The crypto market has experienced sharp declines, led by Bitcoin (BTC). However, one of the most affected assets in this downturn was Ethereum (ETH). Experts have shared critical insights about ETH’s future, warning investors of possible further drops.

Can ETH Price Drop Even Further?

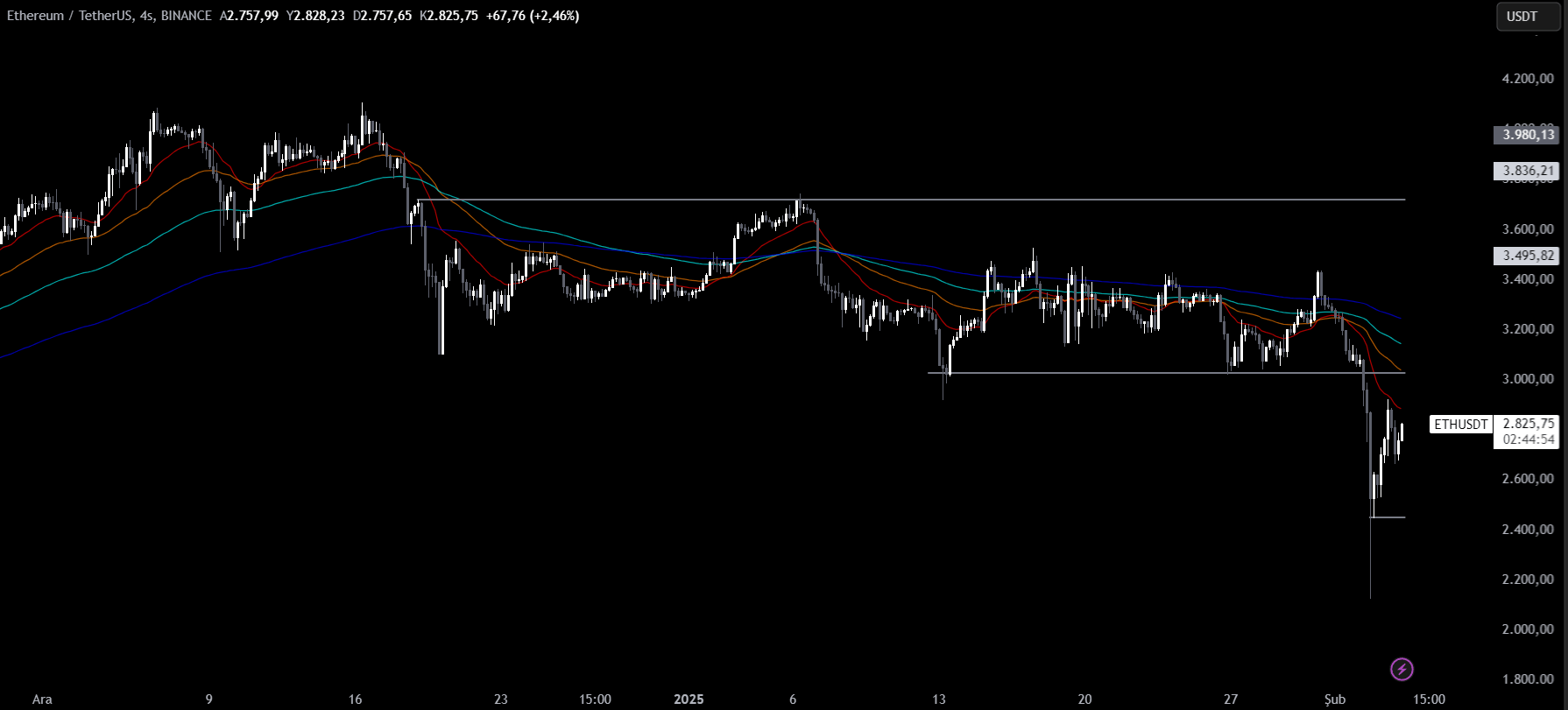

Andrew Kang, co-founder of Mechanism Capital, predicts that ETH could decline to the $2,200 – $2,400 range. According to Kang, the $2,900 – $3,000 range will act as a short-term resistance level for Ethereum.

The ongoing U.S.-China trade tensions have led to high volatility in ETH and other cryptocurrencies. Donald Trump’s recent tariff policies against China have fueled market concerns, triggering massive sell-offs.

Are Whales Selling Ethereum?

With ETH’s recent decline, on-chain data suggests that large investors are reducing their ETH holdings. Joao Wedson, CEO of Alphractal, reported that wallets holding 100,000 ETH or more have been selling off significantly. Even wallets containing over 1 million ETH have also started liquidating their holdings.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Meanwhile, Solana (SOL) continues to rise as Ethereum’s biggest competitor. With the success of platforms like Pump.fun, Solana has become a strong alternative in the DeFi and NFT ecosystems.

