Despite a positive start yesterday, market sentiment has weakened. The total crypto market cap (TOTAL) and Bitcoin prices declined over the past 24 hours, confirming weakening momentum. Meme coin SPX was the biggest loser among cryptocurrencies.

Gate.io announced the presale of Pump.fun’s PUMP token with a $600 million target set for July 12. However, all announcements were quickly removed. Meanwhile, Bit Digital (BTBT) sold all of its Bitcoin holdings and shifted its treasury entirely to Ethereum. The company now holds 100,603 ETH worth $254.8 million, making it one of the largest publicly listed ETH holders.

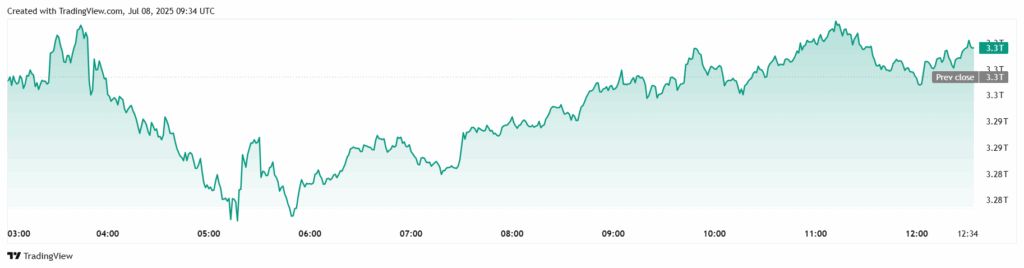

Market Cap and Technical Levels in Motion

The total market cap dropped by $20 billion in the past day, falling to $3.30 trillion. Since July 3, TOTAL has been trading within a narrow range between $3.35 trillion resistance and $3.27 trillion support. This reflects uncertainty among market participants.

If buying momentum strengthens, the $3.35 trillion resistance could be broken, potentially pushing the market cap to $3.44 trillion. However, this scenario requires a notable increase in buying activity. Conversely, if selling pressure rises, TOTAL may fall below the support level to $3.22 trillion, leading to broader market losses.

Trump’s Tariffs and Market Impact

Bitcoin price declined 1% today to $108,206. Interestingly, daily trading volume rose by 15% to $44 billion, indicating rising sell pressure in the market. A falling price coupled with increasing volume suggests panic selling by investors.

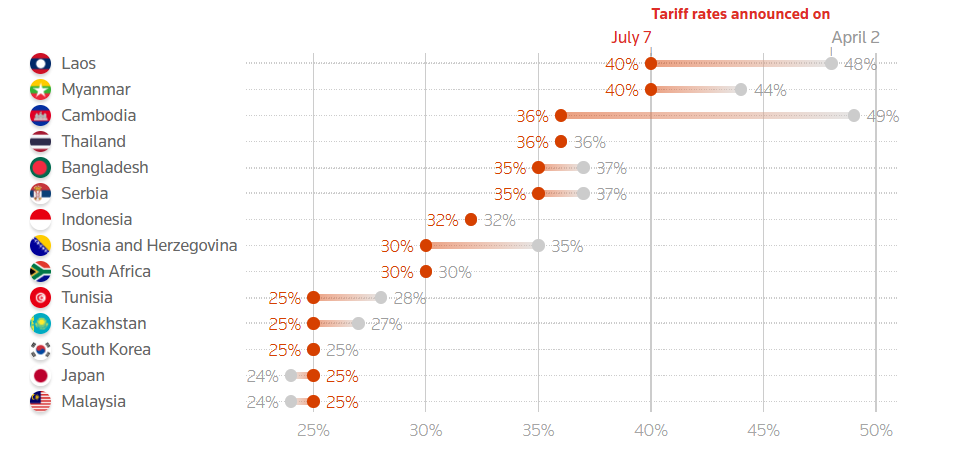

On July 7, U.S. President Donald Trump sent letters announcing new tariffs between 25% and 40% to 14 countries. Initial letters were sent to South Korea and Japan, followed by similar messages to 12 more countries, including Tunisia, Kazakhstan, Serbia, Bosnia, Myanmar, Laos, Bangladesh, Malaysia, Cambodia, Thailand, Indonesia, and South Africa. Trump emphasized concerns over trade deficits and warned of additional tariffs if retaliation occurred.

Economist Peter Schiff described Trump’s action as a fundamental misunderstanding of trade. According to Google Finance, crypto-related stocks like MicroStrategy and Robinhood declined, with Bitcoin mining stocks suffering even greater losses.

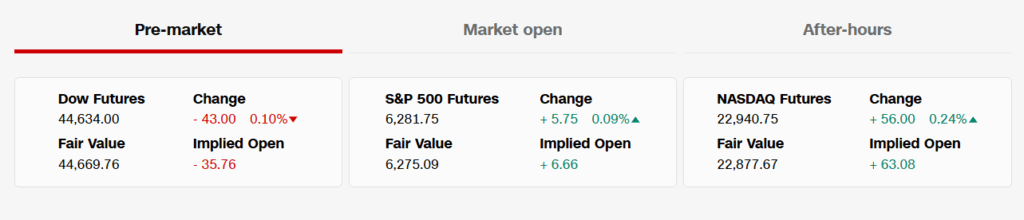

The tariffs also affected U.S. stock markets. CNN data showed the Dow Jones fell by 422 points, the S&P 500 by nearly 50 points, and NASDAQ by 189 points—indicating a correlation between market volatility and tariff news.

In the past, the U.S.–China trade war had pushed Bitcoin below $80,000. The new tariffs are expected to take effect on August 1. In addition, reduced expectations of a Fed rate cut further reinforce the downward trend.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.