Cryptocurrency exchange Coinbase has revealed that it has found “more than 20 instances” of the Federal Deposit Insurance Corporation (FDIC) advising U.S. banks to avoid crypto-related banking services. The discovery comes after Coinbase filed two Freedom of Information (FOIA) requests with the FDIC.

Coinbase Head of Legal: “The Public Has a Right to Transparency”

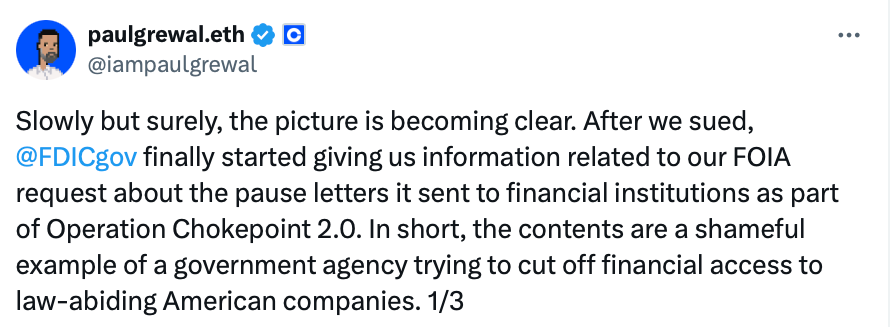

Coinbase Head of Legal Paul Grewal said in a social media post on Nov. 1 that it has found more than 20 instances of the FDIC advising banks to “suspend,” “avoid,” or “discontinue” crypto banking services. Grewal called the FDIC’s covert approach a “shameful example” of a government agency attempting to cut off financial access to lawful American businesses.

FDIC Questions Banks’ Risk Assessments

The 23 documents outlined in the court filing include the FDIC’s instructions to banks not to offer crypto services. The documents, which show instances where the FDIC questioned banks’ risk assessments of crypto services, state that the FDIC advised banks not to offer crypto services until an investigation was completed.

Might interest you: What is BabyDoge?

For example, “Document 5” states that the FDIC met with a bank to conduct a detailed review of crypto services. The bank submitted additional documentation after the meeting, but the FDIC allegedly raised more “questions” and stated that “the service should not be extended to new customers until the investigation is completed.”

These developments come on the heels of Coinbase’s announcement that it is ready to cooperate with whatever administration comes into power in the U.S. elections.

You can join our Telegram channel to not miss the news and stay informed about the crypto world.