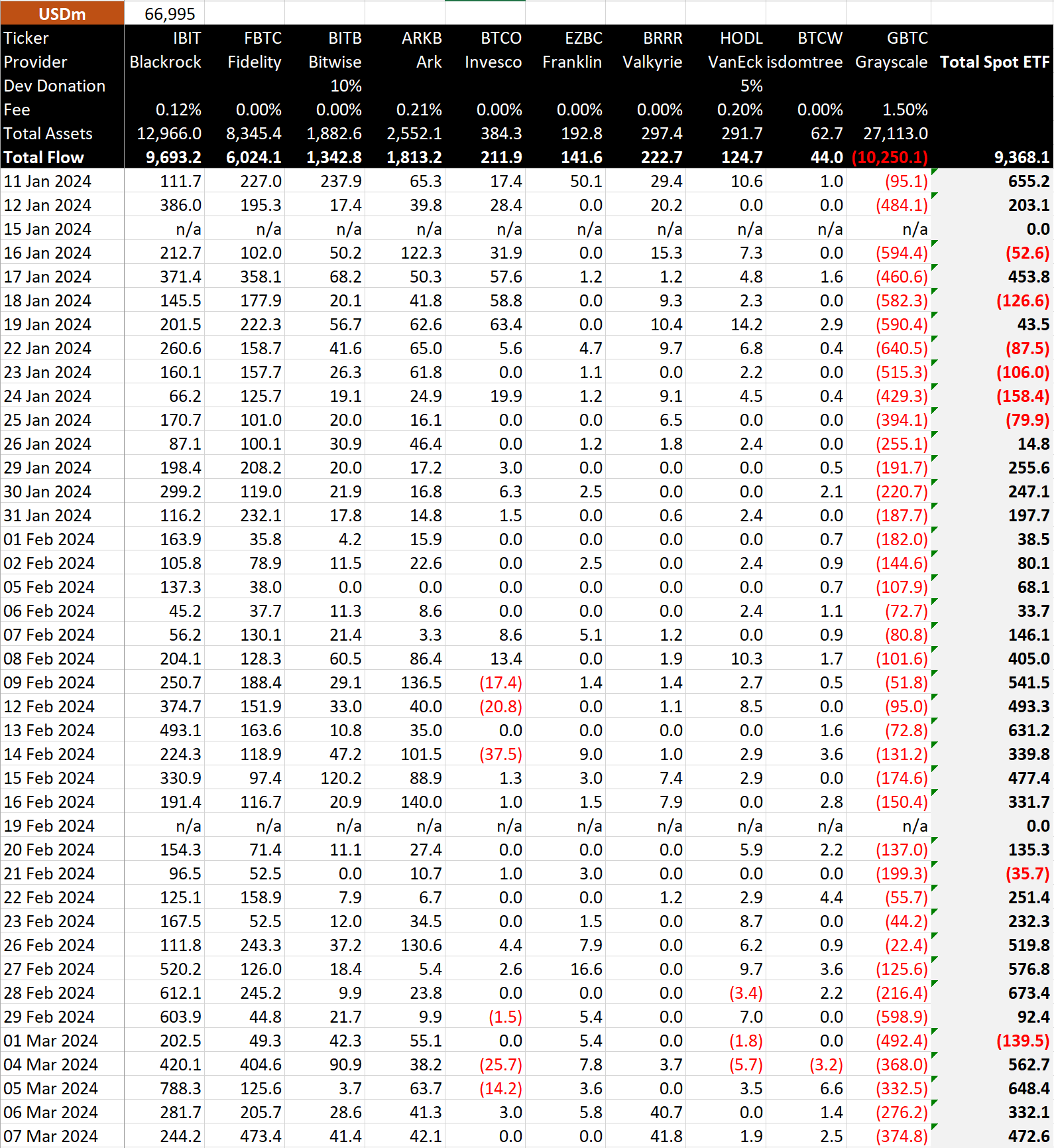

Bitcoin ETFs witness substantial net inflows totaling $9.4 billion, indicating growing investor confidence.

According to data from BitMEX, Bitcoin exchange-traded funds (ETFs) saw a significant inflow of around $473 million, equivalent to approximately 7,000 BTC on March 7. Fidelity ’s FBTC emerged as the top performer, experiencing a record-breaking inflow of $473 million, marking its highest single-day inflow to date. This surge propelled its total net inflows to over $6 billion and expanded its Bitcoin holdings to approximately 120,000 BTC.

BlackRock’s IBIT has consistently recorded strong inflows, with a recent inflow of $244 million, bringing its total net inflow to $9.7 billion and increasing its Bitcoin holdings to around 191,000. Mid-tier ETFs like Bitwise’s BITB and Ark’s ARKB also saw inflows of $41 million and $42 million, respectively. ARKB’s total net inflows reached $1.8 billion, while BITB slightly trailed at $1.3 billion.

BitMEX data reveals that Grayscale’s GBTC continued to experience outflows, contrary to the notion of diminishing outflows. It recorded $375 million in outflows, bringing its total net outflows to a significant $10.3 billion, resulting in approximately 218,000 BTC leaving the ETF since its launch.

Despite the outflows from GBTC, the combined net inflow into Bitcoin ETFs remains strong at $9.4 billion, equivalent to an impressive 174,881 BTC, as per BitMEX’s data.

You can share your opinions in the comments about the topic. Also, follow us on Telegram, Twitter, and YouTube for more content like this.