Bybit’s market share has bounced back to over 7%, returning to pre-hack levels, despite a broader trend of macro “de-risking” among cryptocurrency investors.

The crypto industry was shaken on February 21 by the largest hack in history, as Bybit lost more than $1.4 billion in liquid-staked Ether (stETH), Mantle Staked ETH (mETH), and other digital assets.

According to a report by crypto analytics firm Block Scholes on April 9, Bybit has steadily recovered its share in the market:

“Since this initial decline, Bybit has steadily regained market share as it works to repair sentiment and as volumes return to the exchange,” the report noted.

Bybit’s proportional market share climbed from a post-hack low of 4% to approximately 7%, signaling a strong and stable recovery in both spot trading volume and market activity.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

The report also emphasizes that the decline in volume was not solely due to the hack but was part of a larger macroeconomic de-risking trend that began even earlier.

$1.4 Billion Laundered Through THORChain

The Bybit hackers took 10 days to launder the stolen funds through the decentralized cross-chain protocol THORChain, as reported.

Despite these efforts, 89% of the hacked amount remains traceable via blockchain analytics.

North Korea’s Lazarus Group Suspected

Blockchain security firms such as Arkham Intelligence have linked the attack to North Korea’s Lazarus Group, citing ongoing fund movement patterns designed to obscure origins.

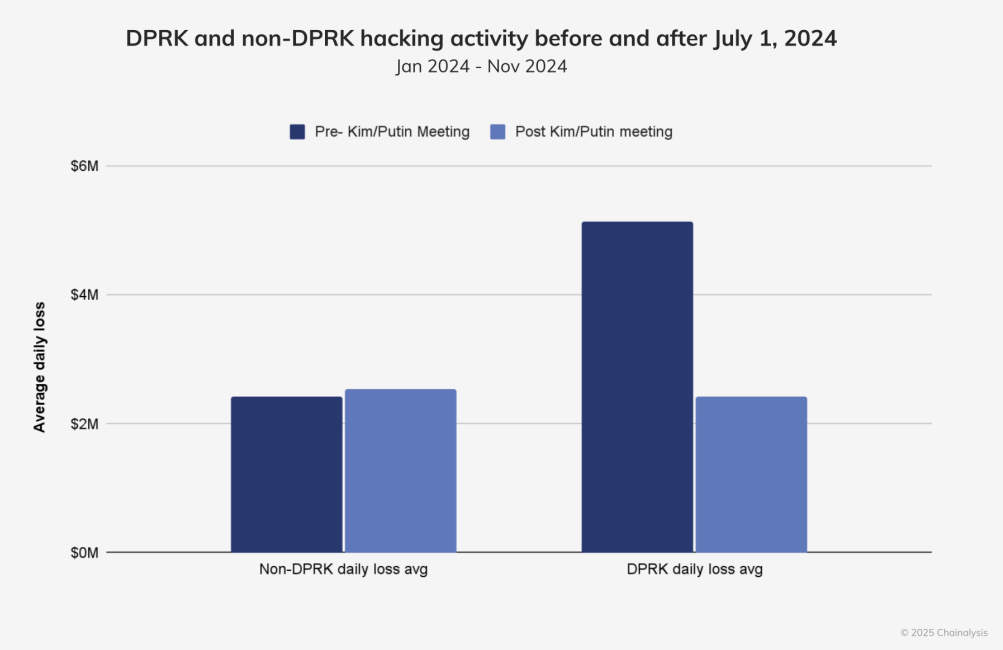

According to Chainalysis, North Korean cyber activity declined sharply after July 1, 2024, even though the first half of the year saw a surge in such exploits.

Eric Jardine, Chainalysis’ Cybercrime Research Lead, commented:

“The slowdown began after the Russia–North Korea summit, which likely shifted DPRK resources toward military involvement in Ukraine. We speculated in our report that this could also include cyber resources. Fast forward to early February—and you have the Bybit hack.”

Industry Analysts Raise Alarm on Exchange Vulnerabilities

The Bybit breach highlights the ongoing vulnerability of centralized exchanges, even those with high security standards.

Meir Dolev, CTO of Cyvers, compared the exploit to other recent attacks such as the $230 million WazirX hack and the $58 million Radiant Capital hack, underlining recurring attack vectors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.