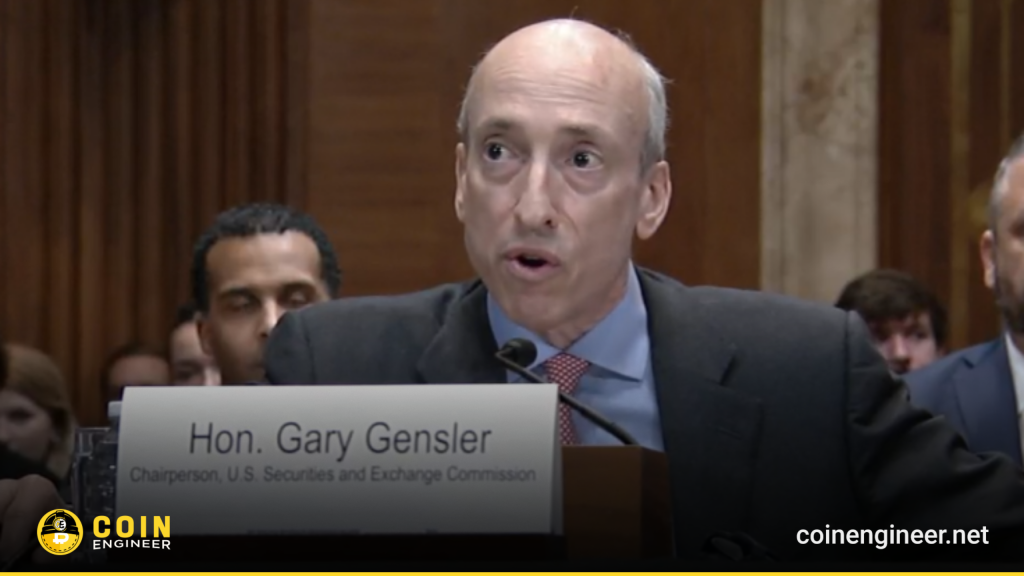

Gary Gensler’s announcement that he will step down as Chairman of the U.S. Securities and Exchange Commission (SEC) on January 20, 2025, has raised expectations for a shift in crypto regulations. Gensler’s tenure was marked by a strong enforcement strategy focused on investor protection, but he also faced criticism for allegedly stifling innovation.

SEC’s Legal Actions and Industry Response

Under Gensler’s leadership, the SEC filed lawsuits against major crypto platforms such as Coinbase, Kraken, and Binance, alleging violations of federal securities laws. These lawsuits focused on claims that these platforms failed to properly register as exchanges or brokers. Gensler’s classification of most cryptocurrencies as “securities” became a major point of contention in the industry.

For example, Coinbase highlighted the regulatory framework’s incompatibility with decentralized and global blockchain technology, emphasizing the lack of regulatory clarity. This has reignited calls for updated legislation balancing innovation with investor protection.

What to Expect from the Change in SEC Leadership

The SEC’s new leadership is anticipated to adopt a different approach to crypto regulation. Former SEC enforcement attorney Ladan Stewart suggested that the next chair might prioritize settlements to resolve ongoing cases. However, a compromise recognizing the SEC’s authority over secondary market token sales could face resistance from both the industry and some policymakers.

Candidates such as Robert Stebbins, Paul Atkins, and Teresa Goody Guillén are expected to bring varied regulatory perspectives. Regardless of who is chosen, there is hope for a more collaborative approach to blockchain regulation.

The Power of the SEC

Legislative dynamics may further complicate the SEC’s regulatory goals. The Congressional Review Act (CRA) could play a crucial role in overturning proposals deemed overly restrictive for crypto. For instance, Regulation ATS, which aims to classify decentralized platforms as exchanges, could be repealed under the CRA if approved before Gensler’s departure.

Meanwhile, judicial rulings are emerging as a counterbalance to the SEC’s broad interpretation of securities laws. A federal court in Texas recently invalidated the SEC’s “dealer” rule, citing overreach. Such decisions signal increasing judicial scrutiny of the SEC’s actions and a potential shift toward more balanced regulatory practices.

Challenges Faced Under Gensler

The crypto industry sees Gensler’s departure as an opportunity to rebuild relationships with regulators. Organizations like the Texas Blockchain Council believe settlements with platforms like Coinbase and Kraken could establish clearer compliance guidelines. However, the ultimate goal for the industry remains the implementation of a comprehensive regulatory framework that supports innovation while ensuring investor safety.

A Pivotal Moment for Blockchain Regulation

As the SEC transitions to new leadership, shifts in the approach to cryptocurrency regulation are expected. This new era, shaped by legislative reforms, judicial interventions, and administrative settlements, will be crucial for creating policies that recognize the transformative potential of blockchain technology while safeguarding public interest.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.