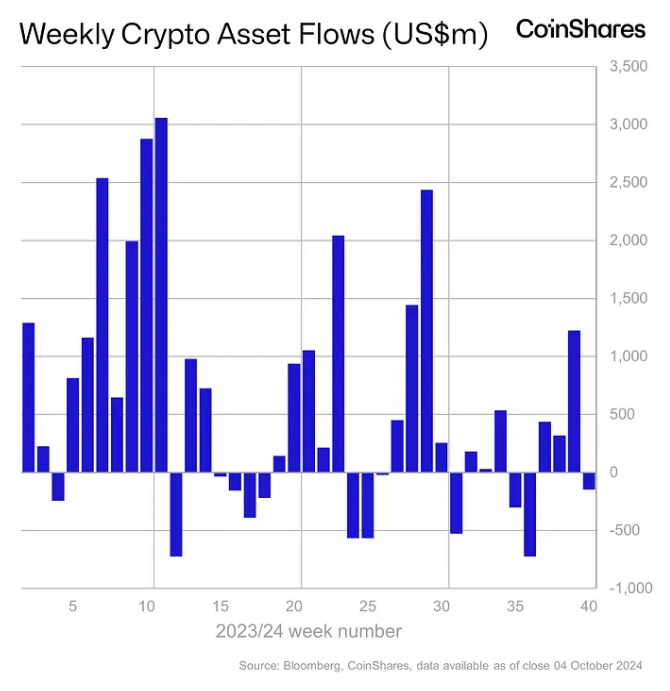

Global crypto investment funds witnessed $147 million in net outflows last week, marking the end of a three-week inflow streak, according to a report from CoinShares. This reversal in sentiment was driven largely by better-than-expected economic data, which lowered the likelihood of significant interest rate cuts, said James Butterfill, Head of Research at CoinShares.

The largest outflows came from Bitcoin-based funds, which saw $159 million in net exits. However, short-bitcoin products, designed to profit from declines in Bitcoin’s price, attracted $2.8 million in net inflows, indicating some bearish sentiment. Funds in the U.S., Germany, and Hong Kong contributed the most to the negative flows, with respective losses of $209 million, $8.3 million, and $7.3 million. On the other hand, Canada and Switzerland recorded some gains, with inflows of $43 million and $34.9 million, helping to offset part of the outflows.

Despite the negative flows, trading volumes for global crypto investment products rose by 15%, reaching $10 billion for the week. This came even as broader crypto market volumes remained lower.

Might interest you: What is BabyDoge?

As of the latest data, Bitcoin was trading at $63,595, showing a 2.6% gain over the past 24 hours, though it had dropped to a low of around $60,000 earlier in the week before rebounding. The cryptocurrency remains up 46.6% year-to-date.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.