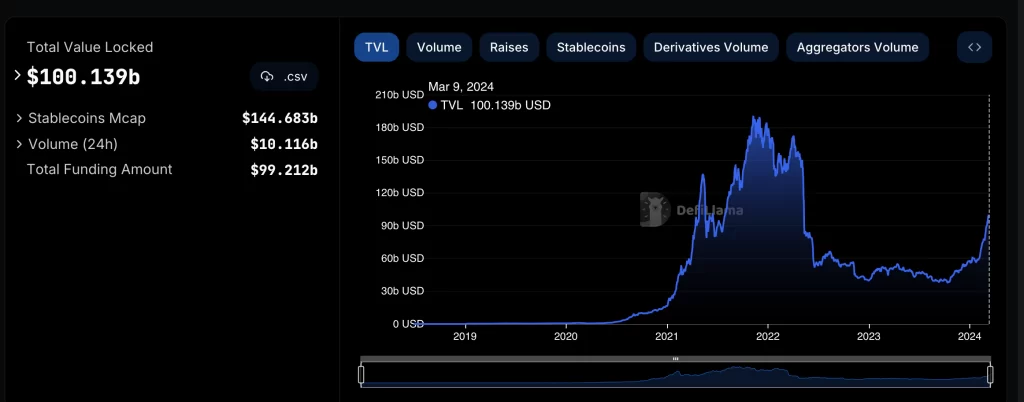

The total value locked in all DeFi protocols worldwide reached 100.1 billion dollars on March 9. However, despite this large increase, these figures still remain below the record of 189 billion dollars set in November 2021.

The demand for Bitcoin is increasing the on-chain locked capital to over 100 billion dollars as of March 10, when the article was written, by boosting developments around the crypto industry.

According to DeFiLlama data, the total global value locked in decentralized finance (DeFi) protocols has reached 100.1 billion dollars, and over 10 billion dollars in transaction volume occurred in the last 24 hours at the time the article was written. However, these figures are still behind the record of 189 billion dollars set in November 2021.

The liquidity staking protocol Lido is leading the ranking with 38.7 billion dollars of on-chain locked capital. Following it are the EigenLayer staking ecosystem and the Aave protocol, both of which have over 11 billion dollars locked.

Recent developments in the DeFi space are quite exciting. After almost two years, the total locked value reaches a new record, exceeding the 100 billion dollar threshold. The effect of spot Bitcoin (BTC) exchange-traded funds (ETFs), launched in January, was very decisive in this success.

Especially institutional demand gained positive momentum in crypto markets as interest in spot Bitcoin ETFs increased. As a result, the Bitcoin price broke a new record this week, exceeding 70,000 dollars. According to BitMEX Research data, assets in Bitcoin ETFs passed 28 billion dollars on March 8. This assessment leaves out the Grayscale’s Bitcoin Trust while it’s important to remember that Grayscale converted from an OTC product to an ETF in January.

On social media, rumors are circulating that OTC trading platforms are experiencing a Bitcoin shortage and usually turning to public exchanges to fulfill customer orders. OTC desks usually serve institutional investors, and such a move might indicate the increasing influence of institutional investors in the crypto market.

After Bitcoin’s price exceeded the 60,000 dollar level, popular centralized crypto exchanges such as Binance, Coinbase, Kraken, and Bybit experienced some service disruptions due to increased trading volume. Kris Marszalek, Crypto.com’s CEO, has announced that they had to hire 480 more customer representatives to manage the increase in demand.

dYdX‘s Chief Strategy Officer and Technical Leader in trading, Ivo Crnkovic-Rubsamen, said in his statement, “Due to much retail interest and rapid price movements, algorithmic trading companies are making a great effort to place and cancel their orders quickly to protect their positions,”.

All these developments seem to create a wave of movement and excitement in crypto markets. Institutional demand and growth in the DeFi space could be a significant step towards wider acceptance of cryptocurrencies.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.