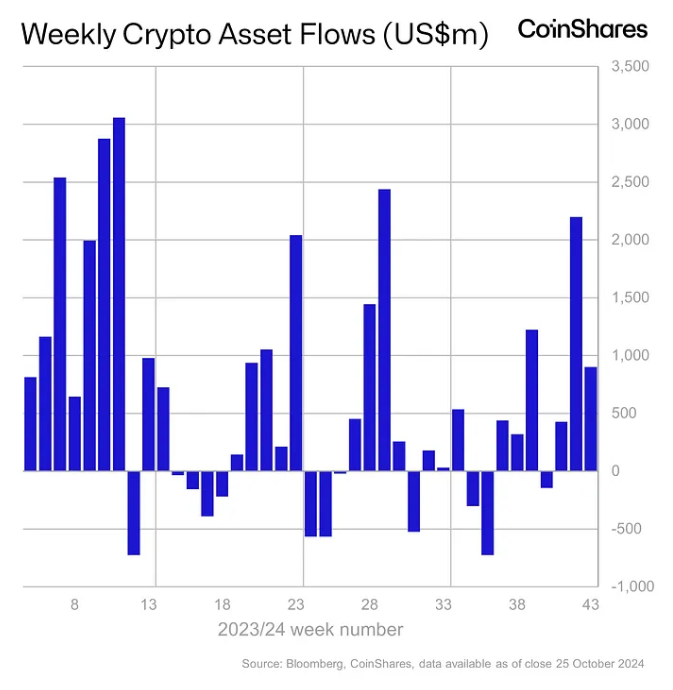

According to CoinShares, crypto investment products saw an additional net inflow of $901 million globally last week, reaching a total of $3.4 billion. Research Director James Butterfill stated that the positive inflows and the rise in Bitcoin prices were driven by an increase in Republican support ahead of the U.S. elections.

CoinShares reported that global crypto funds managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares recorded a net inflow of $901 million last week. In October, over $3.36 billion was invested in crypto investment products, which corresponds to 12% of the assets under management, marking the largest fourth monthly inflow recorded. Year-to-date, inflows have reached $27 billion, nearly tripling the previous record of $10.5 billion set in 2021.

Bitcoin-based funds had a strong week, bringing in $920 million in new money. In contrast, short Bitcoin funds lost a small amount, with $1.3 million going out. Blockchain stocks and Solana products gained $12.2 million and $10.8 million, respectively. However, Ethereum-based funds lost $34.7 million during the same period. At the same time, the ETH/BTC ratio dropped by 2.33%, reaching its lowest point since April 2021.

U.S. Elections and Polls Boost Crypto Inflows.

“We believe that the current levels of Bitcoin prices and inflows are significantly influenced by U.S. politics; the recent increase in inflows is likely tied to the Republicans’ poll gains,” said CoinShares Research Director James Butterfill.

Polymarket, a decentralized prediction platform, reports that pro-crypto Republican candidate Donald Trump is leading Democrat Kamala Harris by 66.5% to 33.4% in the presidential election set for November 5. Trump is also ahead in six important states. The data from Polymarket indicates that Republicans might have an 84% chance of controlling the Senate and a 52% chance in the House of Representatives, with an overall 48% chance of winning, while Democrats have just a 12% chance. Last week, Polymarket stated there was no proof of market manipulation in election betting.

Despite this, recent national poll averages indicate a close contest. According to FiveThirtyEight, Harris is leading with 48.1% while Trump has 46.7%, and the difference is small enough to be within the margin of error. The gap in the polls has decreased since Harris‘s highest lead of 3.7% on August 23. Analysts at Bernstein point out that traditional polls have often underestimated Trump.