Spot Ethereum exchange-traded funds (ETFs) in the U.S. saw their highest inflows in six weeks as crypto markets rebounded following the U.S. presidential election. The nine newly launched spot Ethereum ETFs recorded a net inflow of $52.3 million on November 6. Although this amount is small compared to inflows for spot Bitcoin ETFs, it represents the highest level for Ethereum funds since September 27, according to Farside Investors.

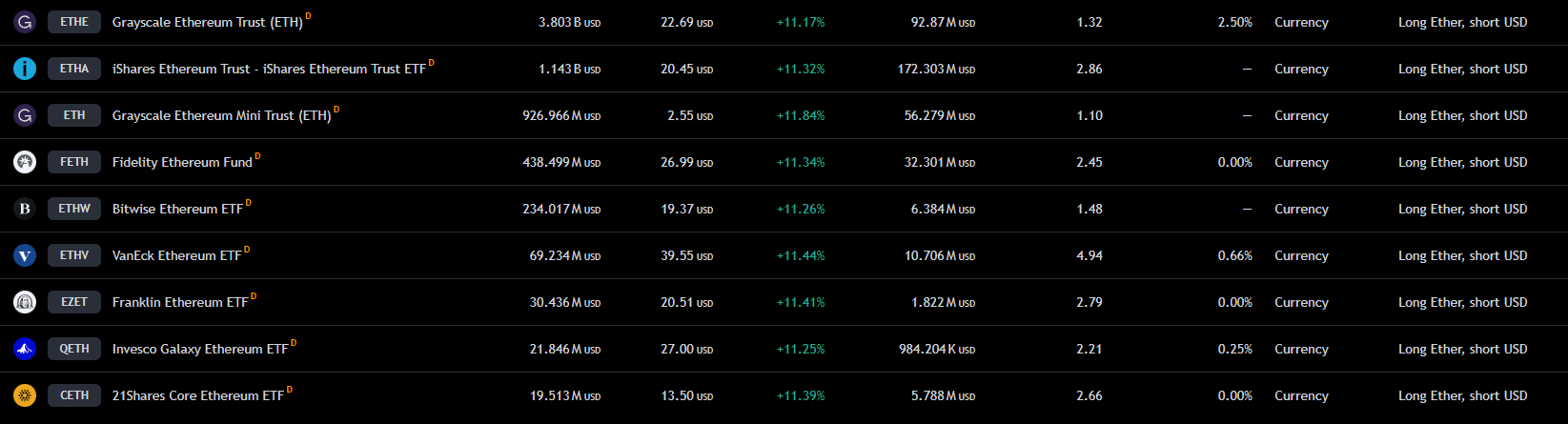

This significant inflow occurred despite the leading BlackRock iShares Ethereum Trust fund showing a net zero flow. The majority of the inflows went to the Fidelity Ethereum Fund, with $26.9 million, while the remaining $25.4 million was allocated to the Grayscale Ethereum Mini Trust. The other seven spot Ethereum ETFs saw no inflows. However, the total net balance of all these products fell to negative $490 million due to continued outflows from Grayscale’s high-fee ETHE fund, which has lost $3.1 billion in assets under management since its conversion to a spot ETF in July.

Meanwhile, the 11 spot Bitcoin ETFs in the U.S. recorded a net inflow of $621.9 million on November 6, reversing a trend of outflows over the previous three trading days.

According to preliminary data from Farside Investors, although BlackRock’s iShares Bitcoin Trust experienced its second consecutive day of outflows with a $69.1 million loss, it still recorded its busiest day ever with a trading volume of $4.1 billion. The inflows were led by the Fidelity Wise Origin Bitcoin Fund, which received $308.8 million—the largest inflow since June 4. Bitwise, Ark 21Shares, and Grayscale also saw over $100 million in inflows for their respective products.

Spot crypto markets rose by 4% over the past 24 hours, bringing total market capitalization to $2.64 trillion. Bitcoin hit a new all-time high, surpassing $76,000 in late trading on November 6. Ethereum surged 10% in early trading on November 7, reaching $2,872—its highest price since early August.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.