After weeks of steady daily withdrawals, the Grayscale Ethereum Trust (ETHE) marks a major turning point with its first day of zero outflows since its establishment. This is true for Ethereum and certain of its layer-2 networks, where on-chain activity has clearly surged.

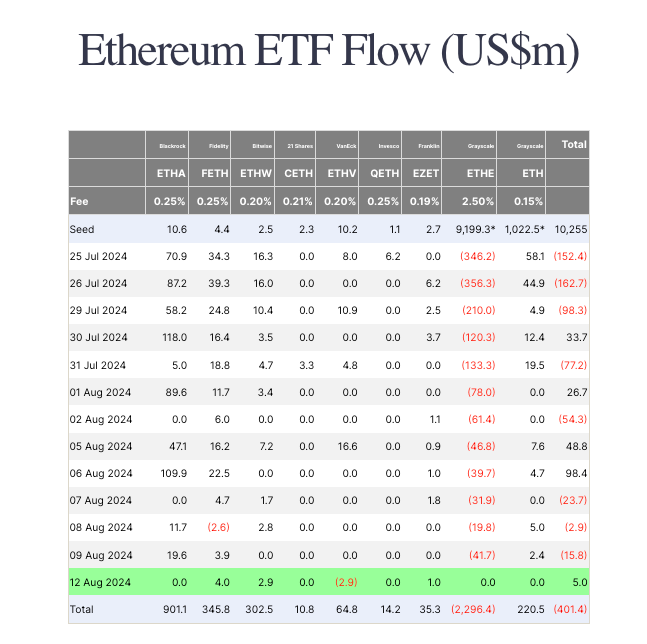

Data from Farside shows that on August 12 Ether exchange-traded fund (ETF) flows went positive for the sixth time since their introduction on July 23, helped by ETHE is first day of zero outflows. ETHE has witnessed about $2.3 billion in Ether outflows since its introduction, dropping more than 25% of its entire assets in little over two weeks, notwithstanding this encouraging trend. ETHE had $9 billion in ETH prior to being turned into an ETF.

By contrast, Grayscale’s Bitcoin Trust (GBTC) waited nearly four months before showing its first day without outflows. ETHe is zero outflows align with a strong rise in Ethereum network activity, especially on layer-2 networks and distributed exchanges (DEXs).

DefiLlama data shows that whilst trade volumes on Solana-based DEXs dropped by 10% over the last 24 hours, Ethereum and Base networks saw trading volumes rise by 12% and 11%, respectively. With 8.65 million new addresses generated on Uniswap’s L2 networks in July, over double the quantity contributed in June, according Dune Analytics, Ethereum layer-2 networks are also seeing record expansion.

Weekly active users of layer-2 networks such Base and Arbitrum have also grown; Base has 2.64 million and Arbitrum has 1.37 million respectively. Based on L2Beat statistics, Ethereum L2 networks handled 298 transactions per second (TPS) on August 12, almost matching the previous all-time high of 322 TPS recorded on July 18.

The total value locked (TVL) across all Ethereum L2s now stands at $37.7 billion, while Ethereum’s mainnet boasts $85 billion in TVL.

Drawing comparisons to the price movement of Bitcoin after its spot ETF approvals, which also witnessed major withdrawals from the Grayscale Bitcoin Trust (GBTC), some commentators have referred to the declining ETHE outflows as a positive indication for Ether’s price in the next months.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.