The crypto market has declined more than 20% since the start of the year. As February begins, investors are split. Some argue that prices have already hit the bottom, while others believe the bear market still has room to continue. In reality, there is no perfect time to buy the dip. However, analytics platform Santiment has shared some insights. Their data shows when fear may turn into opportunity. These signals are critical for filtering out market noise.

When Crowds Throw in the Towel

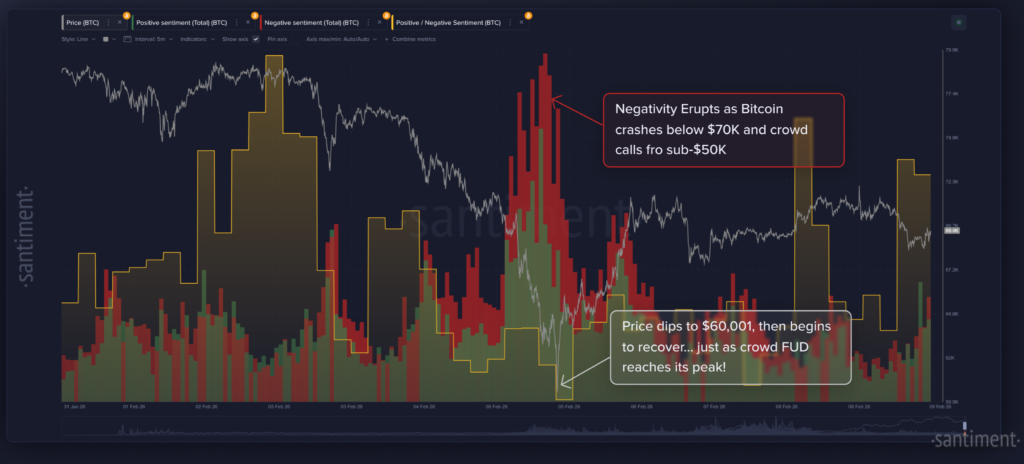

Extreme pessimism on social media is often a precursor to a rebound. When fear spreads, prices tend to bottom out. Santiment recommends monitoring FUD waves closely. In the past, when Bitcoin dropped to $60,001, panic reached its peak. Immediately after, prices jumped 19% within 24 hours. Rising negative sentiment can actually signal a buying opportunity. Pay attention when the language shifts from “dip” to “crash,” as it usually shows retail investors are capitulating. When fear spreads on social media, it often signals that the crypto dip is approaching.

MVRV Ratio and On-Chain Insights

On-chain data shows that the MVRV ratio is crucial. This metric measures whether recent buyers are in profit or loss. When MVRV enters the “strongly undervalued” zone, new investors are underwater, often preceding a market rebound. Santiment views assets in this zone as potential opportunities. Mathematically, selling pressure has usually reached saturation. Still, this data does not guarantee outcomes; investors should act according to their risk tolerance.

“MVRV indicates that when assets reach the ‘strongly overvalued’ zone, heavy investment can be risky. On the other hand, when in the ‘strongly undervalued’ zone, opportunities become clearer. When recent buyers are at a loss, the market may signal a rebound.”

Strategy and Timeframes

The concept of a “dip” differs for each investor. Short-term traders may see a 1.7% drop as an opportunity, while most focus on weekly charts. Santiment advises relying on objective data rather than intuition. These insights clarify when fear-driven sell-offs may be ending. The bear market may still exert pressure, so each decision should align with strategic goals. Opportunity cost matters here.

Ultimately, the decision to buy or hold depends on your risk tolerance, strategy, and time horizon. The market is still under pressure, and the bear market could continue. When fear peaks without panic, that moment might be the right time to buy. But sensing it comes from human judgment as much as data; that’s where the subtle differences emerge.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.