Solidity

- Integrate existing Ethereum tools and SDKs

- Easily connect with protocols in the Ethereum ecosystem

What is x-Shards?

x-Shards provides a structure that enables developers and institutions to create customizable, isolated blockchain environments. On these shards:

- Gas fees

- Block times

- Privacy and access levels

can be fully adjusted according to needs.

This structure transforms Zilliqa not only into a Layer-1 but also into a blockchain-as-a-service platform.

Consensus Mechanism and Network Performance

Zilliqa uses a fast and environmentally friendly consensus mechanism. The network is optimized for high-security institutional applications. Its low energy consumption brings it close to the “green blockchain” approach.

During its launch period, the Zilliqa mainnet produced an average of 900 blocks per day, and over time this number has exceeded 2,500 blocks. The network maintains an active ecosystem capable of handling millions of transactions monthly without issues.

What is the Zilliqa (ZIL) Token?

ZIL is the native utility token of the Zilliqa network and is used for the following purposes:

- Paying transaction fees

- Executing smart contracts

- Securing the network through staking

- Participating in governance processes

ZIL stands at the center of both the technical infrastructure’s continuity and the economic incentive mechanisms.

Zilliqa (ZIL) Staking Models

Zilliqa offers two different staking approaches:

Classic Staking

Users lock their ZIL tokens with a validator to earn rewards. In this process, tokens remain locked and contribute to network security.

Liquid Staking

In the liquid staking model, users can continue using their staked assets in additional DeFi activities. This allows them to earn staking rewards while maintaining liquidity.

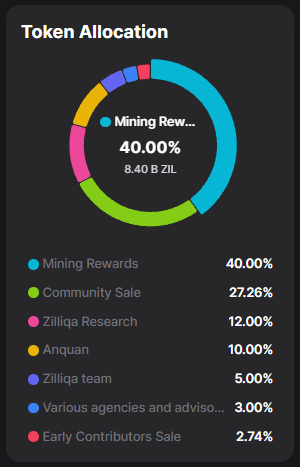

Zilliqa (ZIL) Tokenomics

The ZIL supply has been distributed with long-term network sustainability and incentive balance in mind:

- Mining Rewards: 40%

- Community Sale: 27.26%

- Zilliqa Research: 12%

- Anquan: 10%

- Zilliqa Team: 5%

- Advisors and agencies: 3%

- Early Contributors: 2.74%

This structure aims to balance both early contributors and long-term network participants.

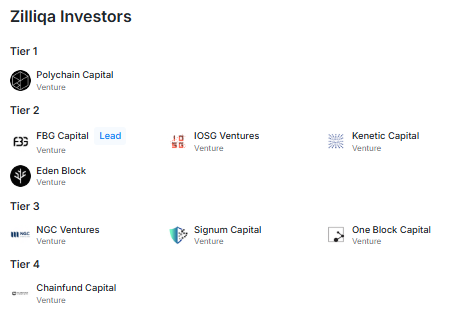

Zilliqa (ZIL) Investors

Zilliqa has received support from both crypto-focused and traditional venture capital funds across different investment rounds. These investors reflect confidence in the project’s institutional vision and technical infrastructure.

Tier 1

- Polychain Capital

Tier 2

- FBG Capital

- IOSG Ventures

- Kenetic Capital

- Eden Block

Tier 3

- NGC Ventures

- Signum Capital

- One Block Capital

Tier 4

- Chainfund Capital

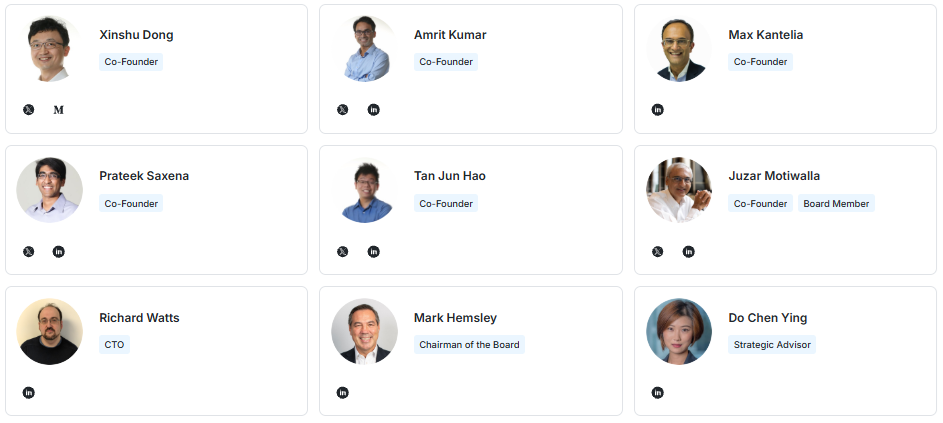

Zilliqa (ZIL) Team

Behind Zilliqa is a team with a strong academic background and high industry experience. The project holds an exceptional position in the field due to its origins in university research.

Founding Team

- Xinshu Dong – Co-Founder

- Amrit Kumar – Co-Founder

- Max Kantelia – Co-Founder

- Prateek Saxena – Co-Founder

- Tan Jun Hao – Co-Founder

- Juzar Motiwalla – Co-Founder

Management and Advisors

- Mark Hemsley – Chairman of the Board

- Richard Watts – CTO

- Do Chen Ying – Strategic Advisor

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.