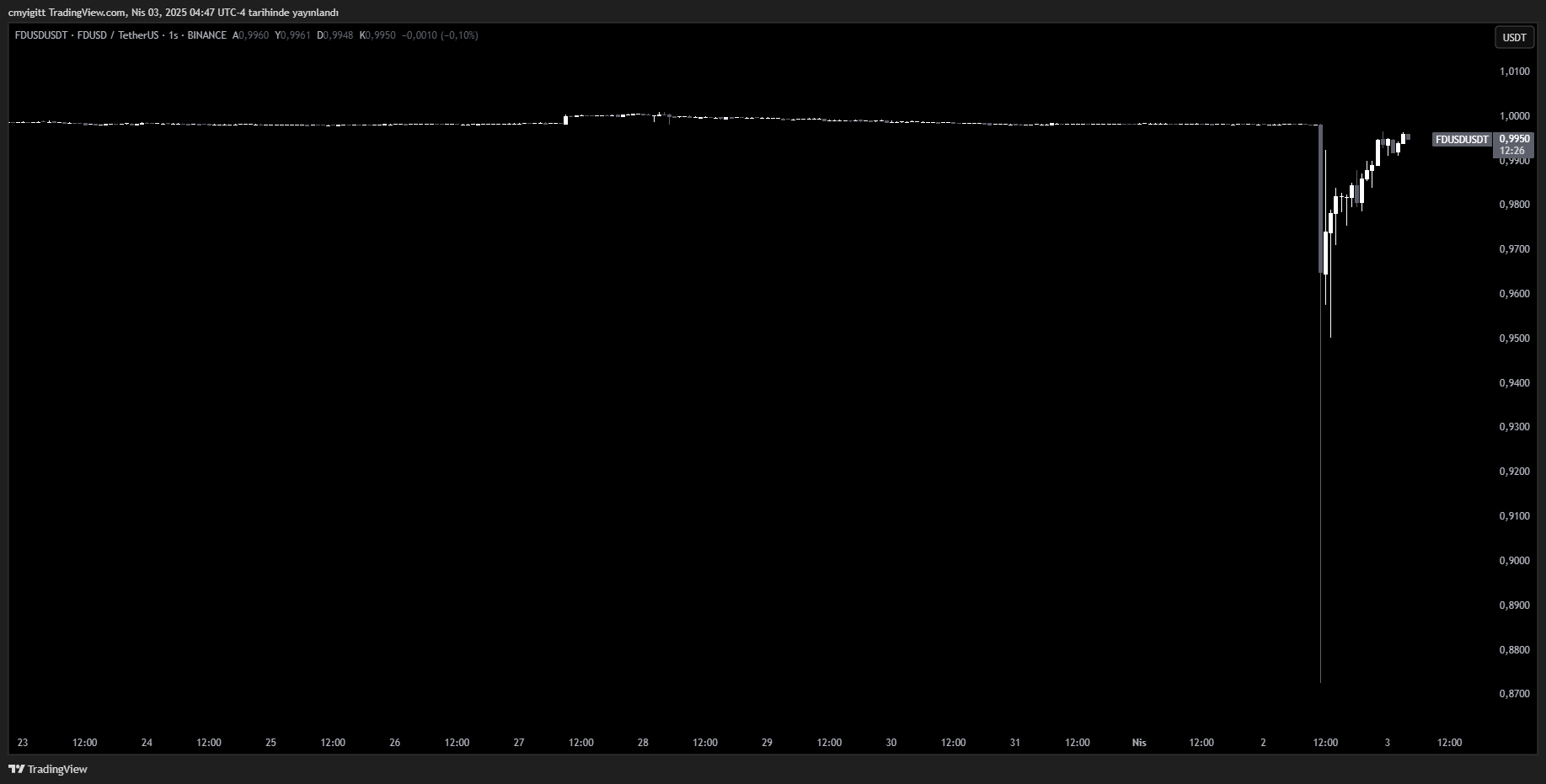

The crypto world is in shock as FDUSD lost its 1:1 peg to the US dollar following Justin Sun’s claims that First Digital is insolvent.

Justin Sun’s Allegations and First Digital’s Response

Justin Sun accused First Digital, the issuer of FDUSD, of facing liquidity issues and being insolvent. However, First Digital denied these claims, calling them a “smear campaign.”

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

The company assured users that FDUSD reserves are fully backed 1:1 with US dollars.

“Every dollar backing FDUSD is completely secure, held in US-backed Treasury Bills, and clearly accounted for in our attestation report.”

First Digital also announced legal action against Justin Sun for spreading misinformation.

Binance’s Crucial FDUSD Statement

To address market concerns, Binance released a statement regarding FDUSD reserves:

“FDUSD reserves consist of $2,051,348,188.70 in US Treasury Bills and overnight deposits. This amount exceeds FDUSD’s circulating supply, confirming its 1:1 backing.”

Binance also confirmed that FDUSD‘s February reserve report has been verified and the March report will be released within two weeks.

Is First Digital Trust Actually Insolvent?

It appears that First Digital Trust (FDT) is struggling to return customer funds and may be effectively insolvent. However, despite significant irregularities, it continues to operate under a public trust entity in Hong Kong.

These developments could have a major impact on the stablecoin market and the crypto ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.