One of the largest stablecoin issuers in the crypto market, Circle, has officially filed with the U.S. Securities and Exchange Commission (SEC) to go public. The company’s shares will trade under the ticker CRCL on the New York Stock Exchange (NYSE).

Circle’s IPO Plan and Financial Standing

According to Circle’s April 1 Form S-1 filing, the company will offer Class A common stock to investors. However, the number of shares and the initial IPO price remain undisclosed.

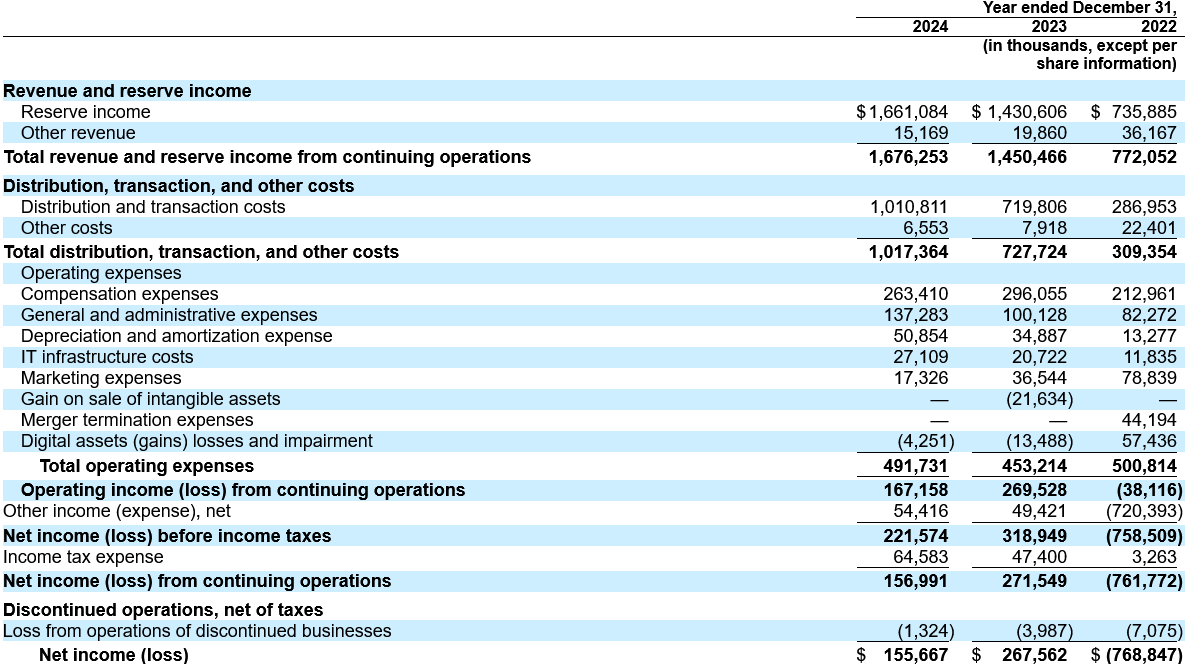

Financial records reveal that Circle generated $1.67 billion in revenue for 2024, marking a 16% increase compared to the previous year. However, net income dropped 41.8% to $155.6 million.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Coinbase, Circle’s primary distribution partner, received $908 million in payments for circulating USDC, highlighting a significant cost in the company’s balance sheet.

More than 99% of Circle’s revenue is derived from stablecoin reserves, with additional earnings from interest-bearing Treasury bills.

Circle’s Crypto Holdings and Market Position

In addition to its stablecoin reserves, Circle holds several crypto assets, including:

- $6.2 million worth of Bitcoin

- $5.6 million worth of Sui

- $3.3 million worth of Ethereum

- Other holdings include Sei, Aptos, and Optimism

USDC remains the second-largest stablecoin with a $60.1 billion market capitalization, trailing behind USDT, which holds $143.9 billion in market value.

Circle’s Previous IPO Attempts

This is not Circle’s first attempt at going public. The company initially sought to go public via a SPAC merger in 2021, but the plan was abandoned in December 2022. Later, in January 2024, Circle reportedly filed for an IPO confidentially with the SEC.

Additionally, on March 25, Circle became the first stablecoin issuer to receive regulatory approval in Japan, launching USDC on the SBI VC Trade exchange the following day.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.