Video game retailer GameStop (GME) has completed a $1.5 billion convertible debt offering, with a portion of the funds allocated for Bitcoin purchases.

The initial target was at least $1.3 billion, but investors opted for an additional $200 million, bringing the total to $1.5 billion.

On March 25, GameStop’s board approved the company’s plan to invest in Bitcoin and US-dollar-pegged stablecoins.

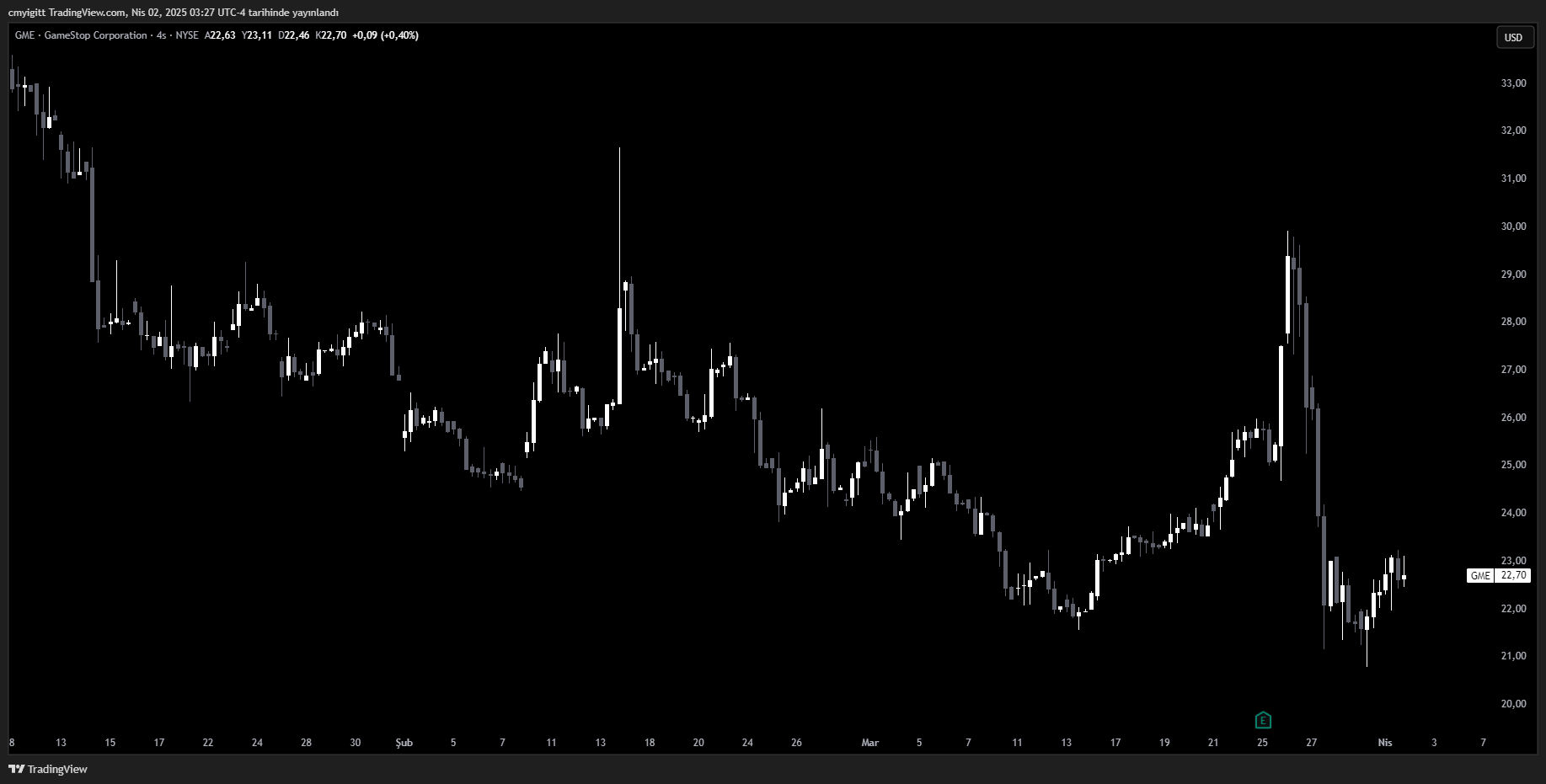

GameStop Stock Movement

Following the announcement, GameStop’s stock didn’t see a significant change. On April 1, it closed 1.34% higher at $22.61, with only a 0.5% increase after the market closed.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

However, on March 26, after revealing its Bitcoin investment plan, GME stock jumped 12% to $28.36, only to drop 24% to $21.68 the next day.

GameStop Joins the List of Bitcoin-Adopting Companies

With $4.77 billion in cash reserves, GameStop is now adding Bitcoin to its balance sheet. Previously, it had launched a crypto wallet but shut it down in November 2023 due to regulatory concerns.

GameStop is best known as the first meme stock success story from 2021, when retail investors collectively pushed its stock over 1,000% in a month, disrupting hedge funds that had bet against it.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.