The global cryptocurrency market has gained strong upward momentum following last week’s sharp decline. The total market capitalization has risen by 5% in the past 24 hours, reaching $3.58 trillion. Bitcoin climbed back above $107,000, while Ethereum, Solana, XRP, and other major altcoins posted double-digit gains. This sharp rally stems from a combination of macroeconomic factors and on-chain market dynamics. Here are the five key drivers behind the market’s rise:

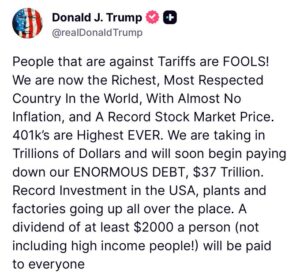

Trump’s $400 Billion “Tariff Dividend” Plan

One of the main catalysts behind the rally is former U.S. President Donald Trump’s “tariff dividend” proposal. In his latest speech, Trump announced plans to redistribute part of the U.S. trade tariff revenues to American citizens. Under this plan, every citizen — except those in high-income brackets — would receive a direct payment of $2,000.

This measure is expected to inject over $400 billion in liquidity into the U.S. economy. The prospect of economic expansion has boosted risk appetite, drawing investors back into crypto assets. Analysts believe this policy could have a similar effect to the 2021 stimulus packages, when a significant portion of government checks flowed directly into Bitcoin and altcoin markets. Many investors now expect the same pattern to repeat, with new liquidity potentially flowing into Bitcoin, Ethereum, and other digital assets, fueling optimism and buying pressure.

Confidence Boosted by the End of the U.S. Government Shutdown

Another major factor supporting the market is the progress toward resolving the 40-day U.S. government shutdown. Over the weekend, the Senate surpassed the 60-vote threshold needed to temporarily reopen and fund the government. This development sent a strong signal that political uncertainty is beginning to fade.

Experts highlight that ending the shutdown is crucial not only for public services and government operations, but also for the resumption of key economic data releases. In recent weeks, the absence of reports such as inflation (CPI), unemployment, and production data had increased market uncertainty. Now, with the government reopening, investors can gain clearer insights into the true state of the U.S. economy, paving the way for more stable price discovery and market conditions.

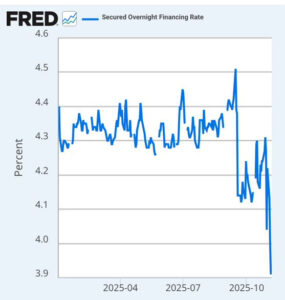

Falling SOFR Rates Support Risk Assets

On the macroeconomic front, the Secured Overnight Financing Rate (SOFR) — a benchmark for short-term borrowing costs between banks — has fallen to its lowest levels in recent years. Lower SOFR means cheaper funding costs and more liquidity entering the financial system.

This decline in SOFR has encouraged investors to take on more risk, accelerating capital inflows into both stocks and cryptocurrencies. Analysts note that if SOFR remains low, it could lay the foundation for a medium-term crypto bull market, as cheaper borrowing costs often drive increased leverage and trading activity in crypto derivatives.

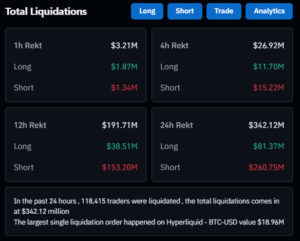

Short Liquidations Accelerate the Rally

Bitcoin’s surge above $106,000 triggered a wave of liquidations in the futures market. Over 118,000 traders lost their positions in the past 24 hours, with $342 million in short positions liquidated overall. The largest single liquidation occurred on the decentralized derivatives platform Hyperliquid, totaling $18 million.

This sparked a classic short squeeze, amplifying upward momentum as forced buybacks pushed prices higher. On-chain data also shows that whales accumulated roughly 22,000 BTC over the past 48 hours, further fueling the rally.

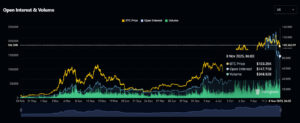

Rising Trading Volumes and Open Interest

Open interest in crypto derivatives rose by 5%, reaching $148 billion, signaling renewed confidence and leverage in the market. Spot trading volume also increased by 40% within 24 hours, with notable inflows of USDT to exchanges such as Binance, Coinbase, and OKX.

On-chain metrics reveal a 12% increase in new wallet addresses, with active addresses climbing to a three-week high, confirming participation from both retail and institutional investors.

Liquidity-Driven Risk Appetite Returns

The convergence of all these factors has created a “risk-on” atmosphere not seen in months. Trump’s economic stimulus plan, the end of the government shutdown, falling interest rates, and large-scale short liquidations have together generated strong upward momentum in crypto markets.

Analysts point to $110,000 as a key resistance level for Bitcoin a critical threshold for confirming the sustainability of this rally. If BTC breaks above it, a new bullish wave across the broader market could follow. However, experts also caution that excessive leverage and potential corrections remain risks investors should monitor closely.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.