Fear

In simple terms, when fear dominates, market participants tend to fear losing their capital. When they are concerned about market stability and the value of token assets, they may sell their assets. Additionally, this situation can lead some investors to start short selling these assets to profit from the fear sentiment.

Whether it’s due to macroeconomic factors (inflation, recession, economic crises, or geopolitical factors) or asset-specific factors (such as a drop in the value of specific assets like oil and gas prices) or negative press about a crypto project causing a drop in token prices, fear is generally associated with falling markets or asset values.

Greed

Conversely, when greed dominates, market participants tend to accumulate more assets and try not to miss out on potential gains. This happens when markets and assets are on an upward trend. Greed is often accompanied by another type of fear known as FOMO (Fear of Missing Out). In this scenario, market participants fear missing out on potential gains.

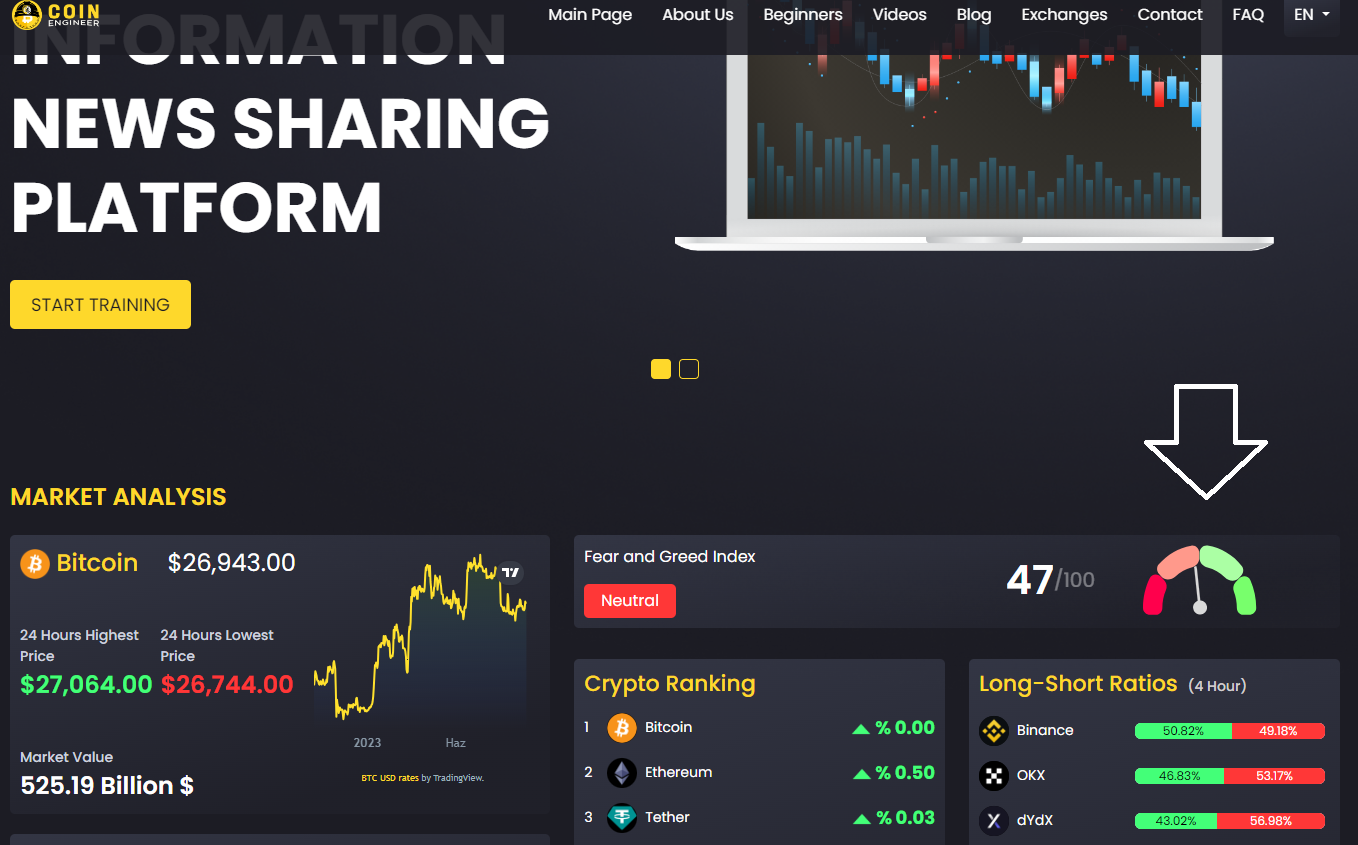

Fear and Greed Index

The original Fear and Greed Index, a significant market indicator developed by CNN Money, aimed to measure how these two human emotions affect the stock market. The index’s purpose was to determine whether specific markets or assets were trading above their supposed values due to greed or below their supposed values due to fear.

The Fear and Greed Index is presented as a spectrum ranging from extreme fear to extreme greed.

While CNN’s Fear and Greed Index relies on various factors to measure fear and greed in stock markets, some of these factors are not directly applicable to crypto markets, which are unique in many ways. This has necessitated the development of a Fear and Greed Index specifically tailored to cryptocurrencies.

You might like it:What is Unibot(UNIBOT)? What Does It Do?

How is the Crypto Fear and Greed Index Calculated?

Subsequently, various crypto indices, like Alternative.me, have been developed using weighted data sources such as:

- Volatility (25%): Current market volatility and average values compared to the last 30 and 90 days; higher volatility indicates higher fear.

- Market momentum/volume (25%): Comparing buying and selling volumes over the last 30 and 90 days; higher buying volumes compared to the recent past indicate higher greed.

- Social media (15%): Interest in Bitcoin on social media, volume of social media interactions, and general sentiment.

- Surveys (15%): Gathering opinions of users and investors.

- Dominance (10%): An increase in Bitcoin dominance usually signals fear.

- Trends (10%): Google search trends.

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram and YouTube channels for the kind of news.