Gold is proving its worth again as a safe-haven asset, outperforming the S&P 500 so far in 2024 amidst looming economic uncertainty. This trend aligns with historical patterns where gold tends to outperform stocks during periods of market turbulence.

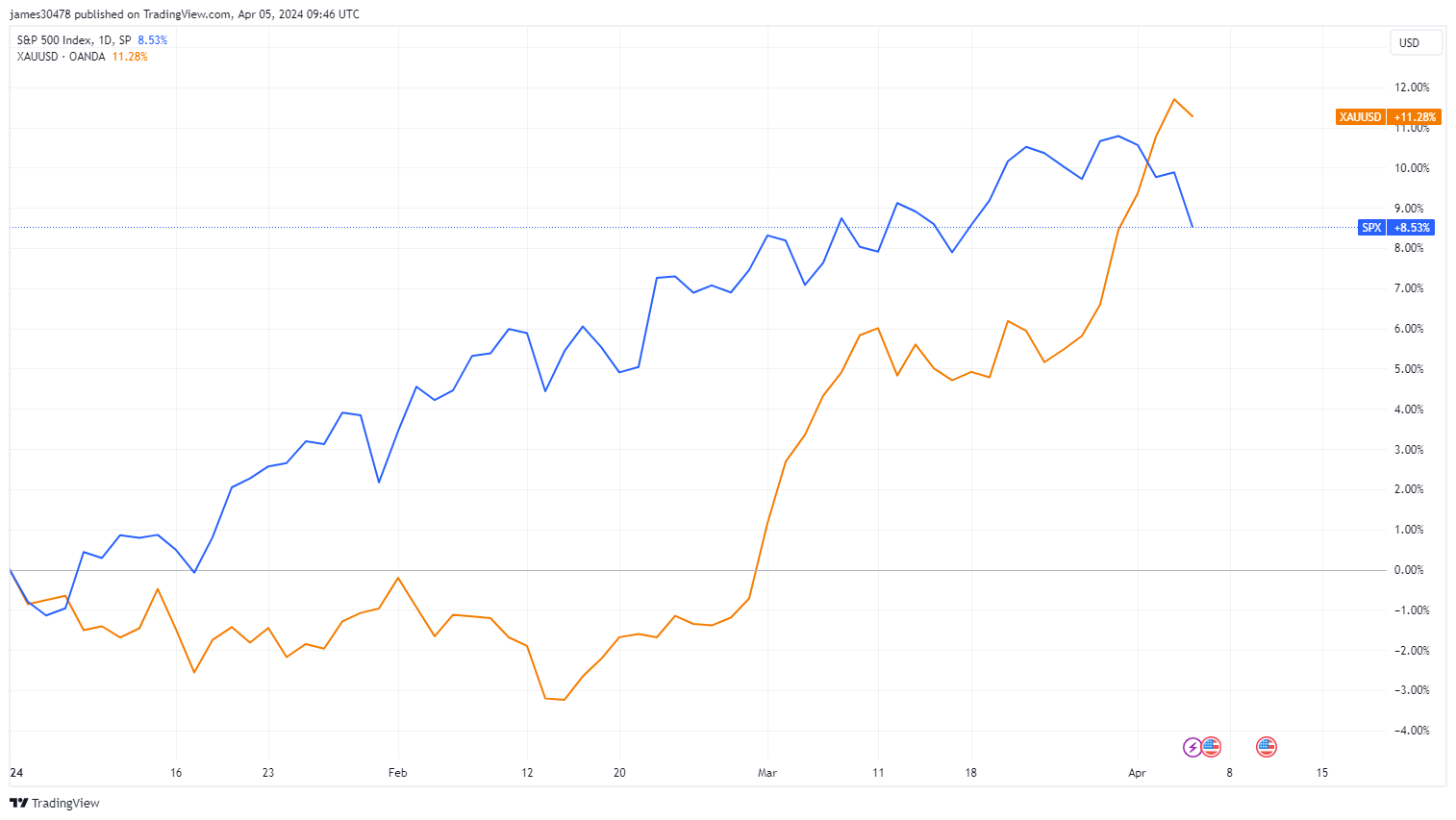

Gold Outpaces Stocks YTD

Year-to-date, gold has surged roughly 11%, compared to the S&P 500‘s more modest 9% gain. This performance reflects the traditional role of gold as a hedge against economic volatility.

