Crypto asset management company Grayscale, following its moves for XRP and Cardano ETFs, has now filed for an ETF based on Polkadot‘s DOT token. This filing comes after the SEC adopted a more crypto-friendly approach towards the digital asset industry.

Grayscale Expands Its Portfolio with Polkadot ETF Filing

Grayscale has filed a request through Nasdaq to list and trade shares of the Grayscale Polkadot Trust (DOT). The filing starts a 45-day review period during which the SEC will assess the application. The SEC can approve, reject, or extend the review period.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Grayscale had previously offered bitcoin and ether ETFs and has now filed to convert its XRP Trust into an ETF. Additionally, it filed for a spot Cardano ETF. These filings come at a time when the SEC has adopted a friendlier stance toward the digital asset space, particularly after it dropped several crypto-related investigations, including those targeting platforms like Robinhood and OpenSea.

Polkadot’s Status and Grayscale’s Role in the Market

Grayscale has never offered a standalone product for Polkadot until now. With this filing, it follows 21Shares, which filed for a spot Polkadot ETF with the SEC last month.

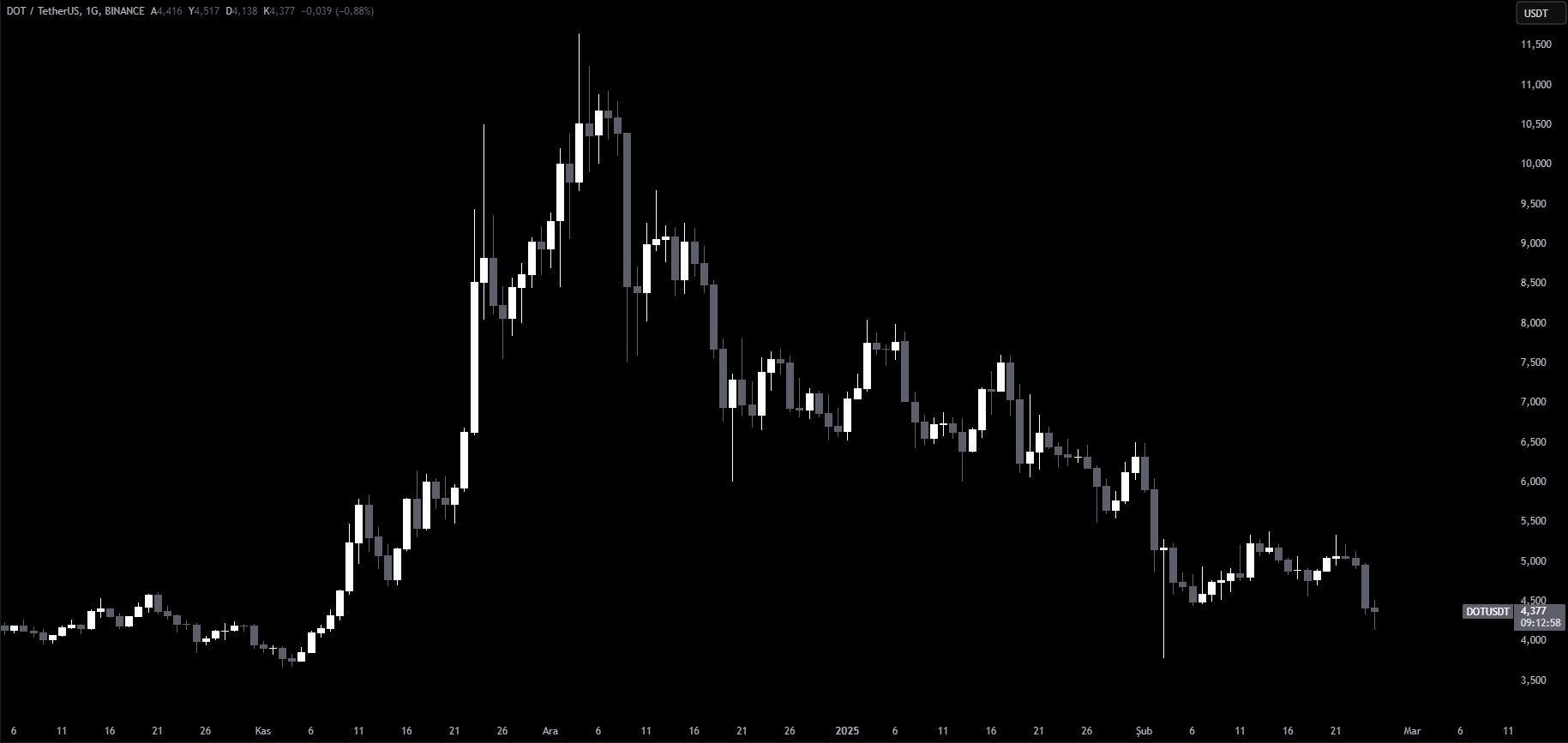

At the time of writing, Polkadot‘s DOT token is trading at $4.4, having lost 6.7% of its value in the last 24 hours, amid a broader downturn in the cryptocurrency market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.