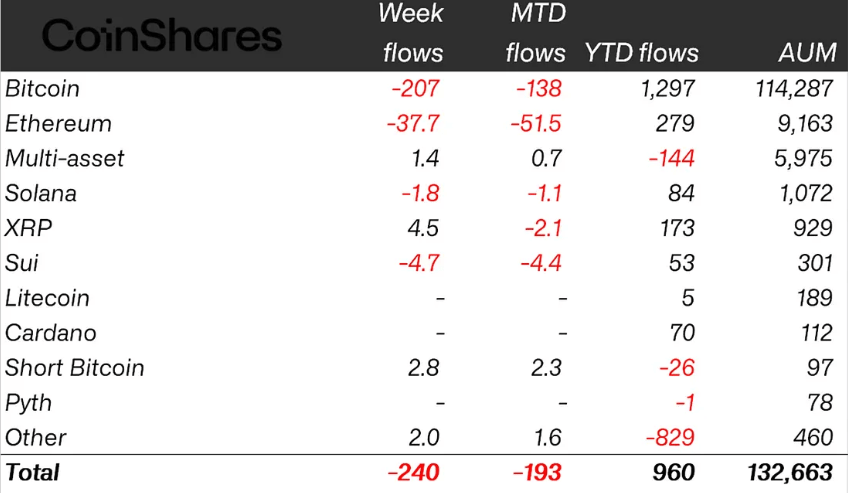

Crypto exchange-traded products (ETPs) saw $240 million in outflows last week, according to CoinShares’ April 7 report. The move comes amid growing investor concerns over the impact of US-imposed trade tariffs on the global economy.

Bitcoin ETPs Turn Negative for the Month

Bitcoin (BTC) ETPs led the decline, with $207 million pulled in just one week. This resulted in a monthly net outflow of $138 million, the first negative monthly total in 2025. Despite that, BTC ETPs still hold $1.3 billion in year-to-date inflows.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Ethereum (ETH) ETPs faced $38 million in weekly outflows. However, they continue to maintain $279 million in net inflows for the year.

Grayscale Tops YTD Outflows

Grayscale Investments led all ETP providers with $95 million in weekly outflows. Its YTD total stands at $1.4 billion, the largest among all issuers.

In contrast, BlackRock’s iShares ETFs retained $3.2 billion in year-to-date inflows. ProShares and ARK Invest are the only two other major issuers still in the green, with $398 million and $146 million respectively.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.