Tokenomics refers to the basic information about a cryptocurrency like how many tokens are available, how they are distributed and what they can be used for. It’s something that cryptocurrency investors look at before deciding to invest in a project.

It’s common sense that a project with a solid plan and a strong token ecosystem will perform better than one that doesn’t. In well-designed projects with good tokenomics, when more investors see positive results and decide to invest, the demand for the tokens increases. This causes the price of the tokens to go up, which is what investors want.

You might like it:How To Use Trading View? What Is It?

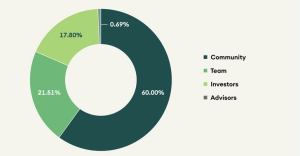

You can find detailed information about a projects tokenomics. For example, you can learn how many tokens are set aside for the market, how many tokens the project team will receive and when and how the tokens will be made available.

An example:

When there are fewer tokens available, the price tends to go up because there’s less supply. That’s why token burning, which means removing tokens from circulation, is important. Tokenomics can provide information about token burning.

Tokenomics also shows how tokens will be distributed, when they can be used and what they can be used for. If a project has well-planned tokenomics, it’s a sign that the project is of good quality and has a vision for the future. It gives confidence that the project’s ecosystem is well thought out and has a strong foundation for success.

You can present own thoughts as comment about the topic. Moreover, you can follow us on Telegram and YouTube channels for the kind of the news.