Although the outflows from GBTC have slowed down as of today, Bitcoin fell to its lowest level in two months on January 23.

You might like: DWF Labs Invests $500,000 in AirDAO to Support Ecosystem

As a result of this situation, Bitcoin fell below $39,000. After the GBTC share turned into a spot Bitcoin ETF investment fund on January 11, nearly $3.4 billion in outflows were made. At the same time, Grayscale transferred approximately 70,582 Bitcoins to Coinbase Prime, a US exchange, possibly to sell them.

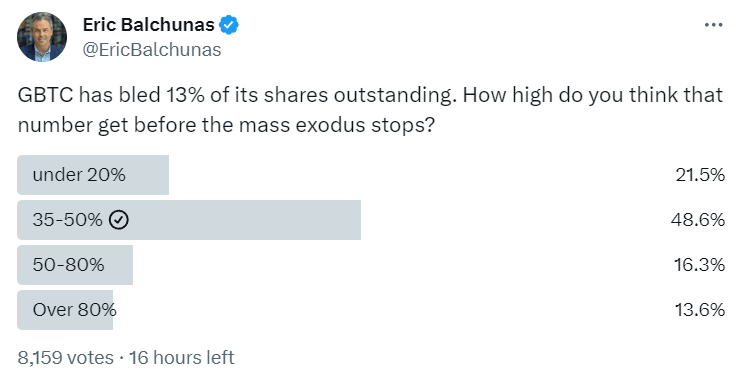

Investors began to worry that the exodus on the GBTC side would continue for a while longer. According to Bloomberg ETF analyst Eric Balchunas;

$515 million in outflows occurred from GBTC on January 23. This means 13% of GBTC shares.

Once again the “experts” told you the GBTC outflows had ended and once again they were wrong. #Bitcoin

— Magoo PhD (@HodlMagoo) January 23, 2024

Eric Balchunas launched a survey about GBTC on X

Eric Balchunas launched a poll on his X account asking “Do you think the outflows will continue?”. Nearly half of those who participated in the survey said it was a 35-50% chance. However, Balchunas and Bloomberg ETF analyst James Seyffart estimated that it would occur in about 25% of the current shares.

As we can see from the Grayscale website, there are currently 600.5 million shares, which means approximately 536,695 Bitcoins are in the fund.

Data from CC15Capital shows that 82,525 Bitcoins have been withdrawn from GBTC since January 10.

Stop panic selling your #Bitcoin just because you see panic-inducing tweets about $GBTC coins being sent to Coinbase every morning around 9:30am.

All $BTC sold by @Grayscale so far has been scooped up by the other (lower-fee) ETFs 👇 pic.twitter.com/1H3S5FFbnU

— CC15Capital 🇺🇸 (@Capital15C) January 24, 2024

It is thought that the outflows, which caused two-thirds of the approximately 22.3 million shares in the last 3 days, were made by the bankrupt FTX exchange. It is known that FTX still has about 8 million shares worth about $281 million.

Some analysts are concerned that Mt. Gox, after it was reported that the Mt. Gox trustee has reached out to creditors to complete identity verification for accounts that will receive Bitcoin and Bitcoin Cash refunds, will create another pressure factor on the Bitcoin price by selling the assets it holds.