U.S. House Representative Gerald E. Connolly has sent a letter to the U.S. Treasury Department, urging it to halt the Donald Trump administration’s plans to establish a Bitcoin reserve. Connolly argued that this initiative does not serve the public interest and would instead enrich Trump and his donors.

Bitcoin Reserve Controversy

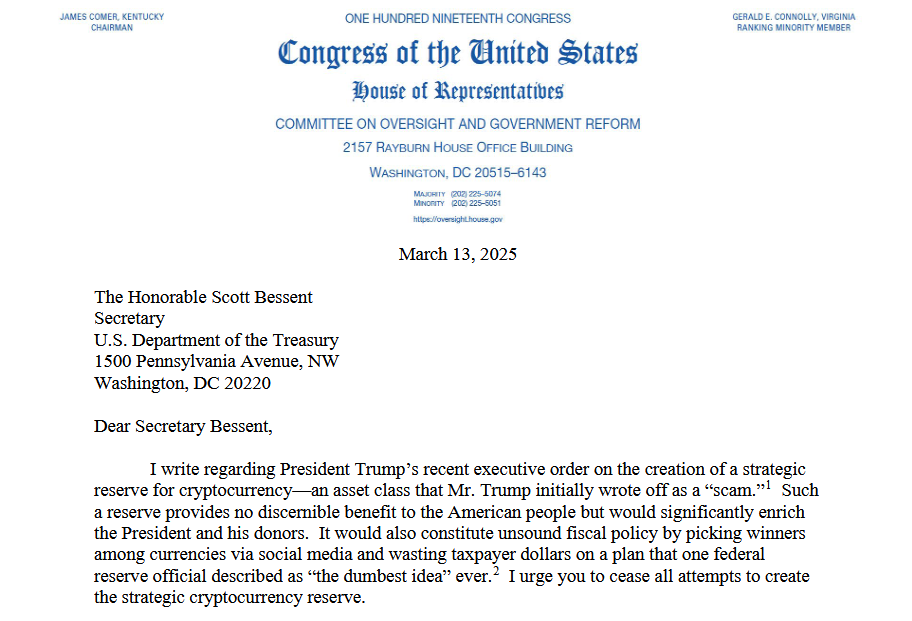

In his letter to U.S. Treasury Secretary Scott Bessent, Gerald E. Connolly stated that the proposed cryptocurrency reserve by the Trump administration lacks economic justification. He further warned that the government favoring specific digital assets through social media could disrupt the market.

According to Connolly, establishing such a reserve holds no strategic benefit for taxpayers. The Federal Reserve (FED) also criticized the initiative, calling it “the dumbest idea ever.”

Trump and Crypto Conflict of Interest

Connolly pointed out that the Trump administration did not consult Congress before moving forward with the Bitcoin reserve plan and did not receive any official authorization. He also accused Trump of a conflict of interest, as the Trump Organization owns the crypto platform World Liberty Financial and has profited significantly from the Official Trump (TRUMP) memecoin.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

The Democrat lawmaker described the TRUMP token as “Trump’s most lucrative get-rich scheme yet.” Other Democrats, including Maxine Waters, also criticized the token, arguing that Trump’s crypto initiatives do not serve the public good.

Treasury Department’s Response Awaited

Connolly has requested the U.S. Treasury Department to provide documents detailing the creation of the Bitcoin reserve and to clarify what steps the Trump administration has taken to prevent conflicts of interest. He also inquired about which crypto assets the government currently holds.

Meanwhile, the White House stated that the Strategic Bitcoin Reserve would only consist of cryptocurrencies seized in federal criminal or civil cases and would be managed through budget-neutral strategies. The Digital Asset Stockpile, on the other hand, would include non-Bitcoin cryptocurrencies, such as XRP, Solana, Cardano, and Ethereum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.