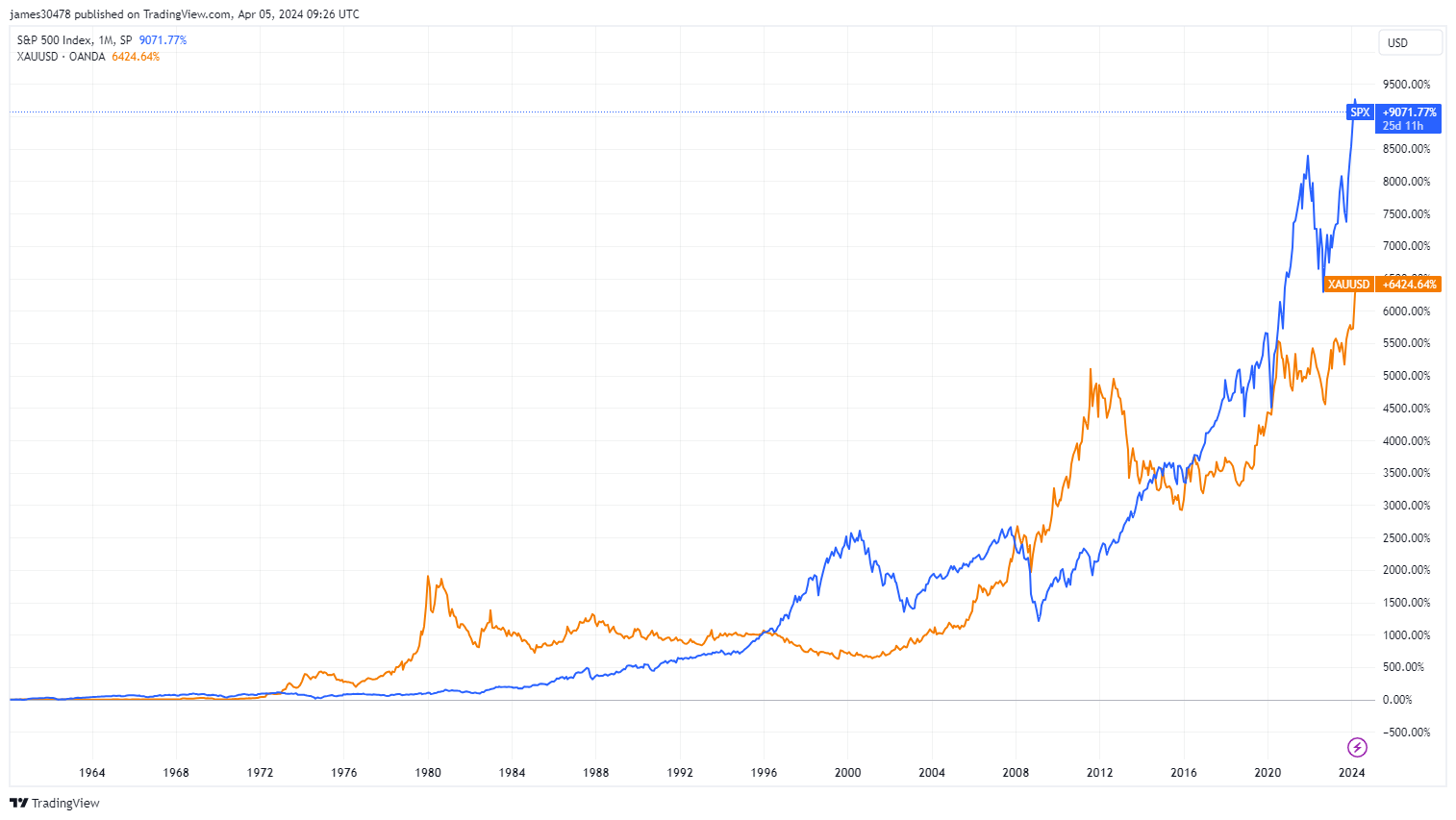

History Repeats: Gold’s Strength During Uncertain Times

Looking back 70-80 years, the relationship between the S&P 500 and gold has been cyclical, with each asset class taking turns as the dominant performer. However, gold has a well-established reputation for outperforming during periods of economic uncertainty. This was evident from 1972 to 1996, a period encompassing five recessions, and again in the aftermath of the 2008 financial crisis.

