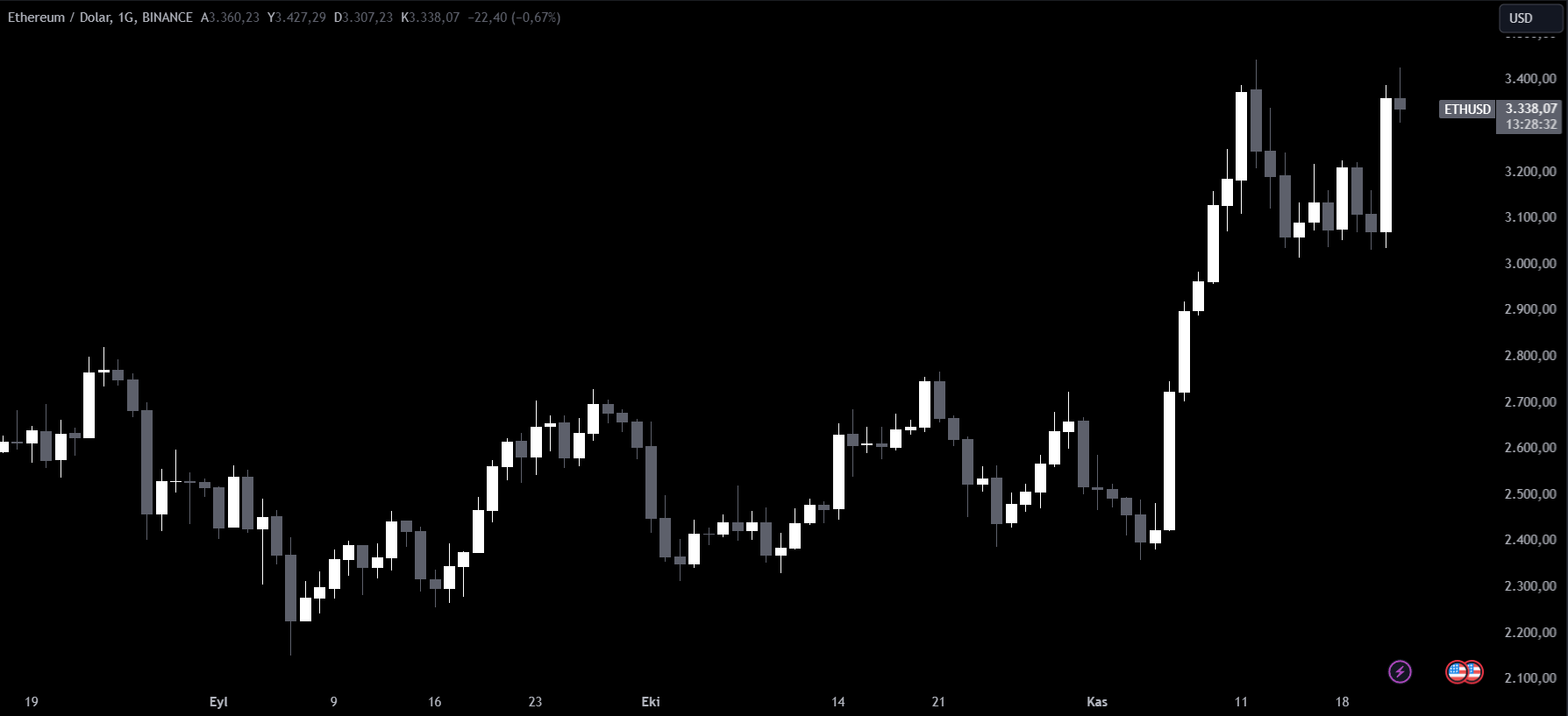

As Ethereum’s price surpasses $3,300, much of the positive market momentum is tied to Donald Trump’s presidential election win. During his campaign, Trump promised to remove SEC Chairman Gary Gensler and appoint a more crypto-friendly leader. Although Gensler was expected to serve until 2026, it was recently confirmed he will resign in January 2025, sparking expectations of a more favorable regulatory environment for the cryptocurrency sector.

Trump also pledged to establish a “Bitcoin and Crypto Presidential Advisory Council”, and end the SEC’s restrictive stance on the industry. These moves are seen as significant catalysts for the success of Ethereum Spot ETFs in the market, with analysts predicting that these changes will attract more institutional investors into the space.

The approval of Ethereum Spot ETFs has further facilitated institutional entry into the market, driving expectations of billions of dollars in new fund inflows. Analysts highlight that these investment vehicles are particularly attractive to Wall Street financial advisors and institutional portfolio managers, increasing Ethereum’s appeal. Additionally, these developments are accelerating Ethereum’s liquidity and market infrastructure, which in turn strengthens its institutional integration.

The rising Ethereum price and positive sentiment in the market are gaining strength amid increasing expectations of loosened regulations. These developments signal a pivotal moment for the broader crypto ecosystem’s wider acceptance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.