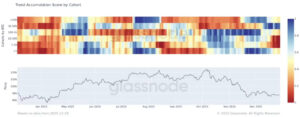

The main buyers behind Bitcoin’s recent price movements are becoming increasingly clear. On-chain data analytics firm Glassnode reports that the current buying pressure is largely driven by whales. According to analysts, the demand capable of pushing prices higher is not coming from retail investors, but from large wallets holding significant amounts of Bitcoin.

Glassnode: Buying Pressure Comes From Whales

According to on-chain data shared by Glassnode analysts, wallets holding more than 1,000 BTC are currently the main buyers in the market. This group continues to accumulate despite short-term price fluctuations and is described as being more resilient to market uncertainty. The approach of large wallets suggests that recent pullbacks are being viewed as buying opportunities.

Analysts emphasize that the existing upside potential is primarily supported by this group of large investors, while retail investors remain more cautious on the buying side due to heightened risk perception. This shows that buying pressure is predominantly coming from whales, giving them a decisive role in current price movements.

“They Have Been Buying Since $80,000”

Glassnode experts note that whales accelerated their Bitcoin purchases starting from the $80,000 level seen toward the end of November. The analysts stated:

“These whales began aggressive accumulation after Bitcoin bottomed around $80,000 in late November. They continue to buy even while prices remain below $90,000.”

This data indicates that large investors are positioning based on long-term expectations rather than short-term price action. Their tendency to view price declines as opportunities is interpreted as a significant signal for the market.

Glassnode’s analysis also highlights that market volatility has been putting pressure on retail investors. According to analysts, individual investors—discouraged by price fluctuations and acting impatiently—have largely stepped away from the market in recent periods. As a result, buying power in Bitcoin is increasingly shifting toward institutional and large-scale investors. Experts note that while this structure resembles past market cycles, it also contains some important differences.

“Whales Holding Over 10,000 BTC Have Slowed, but Are Not Selling”

Glassnode data shows that the largest whales, holding more than 10,000 BTC, have slowed the pace of their purchases. However, analysts underline that this group has not shown any signs of selling.

Glassnode experts commented on this situation as follows:

“Whales holding over 10,000 BTC may have eased their buying activity, but they are not showing any signs of selling. This differs from the heavy selling pressure observed when Bitcoin was trading above the $100,000 level.”

This assessment suggests that strong investors are maintaining their positions at current price levels and continuing to show confidence in the market.

Overall Assessment

The on-chain data shared by Glassnode clearly shows that the main buyers in Bitcoin are large whales. Ongoing accumulation since the $80,000 level indicates that these investors are acting with long-term expectations and treating price pullbacks as opportunities. Despite the cautious stance of retail investors, the fact that whales are refraining from selling and maintaining their positions stands out as a supportive factor for Bitcoin’s price in the medium to long term. Going forward, the behavior of these large wallets will continue to be a key determinant of market direction.