As August draws to a close, Bitcoin (BTC) is showing strong signs of recovery, aiming for the $65,000 mark after a challenging start to the month. With BTC/USD bouncing back and up by an impressive 40% from the lows of $45,500, the cryptocurrency market is buzzing with optimism.

Here’s what to keep an eye on this week as Bitcoin navigates its next moves:

Monthly Candle Close on the Horizon

Bitcoin’s monthly close is a significant event, often accompanied by increased volatility. With BTC/USD nearly back to its position at the start of August, traders are keenly watching whether Bitcoin can maintain its momentum and push past the strong resistance levels just below the all-time high. This week could be crucial as Bitcoin attempts to break free from its six-month consolidation phase.

Potential for a Breakout

With Bitcoin’s price action consolidating for nearly half a year since its last all-time high, traders are hoping for a breakout. The current consolidation is the longest since Bitcoin hit its peak in mid-March. Historically, such long consolidation periods have led to significant price movements, either up or down, making this week’s developments particularly important.

Macroeconomic Data and Market Sentiment

The end of the week will see the release of key macroeconomic data, which could influence Bitcoin’s price movements. Given the increasing risk aversion among short-term holders, any unexpected economic news could lead to a sell-off or a buying frenzy, depending on its nature. Meanwhile, market sentiment has moved back to a neutral position, indicating a balanced outlook among investors.

Might interest you: New Developments in FTX’s Creditor Payment Plan!

Mining Fundamentals Look Strong

Bitcoin’s mining fundamentals remain robust, with a modest uptick in mining difficulty expected in the coming days. This is a positive sign for the network’s health and suggests that miners are confident in Bitcoin’s long-term prospects. A healthy mining environment supports the underlying security of the Bitcoin network, which is crucial for maintaining investor confidence.

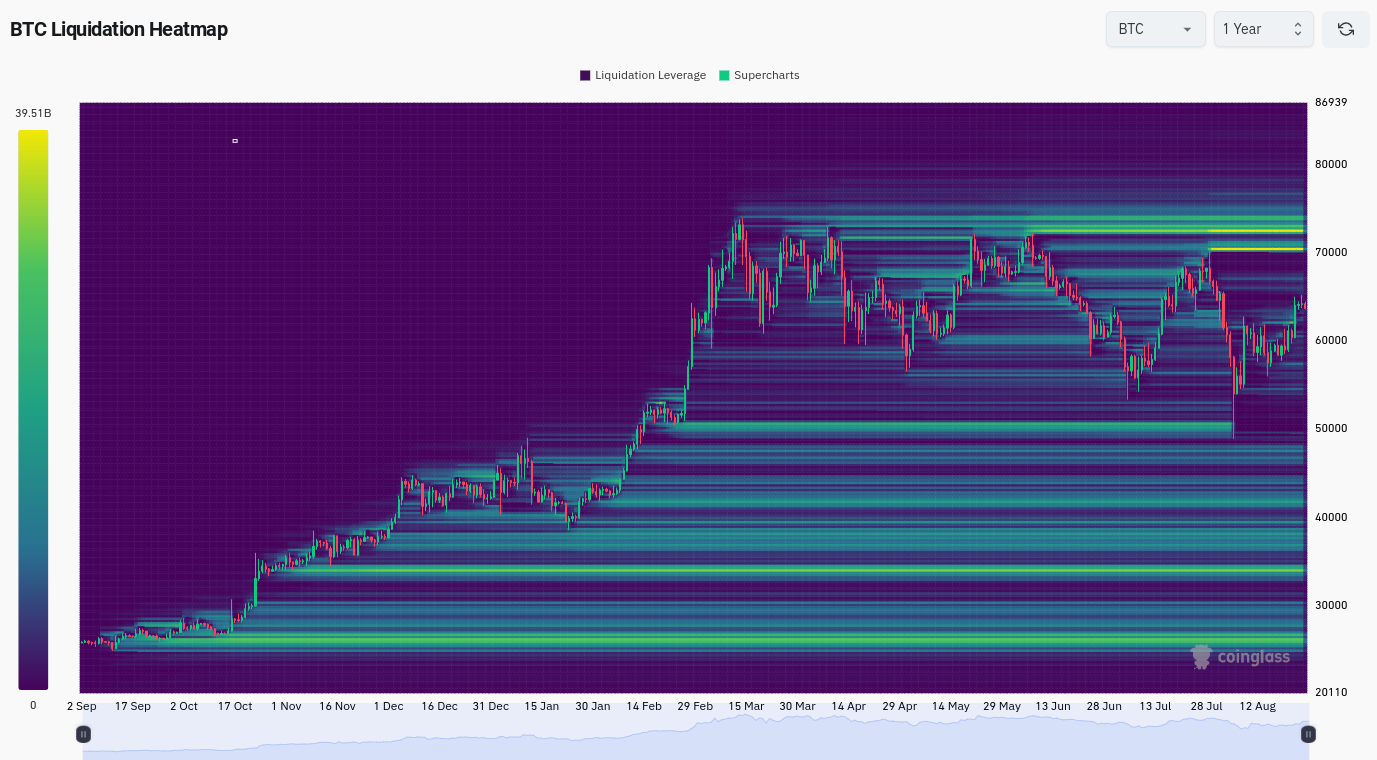

Resistance Levels and Liquidity Insights

Current order book data indicates significant resistance above the current BTC price, creating a challenging environment for any upward movement. For Bitcoin to push towards its all-time highs, it will need to overcome this “wall of asks.” Traders are watching closely to see if there’s enough buying momentum to push through these resistance levels.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.