Coinbase (COIN) and MicroStrategy (MSTR) shares rose in pre-market trading on Tuesday, January 3, following a rally in Bitcoin prices.

You might like: Bitcoin ATMs Shrink by 11%

Bitcoin prices rose above $45,000 on Tuesday morning, up about 7% in the past 24 hours, amid expectations of a spot ETF approval in the United States. MicroStrategy (MSTR) and Coinbase (COIN) shares rose by about 6% and 9%, respectively, in pre-market trading.

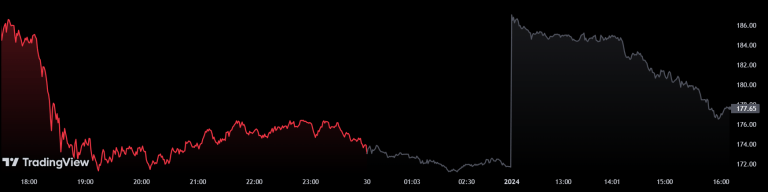

Coinbase (COIN) closed 2023 at $173.92 and rose to $187.5 in early trading on Tuesday, up about 10%. Coinbase shares closed in 2023 up about 430% and rose about 35% in the past month. It is currently trading at $173.92.

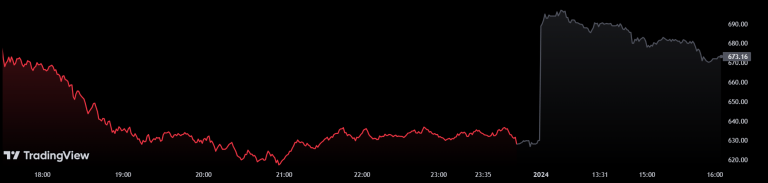

MicroStrategy (MSTR) closed 2023 at $631.6 and rose to $690.3 in early trading on Tuesday, up about 9.3%. MicroStrategy shares rose about 25% in the past month and closed 2023 up about 372%. It is currently trading at $631.62.

The implications of the Bitcoin rally

The Bitcoin rally is likely to be a positive sign for Coinbase and MicroStrategy, as both companies are heavily exposed to the cryptocurrency. Coinbase is a cryptocurrency exchange, while MicroStrategy is a business intelligence company that has invested heavily in Bitcoin.

However, it is important to note that the Bitcoin market is volatile and that prices could fall as quickly as they rise. Investors should carefully consider the risks before investing in any cryptocurrency-related company.