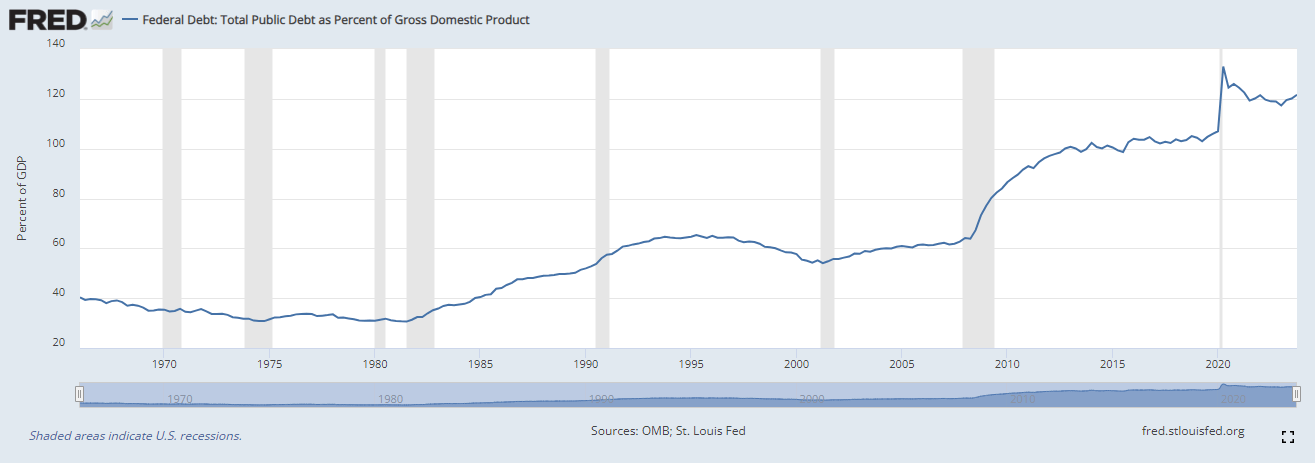

Macroeconomic Factors Supporting Gold’s Rise

Several current macroeconomic factors are likely contributing to gold’s current strength. According to data from FRED, the United States is grappling with significant deficits, with public debt exceeding 120% of GDP in Q4 2023. Additionally, rising commodity prices and ongoing global conflicts add to the potential for an inflationary rebound.

