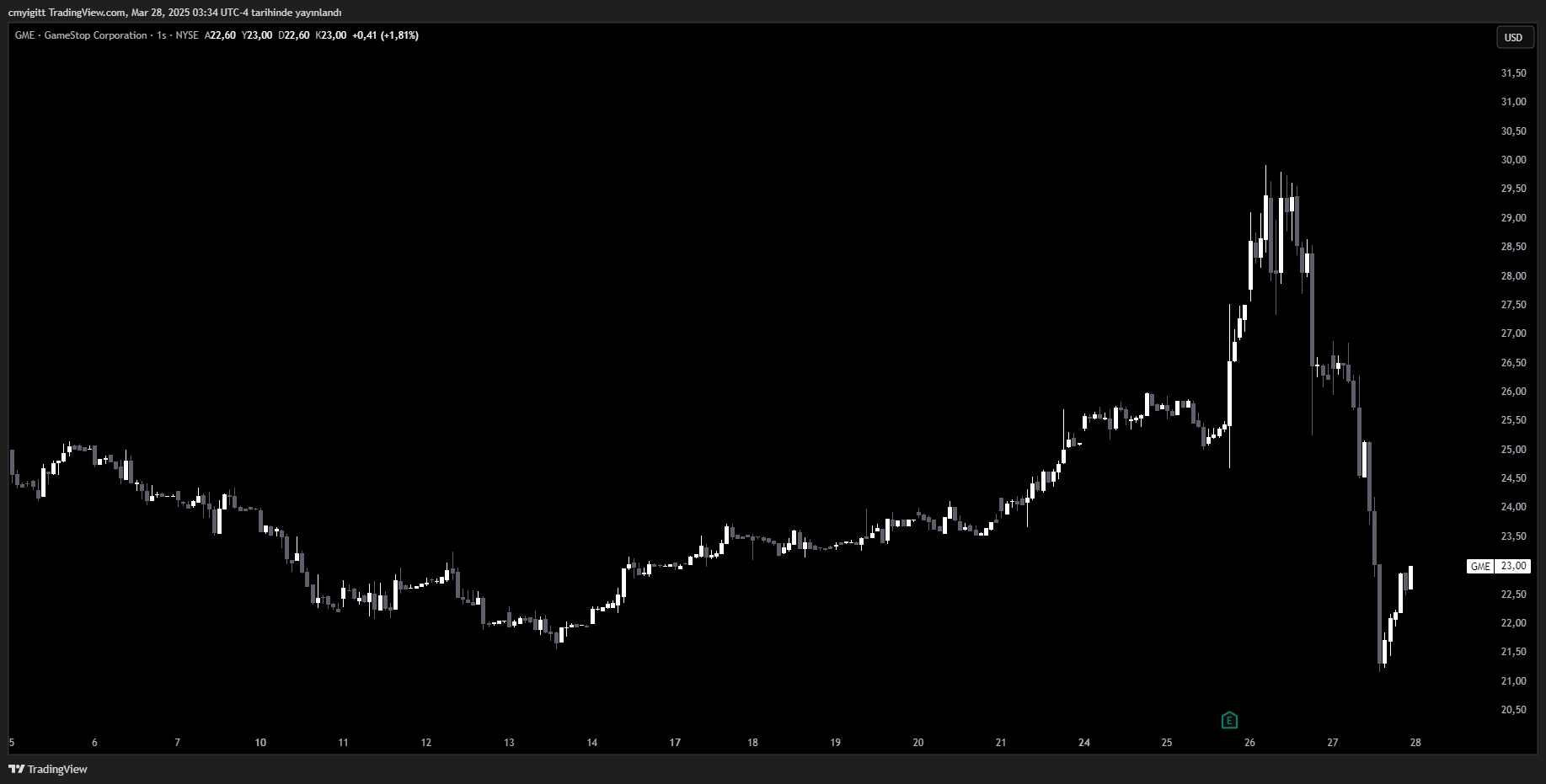

The New York Stock Exchange (NYSE) has imposed a Short Sale Restriction (SSR) on GameStop (GME) after its short sales volume surged by %234 in 24 hours, reaching 30.85 million shares. Under NYSE rules, SSR is applied when a stock drops more than %10 from the previous day’s closing price. GameStop shares fell %22, completely wiping out the %12 gain from its Bitcoin announcement.

Is Another GameStop Short Squeeze Coming?

GameStop‘s short sale volume is approaching 2021 short squeeze levels.

Kevin Malone, CEO of Malone Wealth, noted on X (Twitter):

“GameStop traded 50x more shares today than last Thursday. That’s statistically impossible without naked short-selling.”

In January 2021, GameStop stocks skyrocketed due to a short squeeze, causing massive losses for hedge funds while some retail traders made huge profits. The highest short volume during that time was 33.26 million shares on January 19, 2021.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

GameStop’s Bitcoin Purchase Feels Like “Dot-Com Hype”

GameStop has not disclosed how much Bitcoin it plans to purchase. However, on March 26, after market close, it announced a $1.3 billion convertible notes offering.

Tastylive CEO Tom Sosnoff told Yahoo Finance:

“It feels a little like the dot-com hype—just adding ‘.com’ to your name or buying Bitcoin with excess cash.”

Meanwhile, eToro U.S. investment analyst Bret Kenwell stated that investors are not confident in GameStop’s core business model.

Keith Gill’s Comeback Holds the Record for Largest Short Sale Volume!

The biggest short-selling day in GameStop history was June 3, 2024, with 46.20 million shares sold. This surge came after Keith Gill (Roaring Kitty) revealed on June 2 that he had invested $180 million in GameStop stocks. Some analysts believe GameStop’s stock drop was caused by its convertible notes offering.

Han Akamatsu compared it to MicroStrategy in 2021:

“In 2021, MicroStrategy issued $1.05 billion in 0% convertible notes, and the stock initially dipped due to hedging shorts. But when Bitcoin surged, it exploded. GameStop is following the same blueprint.”

If GameStop or Bitcoin prices rise significantly, another short squeeze could be on the horizon!

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.