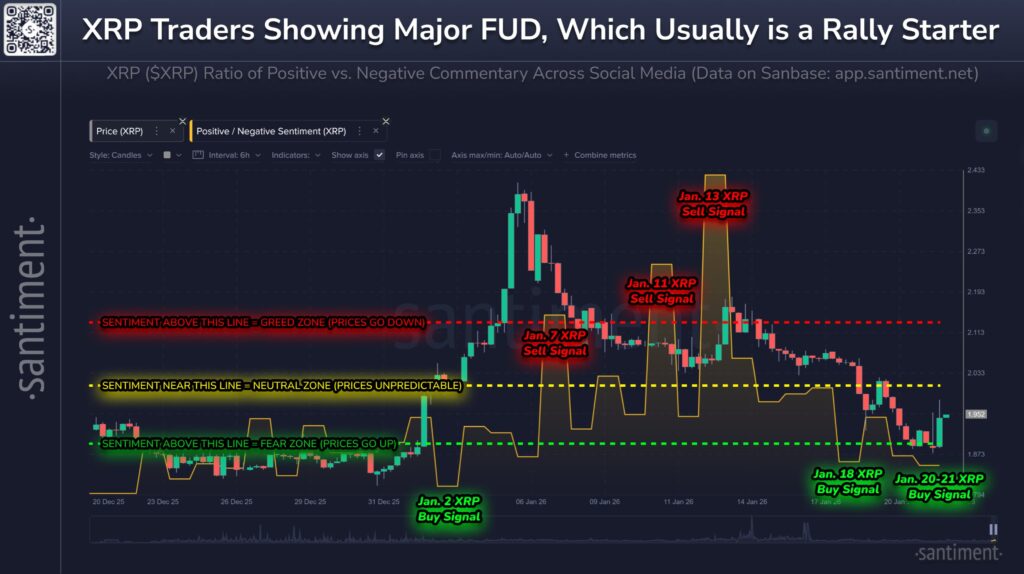

XRP has dropped roughly 20% from its early 2026 highs, entering what Santiment defines as the “extreme fear” zone. Retail investor sentiment has hit levels historically associated with short-term rebounds, signaling a potential buying opportunity.

Retail Fear Signals a Contrarian Move

On January 20, Santiment reported that XRP’s positive-to-negative sentiment ratio fell below 1.873, and it has continued sliding to around 1.794. This reflects growing pessimism among retail investors, who remain wary of the token’s short-term prospects. However, analysts view this extreme fear as a contrarian signal, noting that past patterns often show prices rebounding when sentiment hits these lows.

“Historically, high levels of bearish commentary tend to trigger rallies. Prices often move opposite to retail expectations,” Santiment noted.

The current decline comes as XRP struggles to stay above the $2 psychological level, intensifying bearish sentiment. Yet, this setup could present an opportunity for traders looking to buy the dip.

ETF Outflows Increase Short-Term Pressure

The decline coincides with $53 million net outflow from U.S. spot XRP ETFs on January 21. While this adds pressure, past data shows that ETF-driven outflows don’t always trigger extended drops and can sometimes create accumulation points.

Historical Patterns Suggest Possible Upside

Historically, when sentiment dips below 1.873, XRP has bounced. In early January 2026, XRP recovered from a Q4 2025 drop of 30%, surging 29% to $2.41. A similar pattern repeated later in January, showing that extreme fear often aligns with short-term price surges.

Why This Level Matters

XRP currently trades at $1.94, marking a slight recovery from its weekly low of $1.80, though it remains 7.5% down for the week. Market sentiment remains heavily fear-driven, but historical data indicates that such extreme pessimism often precedes short-term rallies. ETF flows and broader market conditions may delay this reaction, yet the setup remains noteworthy for active traders.

Analysts suggest monitoring key levels and sentiment changes closely, as a renewed shift in retail mood could trigger another bounce.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.