$1 Billion Liquidation in Crypto Market: Bitcoin and Ethereum Lose Value, Is a Trend Shift Coming?

Crypto Market Chaos: Nearly $1 Billion Liquidated

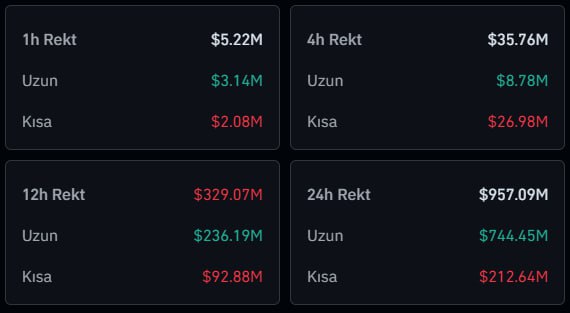

The cryptocurrency market is going through a tough period, with investors facing significant losses. In the last 24 hours, nearly $1 billion worth of liquidations have hit the market. Meanwhile, the total value of the crypto market has dropped to $2.62 trillion, with Bitcoin suffering the most losses. This sudden crash has triggered a wave of fear in the crypto industry, pushing the Fear & Greed Index down to 17, signaling “Extreme Fear.”

Recent data from Coinglass reveals that about 320,374 traders were liquidated in the last 24 hours, with total losses reaching $907.7 million. Long traders, who bet on rising prices, suffered the most, losing $72 million.

However, short traders, who expected prices to fall, were also not spared, with their losses totaling $179 million. The largest single liquidation occurred on Bybit, where a $5.26 million BTC/USD trade disappeared instantly.

Bitcoin (BTC) Takes the Biggest Hit

Bitcoin faced the biggest loss, with $318.2 million in positions wiped out. Of this, $235 million came from traders who expected prices to rise, while $82.6 million came from short sellers.

Key Reasons Behind the Market Drop

One of the major reasons for the market’s decline is rising fears of a recession. In a recent interview with Fox News, U.S. President Donald Trump mentioned an “economic transition period,” causing concerns among investors about the future.

Another major factor is the massive Bitcoin transfers from Mt. Gox. The defunct exchange recently moved 11,834 BTC, worth $931.1 million, followed by another 332 BTC worth $26.6 million. This raised fears of additional selling pressure in the market.

Lastly, a number of Ethereum whales have deposited 7,000 ETH worth $12.9 million to Kraken, while another moved 21,000 ETH to Binance, signaling potential sell-offs.

Bitcoin and Ethereum in Trouble

As of now, Bitcoin is trading at $81,632, close to its critical support level at $78,000, raising concerns among investors. Meanwhile, Arthur Hayes, co-founder of BitMEX, warned that Bitcoin could potentially drop further, testing levels between $70,000 and $75,000, adding more uncertainty to the market.

Ethereum isn’t doing any better, as it dropped 8.4% in the last 24 hours, now trading at $1,915, the lowest level since late 2023.

In the comment section, you can freely share your comments about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.