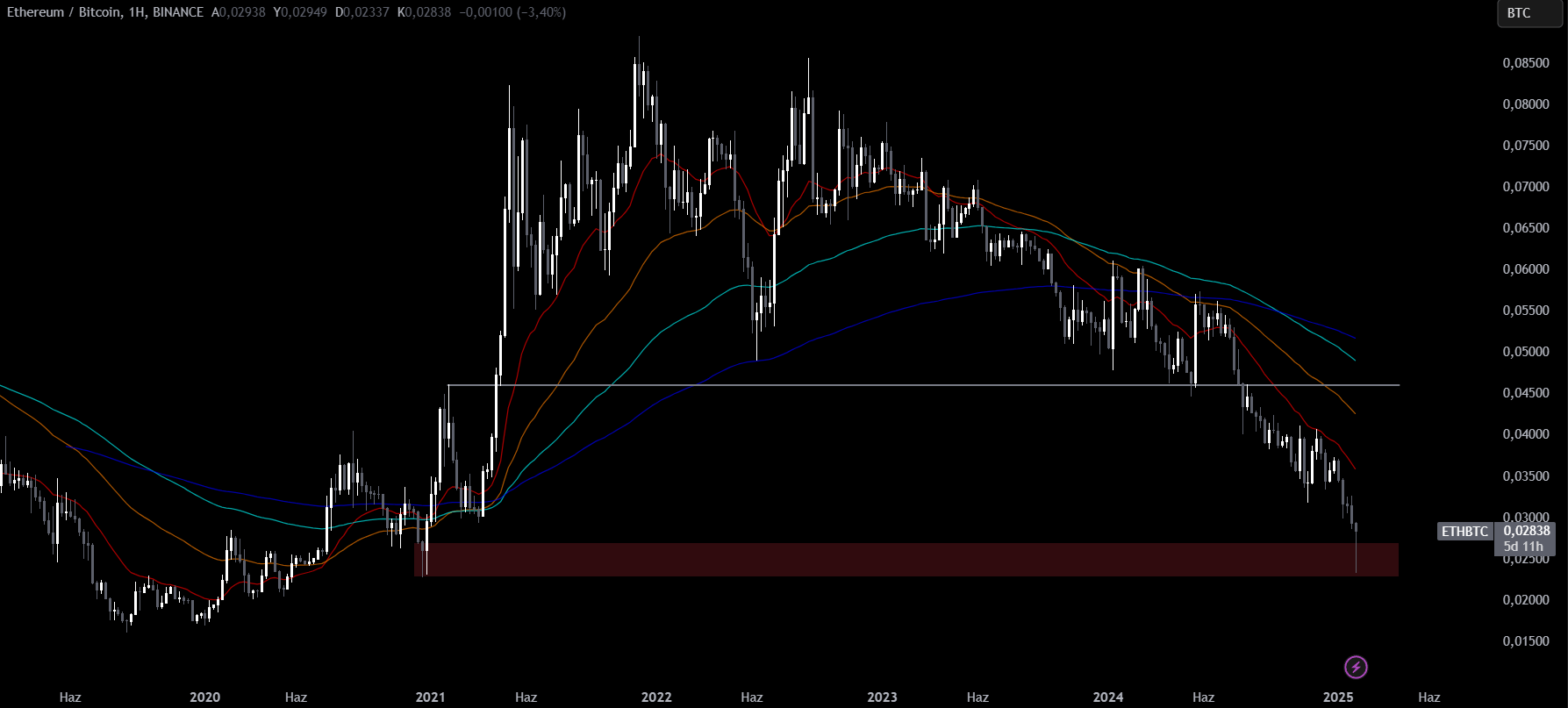

Critical Levels in ETH/BTC Pair

Ethereum’s performance against Bitcoin (BTC) is also causing concern among investors. Since the Merge, the ETH/BTC pair has lost around 70% of its value. Technical analysis suggests that ETH/BTC is currently testing the 0.024-0.023 BTC support level.

According to experts, if ETH fails to hold this level, it could drop to 0.020 BTC. However, a potential rebound toward the 50-week EMA level remains possible.

To regain market dominance, Ethereum must see increased blockchain activity and wider adoption.

Ethereum’s short-term trajectory remains uncertain. Whale movements, macro-economic developments, and Bitcoin’s price action will continue to play a crucial role in ETH’s future. Investors should remain cautious about a potential drop toward $2,400!

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.