Both traditional and crypto investors are eagerly awaiting the upcoming Personal Consumption Expenditures (PCE) inflation data from the US. This report could ease inflation concerns and increase investor appetite for risk assets like Bitcoin.

The US Bureau of Economic Analysis (BEA) will release the PCE inflation report on March 28, measuring the inflation rate in the prices US consumers pay for goods and services.

Singapore-based digital asset firm QCP Group stated that the PCE data could be a key catalyst for Bitcoin and other risk assets.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

In a Telegram post, QCP Group said:

“As we approach Friday’s quarterly expiry, with the highest open interest in topside strikes above $100K, we don’t expect major volatility driven by options positioning alone. But attention will turn to the PCE inflation print, which could become the next key catalyst.”

April Has Historically Been a Strong Month for Bitcoin!

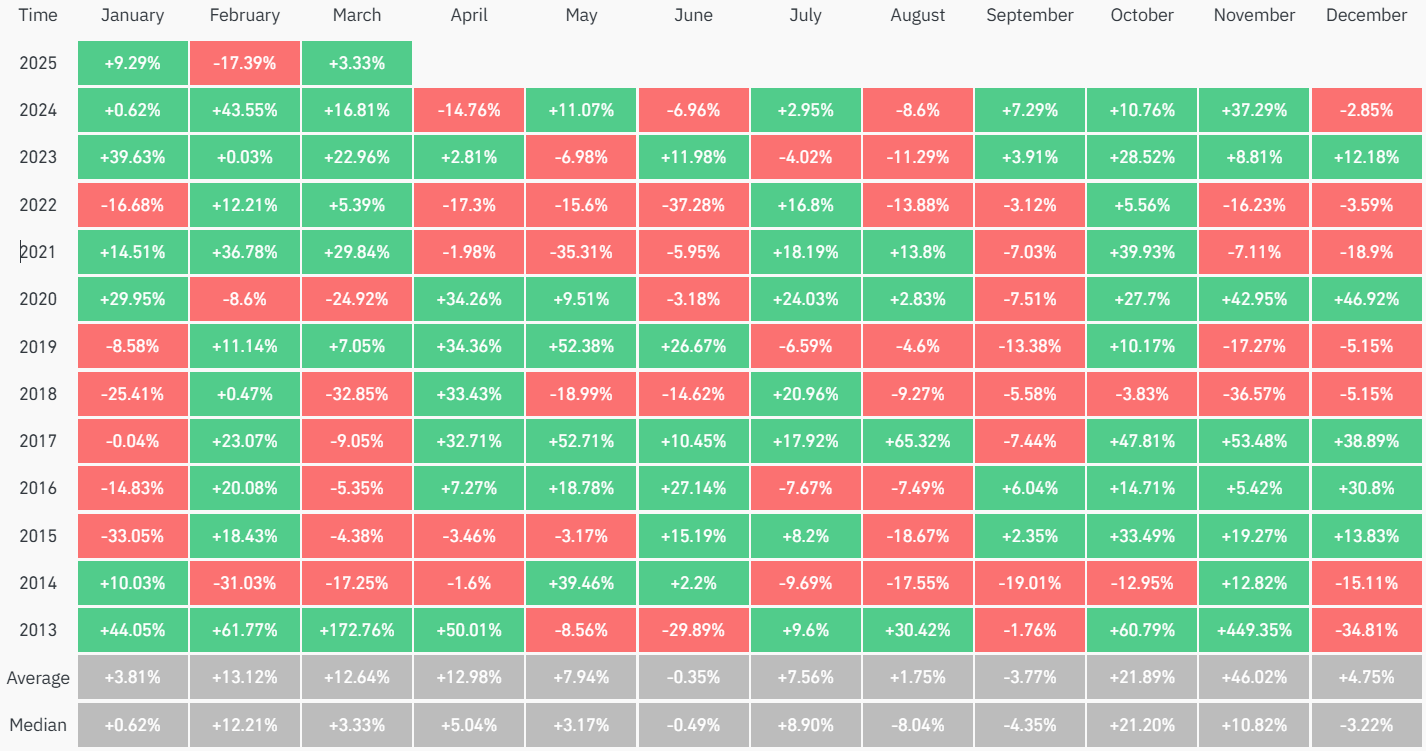

Bitcoin has averaged a 12.9% return in April, making it one of the strongest-performing months historically. CoinGlass data shows that April is among Bitcoin’s best months in terms of price gains.

Can Bitcoin Reach $110,000 Amid Easing Inflation Concerns?

BitMEX co-founder Arthur Hayes predicts that Bitcoin could first reach $110,000 before pulling back to $76,500.

Juan Pellicer, senior analyst at IntoTheBlock, noted that Bitcoin is showing strong signs of recovery, driven by institutional demand and significant investments.

“BTC is showing signs of recovery, driven by growing institutional interest and significant investments from large players. Additionally, the Federal Reserve’s recent monetary easing could further boost liquidity, favoring a price increase in the near term.”

Pellicer emphasized that while market volatility remains a risk, the overall momentum suggests that Bitcoin is more likely to hit the $110,000 target before any potential pullback.

Bitcoin is entering April, a historically strong month for its price performance. If US inflation data meets expectations and the Fed maintains its loose monetary policy, Bitcoin could soar to $110,000. However, global economic uncertainties could also lead to a potential correction down to $76,500.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.