Cryptocurrency exchange Bybit announced that it has purchased 36,893 $ETH (87.5 million USD) through OTC in the past 3 hours. This move indicates that the exchange has begun repaying its debts in $ETH. Following the liquidation of 570.89 million USD worth of long positions in the last 24 hours, Bybit has swiftly started paying off institutional loans with $ETH, signaling a strategic shift in its liquidity management.

Bybit’s Liquidity Management and Debt Repayment Strategy

Bybit’s recent purchase of $ETH highlights its efforts to manage liquidity and repay debts amid ongoing market volatility. The liquidation of significant long positions, worth 570.89 million USD, shows the exchange’s cautious approach as it navigates through market fluctuations. Bybit’s actions may be aimed at stabilizing its positions and ensuring more liquidity in the market.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

At the same time, Ethereum’s price movements have also captured attention. Bybit’s large ETH purchase could be seen as an attempt to inject liquidity into the market while influencing Ethereum’s price. This could have important consequences for Ethereum’s short-term price actions as well, with ETH‘s future movements becoming a focal point for traders and investors.

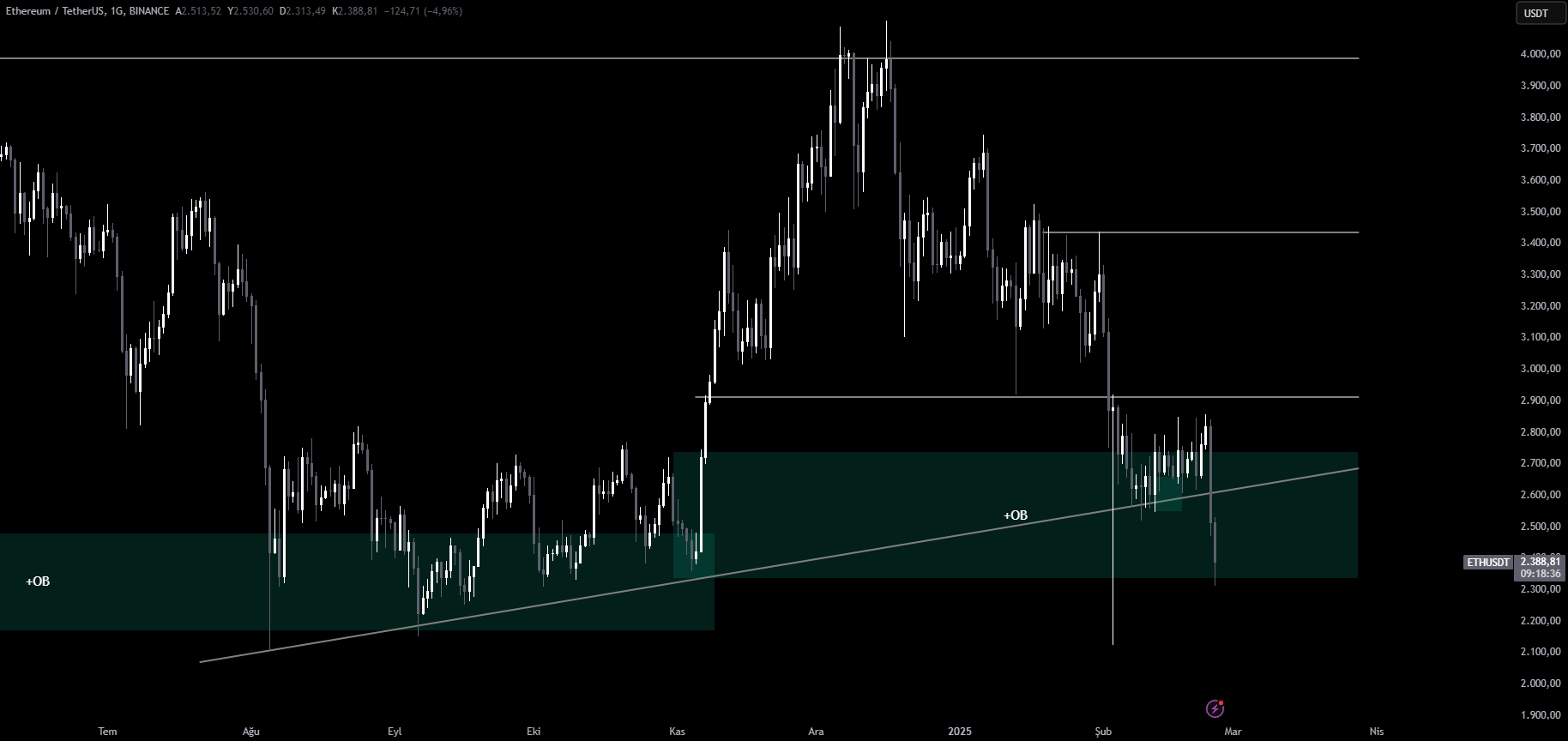

Critical Price Levels for Ethereum: 2000 $ and 2300 $

On the Ethereum front, a significant development has occurred as ETH faced a major drop. ETH fell from 2800 $ to 2300 $, causing concern among investors. If ETH closes below the order block level, the 2000 $ region might become the next target. This level could serve as a psychological support zone, signaling potential buying opportunities for some traders.

If ETH sees an upward move, the descending trendline might act as resistance, making it harder for the price to break through and return to higher levels. These technical signals are closely watched by market participants, as they could indicate the direction Ethereum is heading in the near future.

The drop in ETH‘s price could also have broader implications on the market. If ETH maintains these lower levels, it might directly influence liquidity in the market. Bybit’s decision to repay its debt in $ETH may drive additional demand for the cryptocurrency, potentially changing Ethereum’s price trajectory.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.