Bitcoin and altcoins continue to face strong selling pressure. Analysts have evaluated the latest market developments and outlined potential scenarios for investors.

Decline Signals in Bitcoin and Ethereum

Recent sharp declines in the markets have increased investors’ concerns, while analysis platform 10X Research highlighted a significant pattern in Bitcoin’s price movements.

According to analysts, Bitcoin is currently following a “Diamond Top” formation, which indicates that prices tend to drop after a growth phase. This pattern suggests that BTC may decline further and lose some of the gains it made since the November rally.

While major altcoins also suffered losses, the biggest drop was seen in Ethereum (ETH). Analysts noted that despite Eric Trump’s support for ETH, the decline was mainly driven by options gamma hedging and futures liquidations, which can cause significant price fluctuations.

Bitcoin Recovers, Why Is Ethereum Still Under Pressure?

According to analysts, after the recent selling wave, Bitcoin showed a partial recovery, but the same did not happen for Ethereum:

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

“Bitcoin exhibited a partial recovery, but this did not happen for Ethereum. Large ETH sell-offs failed to trigger the expected strong rebounds, indicating that ETH prices may still be under pressure.”

Analysts emphasized that the combination of ongoing economic uncertainty and weak technical indicators suggests that Bitcoin and altcoins could face further price declines in the short term. Investors are advised to act cautiously at this stage.

When Will the Altcoin Rally Begin?

10X Research predicts that Bitcoin and altcoins may experience further declines in the near term, while a similar forecast was made by popular analyst Rekt Capital.

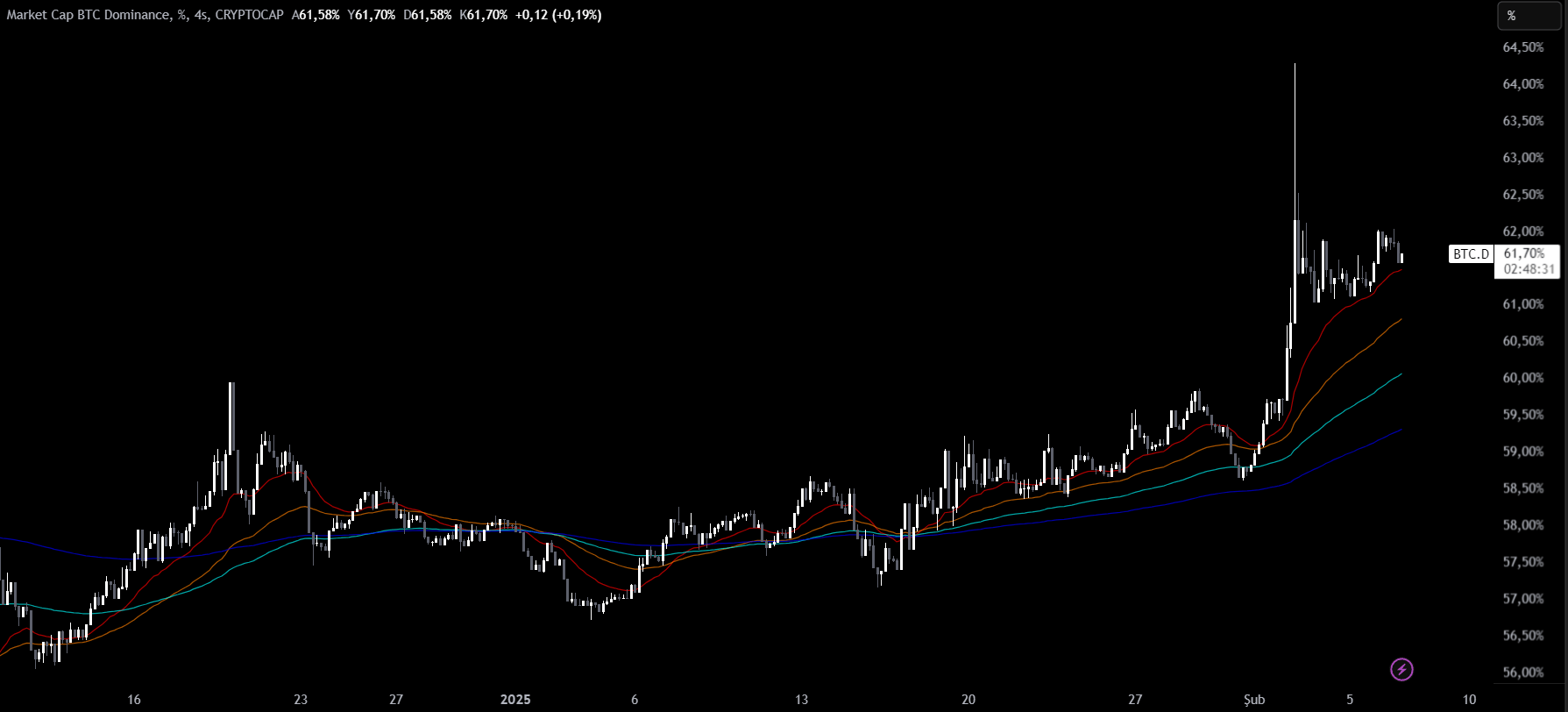

Rekt Capital analyzed key trends in Bitcoin Dominance (BTC.D) and argued that the altcoin season will begin after Bitcoin Dominance reaches its 71% peak.

The analyst pointed out that historically, Bitcoin Dominance has moved within the 58-71% macro range, and each time it reached the 71% resistance level, the altcoin market saw major activity. He also suggested that during this period, altcoins could experience a 5-10% pullback

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates..