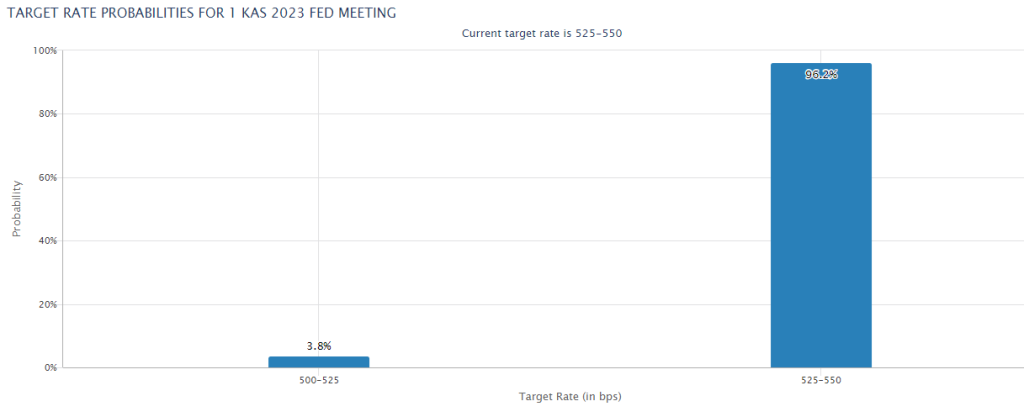

FED Interest Rate Decision, Weekly Developments! Amid evolving global economic dynamics, critical developments of importance in the financial world are unfolding this week, from the FED interest decisions to the latest movements in the cryptocurrency markets. There is speculation about how the upcoming interest decision of the US Central Bank (FED) will impact the already volatile financial markets. Especially according to the data provided by CME Fedwatchtool, there is a broad consensus among investors that the interest will be maintained at its current level.

While waiting for the FED decisions in global markets, the world of cryptocurrency is also presenting many innovations and changes. Movements are observed across a broad spectrum from Bitcoin to dYdX, and in particular, the SEC’s Bitcoin ETF decisions will be decisive for the future of the crypto market.

You may be interested: Thailand Bank Buys Shares in Crypto Exchange!

Will the FED Reduce the Policy Rate?

This week, all eyes are turned to the FED’s interest decision in global markets. It is expected that on Wednesday, the FED will keep its policy rate steady at the current level of 5.25%-5.50%. According to the CME Fedwatchtool, this expectation seems to be 99.9% likely.

The FED’s inflation indicator, the core personal consumption expenditure price index, met market expectations with a monthly increase of 0.3% and an annual increase of 3.7%. The US’s annual budget deficit of 2 trillion dollars and the downgrade of its credit rating by Fitch Ratings have been a source of concern for investors.

Especially this Wednesday, in addition to the FED, the impact of corporate balance sheets and macroeconomic data will also be felt in the markets. The balance sheet to be announced by Microstrategy at 23:05 is eagerly awaited by cryptocurrency investors.

Especially this Wednesday, in addition to the FED, the impact of corporate balance sheets and macroeconomic data will also be felt in the markets. The balance sheet to be announced by Microstrategy at 23:05 is eagerly awaited by cryptocurrency investors.

What Do The Movements in Crypto Markets Indicate?

There are lively days in the cryptocurrency markets as well. Especially the BTCUSDT futures data is one of the most popular analysis topics lately. According to the current data, there are open futures worth 2.9 billion dollars in BTCUSDT pairing on Binance. Retrospective reviews indicate that this level is extremely high.

Also, the position difference between large investors (whales) and small investors is striking. Especially, it is observed that whale accounts predominantly hold long positions, and small investors are mostly in short positions.

Bitcoin Mining Shares are on the Rise!

Following the recent rise in Bitcoin, mining shares are also attracting a lot of interest. The price of Bitcoin reaching 35,000 dollars has been considered a profit-taking opportunity, especially for short-term investors. However, the performance of Bitcoin mining shares is directly affected by Bitcoin price movements.

Marathon Digital and Riot Platforms stand out with their market value among mining shares. However, there are significant differences regarding energy costs and margins. Needham analyst favors Riot and Cipher shares, predicting that these shares will be less affected by the Bitcoin halving.

In conclusion, both traditional and crypto markets are going through a dynamic period. Investors need to pay attention both to the FED’s interest decisions and the movements in the cryptocurrency market. Statistical data and market analyses are crucial for shaping investment decisions accurately.

Important Headlines in the Crypto Sector This Week!

- dYdX: With the dYdX V4 code published in recent days, the protocol will operate as a Cosmos chain that includes revenue sharing with DYDX stakers. This new version is transitioning to the Cosmos ecosystem. In particular, revenues will be distributed to those who stake the dYdX token. Initially, dYdX v4 will focus on the security and operability of the network and will be gradually opened to users. One of the main goals will be full decentralization, and the dYdX Foundation and the community will be the decision-makers.

- Celestia: Celestia, one of the projects that has been drawing attention lately, will transition to the mainnet on October 31. This project is also expected to bring many innovations in terms of rollups and data availability.

- Binance: Binance, one of the world’s largest crypto exchanges, is preparing to suspend Visa card services in Europe. Additionally, they terminated their partnership with Paysafe and made agreements with new fiat partners for euro deposit and withdrawal transactions.

- Gravity: Preparing to operate as the first Hyperchain of zkSync, Gravity is known as a hybrid derivatives exchange that includes futures and options trading products.

- JPMorgan: The company’s global payments director, Takis Georgakopoulos, stated that they conducted daily transactions worth 1 billion dollars through the JPM Coin payment system.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates instantly.