The European Union’s insurance authority has introduced a proposal requiring insurance firms to hold capital equal to the value of their crypto holdings. This move aims to mitigate risks associated with high volatility in the digital asset market.

The European Insurance and Occupational Pensions Authority (EIOPA) presented the proposal in a Technical Advice report to the European Commission on March 27. Unlike traditional asset classes such as stocks and real estate, which have lower capital requirements, crypto assets would need to be fully backed.

“EIOPA considers a 100% haircut in the standard formula prudent and appropriate for these assets in view of their inherent risks and high volatility,” the authority stated.

Why the 100% Requirement?

The 100% capital charge is based on the assumption that crypto prices could drop completely. EIOPA noted that Bitcoin (BTC) and Ether (ETH) have previously seen declines of 82% and 91%, respectively. This is significantly higher than the capital requirements for stocks (39%-49%) and real estate (25%), according to Commission Delegated Regulation 2015/35.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

EIOPA offered four options for the European Commission:

- Make no changes.

- Implement an 80% stress level for crypto holdings.

- Implement a 100% stress level (EIOPA’s recommendation).

- Broaden the approach to include risks of tokenized assets.

“An 80% stress to the value of crypto-asset exposures does not appear sufficiently prudent,” EIOPA stated, emphasizing the need for 100% backing.

Impact on Insurance Markets

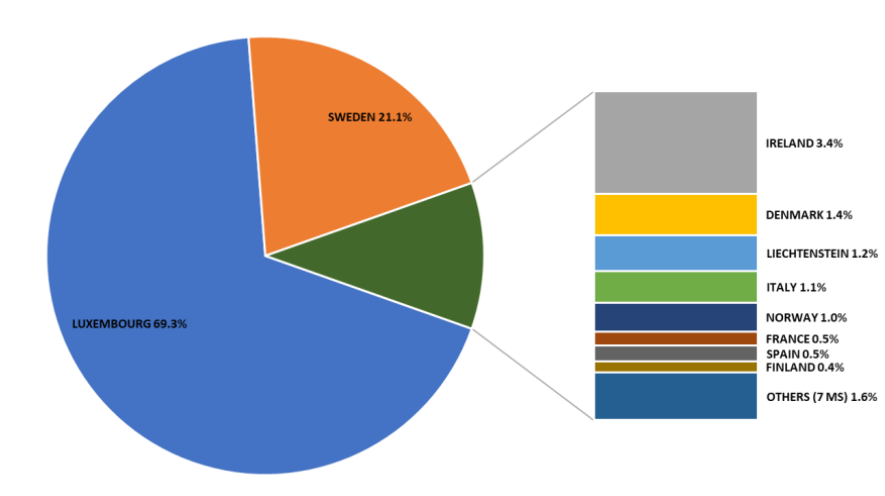

The proposed regulation would mostly affect insurers in Luxembourg and Sweden, which account for 69% and 21% of all crypto-related insurance undertakings. Other impacted nations include Ireland (3.4%), Denmark (1.4%), and Liechtenstein (1.2%).

Most of these holdings are structured within funds, such as exchange-traded funds (ETFs), and held on behalf of unit-linked policyholders.

Future of Crypto in Insurance

Despite proposing a 100% capital requirement, EIOPA acknowledged that broader adoption of crypto assets may require a more differentiated approach in the future. As the sector evolves, further regulatory adjustments could be introduced.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.