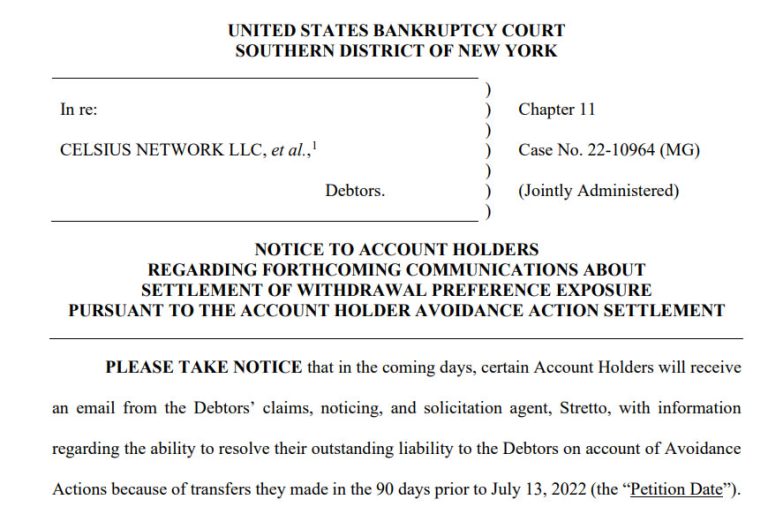

Celsius Aims to Recoup Some Pre-Bankruptcy Withdrawals! Troubled crypto lender Celsius has filed an intent to recoup funds from individuals who withdrew $100,000 or more three months before it filed for bankruptcy.

You might like: 5ire x MCB: Congo with 7 Billion Dollar Deal

Creditors of the bankrupt crypto lender who withdrew large sums from the platform before Celsius filed for bankruptcy may be forced to return some of those funds or face legal action.

On January 9, Celsius bankruptcy administrators filed an intent motion notifying account holders who withdrew more than $100,000 in the 90 days leading up to the date of bankruptcy filing on July 13, 2022 of their obligation to return those amounts.

The motion states that account holders with “withdrawal preference risk” of more than $100,000 who are not excluded parties, did not vote to reject the reorganization plan, and did not waive, may terminate their liability by paying 27.5% of the funds by January 31, 2024.

Those who wish to complete the agreement must submit a selection form indicating their intent by January 25.

Account holders who agree to the deal will be granted immunity from all avoidance actions and distributions under the reorganization plan.

Those who do not agree by the deadline will have their withdrawal preference risks addressed

Those who do not agree by the deadline will have their withdrawal preference risks addressed by the administrators and may be sued to recover the preferences they took.

“Any Withdrawal Preference Risk that is not resolved by January 31, 2024, shall be addressed by the Litigation Manager through Separate Writing or other action after the Effective Date,” the motion states.

In late November 2023, Celsius administrators began allowing eligible participants to withdraw some of their crypto assets.

Celsius has been actively working to withdraw and settle Ethereum for “timely distributions to creditors.” According to Nansen, it currently comprises 20.3% of the withdrawal queue and includes 112,037 Ether worth approximately $266 million.

In November 2023, the firm restructured its post-bankruptcy strategy to focus on Bitcoin mining, and that plan was approved by the judge overseeing the bankruptcy proceedings at the end of December.