The US Federal Reserve’s potential decision to completely delay rate cuts in 2025 could spark a widespread market sell-off. Network economist Timothy Peterson suggests that this scenario might push Bitcoin prices down to the $70,000 range.

Fed’s Move Could Ignite the Bear Market!

On March 8, Timothy Peterson posted on X, saying, “It only needs one trigger. I think that trigger may be as simple as the Fed not cutting rates at all this year.” Just a day earlier, Jerome Powell had stated that there’s no rush to lower interest rates.

Speaking in New York, Powell remarked, “We do not need to be in a hurry and are well-positioned to wait for greater clarity.” These statements have increased uncertainty in the markets.

Could Bitcoin Drop to $57,000?

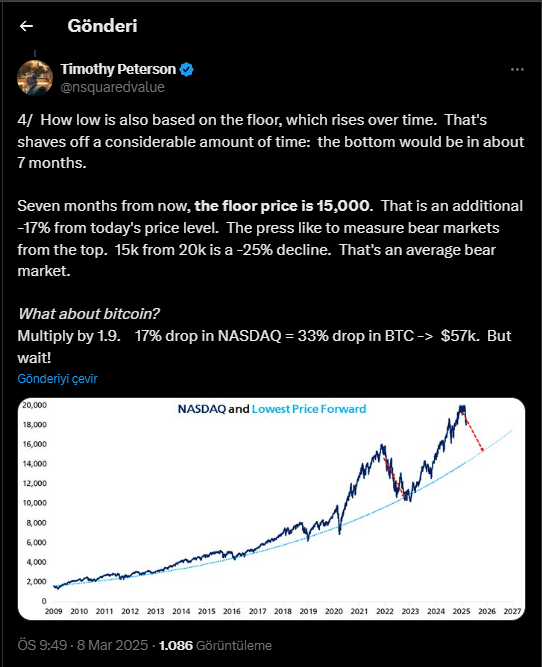

Peterson, using his Nasdaq decline model, estimated that if a bear market begins, Nasdaq could drop by 17%. Adapting this to Bitcoin, he predicted a 33% decrease, potentially bringing BTC down to $57,000.

However, Peterson noted that such a drop is unlikely. “Traders and opportunists hover over Bitcoin like vultures,” he explained, adding that if Bitcoin approaches $57,000, buyers will likely step in before it gets that low. He expects Bitcoin to bottom closer to the $70,000 range.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Peterson recalled how, in 2022, many expected Bitcoin to bottom at $12,000, but it only dropped to $16,000. “The same could happen here. If the bottom is expected at $57,000, a 25% higher level would be around $71,000,” he added.

Bitcoin was trading near $71,000 on November 6, after Donald Trump won the US election. It then rallied for a month, surpassing $100,000 by December 5.

In January 2025, Arthur Hayes forecasted a correction in BTC prices to the $70,000–$75,000 range. He also predicted a rally to $250,000 by the end of the year. Blockware Solutions offered a more conservative bear case, projecting Bitcoin could reach $150,000 in 2025 if the Fed reverses its stance on interest rate cuts.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.