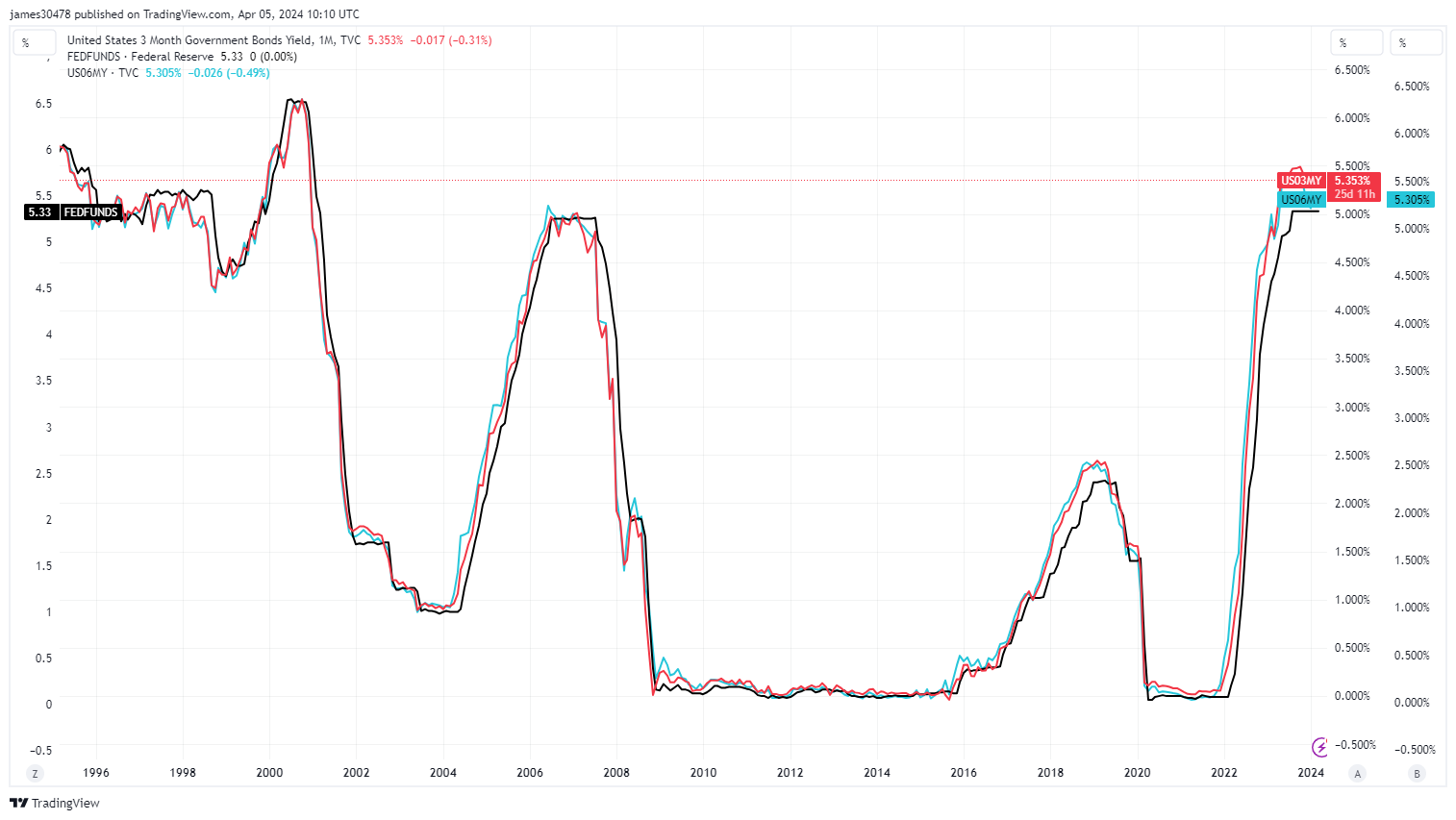

Rising Interest Rates and Debt Challenges

The Federal Reserve’s current target interest rate range of 5.25% to 5.50% could lead to increased challenges for companies servicing their debt in the coming year.

Rate Cuts on Hold, Short-Term Yields Tell the Story

While some anticipate future rate cuts, the short-term treasury market suggests otherwise. As Caleb Franzen, Founder of Cubic Analytics, points out, the yields on 3-month and 6-month treasury bills are currently higher than the Effective Federal Funds Rate (EFFR). This indicates that the market doesn’t expect a rate cut within the next six months.

Bitcoin’s Rise: Another Hedge Against Uncertainty?

Interestingly, Bitcoin, often dubbed “digital gold,” has also seen significant growth, exceeding 50% year-to-date. If this rally continues following the recent Bitcoin halving event, it could further solidify Bitcoin’s position as a potential hedge against economic uncertainty.

Conclusion

Gold’s current outperformance reinforces its historical role as a safe-haven asset during economic turbulence. As economic uncertainty persists, investors are likely to continue seeking the stability that gold offers. The future performance of Bitcoin as a potential hedge against economic challenges also remains a topic of interest.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.