While BNB price has shown a slight recovery, could weak network activity and the lack of expected results from Binance Launchpad limit this rise?

BNB Chain’s native token, BNB, has shown signs of resilience after briefly testing the $555 support level by increasing by 4.1% on October 10-11. While BNB price has remained relatively stable since July, the broader altcoin market has lost 15.6%. This performance has positioned BNB as the third-largest cryptocurrency and given it a significant $15 billion market cap advantage over Solana.

Falling Activity on BNB Chain Could Threaten BNB Price

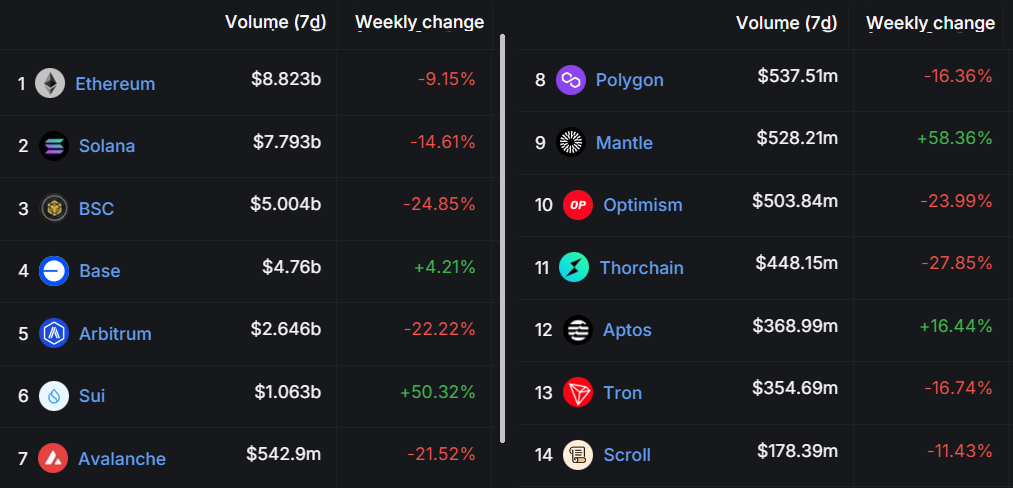

On-chain activity on BNB Chain has dropped by 37% in the past week, raising concerns among investors about the sustainability of BNB’s recent strong performance. Investors are concerned about the popularity of Ethereum’s layer-2 solutions, especially with the launch of the Base network, which offers fast and low-cost integration with leading US exchange and Web3 wallet provider Coinbase.

It can be argued that BNB’s value is partly supported by the privileged launchpad access and transaction fee discounts offered by Binance exchange. However, BNB is widely used in many areas, not only in network transaction fees, but also among the ecosystem’s decentralized applications (DApps) such as trading, staking, yield farming, real-world assets (RWA), lending, launchpads, gaming, and derivatives markets.

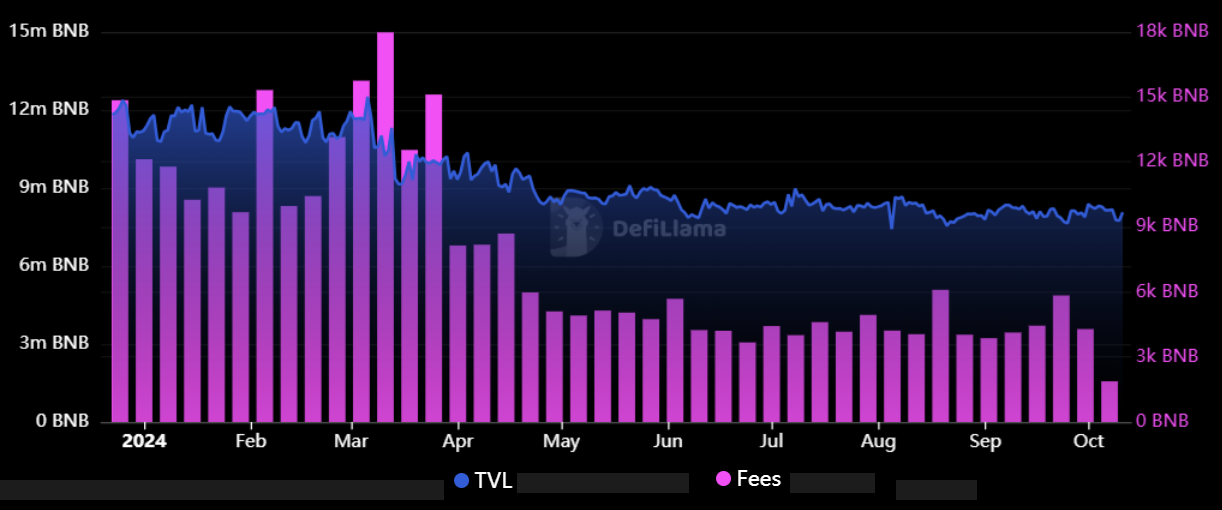

It is important to examine key indicators such as on-chain deposits and network fees to assess whether activity on BNB Chain supports the BNB price.

A Decline in DApp Volume Could Negatively Affect BNB Price

BNB Chain’s total locked value (TVL) currently stands at 8.1 million BNB, unchanged from two months ago. However, network fees fell to their lowest level in four years for the week ending October 7. The total fees accumulated during that period of 1,880 BNB represented a significant 56% decrease compared to the previous week.

This fee decrease is largely due to the 25% decrease in DApp volumes on the BNB Chain, which could be a potential concern for the BNB price outlook. Platforms that performed poorly include PancakeSwap, which saw its weekly volume drop by 25%, and Uniswap, which saw a 22% decrease. For comparison, Ethereum DApps saw a 9% volume decrease during the same period, while Solana saw a 15% decrease in on-chain activity.

Might interest you: What is BabyDoge?

Comparative TVL Situation for BNB Price

Ethereum’s TVL in terms of deposits remained unchanged from two months ago at 19.2 million ETH, while Solana’s network TVL reached a two-year high of 40.9 million SOL. This represents a 26% increase over the last two months. BNB Chain’s activity has been slightly down compared to its peers, which does not support BNB’s recent outperformance against the broader altcoin market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.