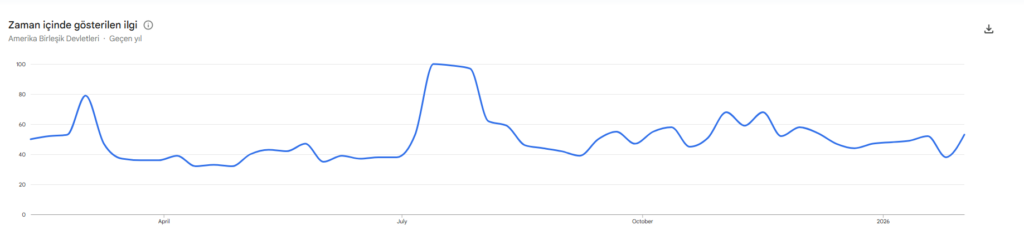

Crypto market downturns are clearly reflected in investor behavior. According to Google Trends, worldwide searches for “crypto” are hovering near the lowest levels of the past year. The current index stands at 30, where 100 represents the peak of interest.

This level marks the weakest search interest since August 2025, when the total crypto market capitalization exceeded $4.2 trillion. Today, it stands around $2.4 trillion.

US Search Data Diverged, Global Interest Remains Weak

Google Trends data shows that global search interest has declined. In the US, interest peaked at 100 in July, fell below 37 in January, and partially recovered to 56 in early February. The yearly low of 32 was recorded during the April 2025 market crash, driven by US President Donald Trump’s tariff policies.

Globally, the 12-month low is 24, and current figures remain close to this range.

Trading Volume Shrinks, Liquidity Pulls Back

Not only search interest but also market activity has weakened significantly. According to CoinMarketCap, total crypto trading volume fell from over $153 billion on January 14 to about $87.5 billion by Sunday.

This contraction reflects investors’ rapidly declining risk appetite.

Google search data is often considered an early signal of market sentiment and is interpreted alongside other indicators like the Crypto Fear & Greed Index.

Fear Index at Levels Seen During 2022 Terra Collapse

The Crypto Fear & Greed Index fell to 5 last Thursday, marking one of the historical lows, and rose slightly to 8 by Sunday. Both readings still indicate “extreme fear.”

Investor sentiment is now almost identical to the levels seen after the collapse of the Terra ecosystem and its algorithmic stablecoin in 2022. The Terra crash triggered cascading liquidations, which intensified the bear market at the time.

Why Is Bitcoin Falling? Has BTC Entered Bear Territory?

Social Metrics Show Negative Sentiment Peaking

On social media and community platforms, the mood has become even more tense. According to Santiment, investors are currently relying on collective sentiment to time their entries.

The report published Friday states:

The ratio of positive to negative comments has collapsed, with negative mentions reaching their highest point since December 1. Investors are now largely indifferent to positive news, focusing solely on understanding where the market might truly bottom. This indicates that short-term uncertainty persists while overall market pressure has not yet fully eased.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.