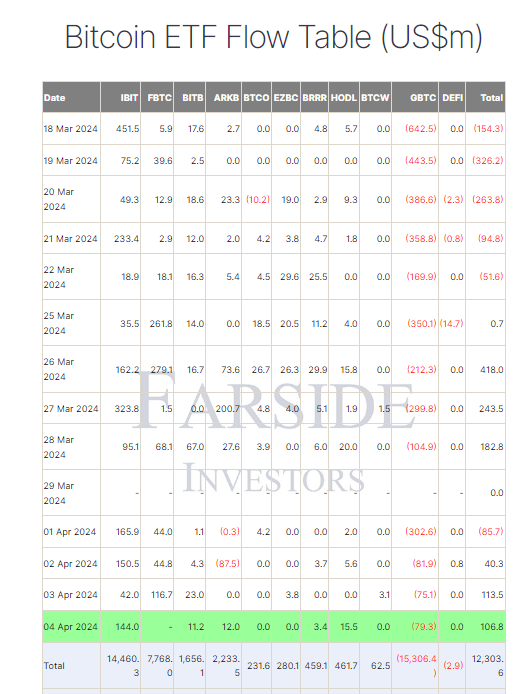

Bitcoin exchange-traded funds (ETFs) continued their positive trajectory on April 4th, recording a collective net inflow of $106.8 million. This marks the third consecutive day of net inflows, extending the positive trend that has seen inflows on seven out of the last eight trading days.

Grayscale GBTC Sees Outflow, Newer Funds Shine

However, the picture isn’t entirely rosy. Farside data reveals that the Grayscale Bitcoin Trust (GBTC) experienced its third consecutive double-digit outflow, this time amounting to $79.3 million. This pushes its total net outflow to -$15,306.4 billion.

Despite this, newer Bitcoin ETFs are attracting significant inflows. BlackRock’s iShares Bitcoin Trust (IBIT) registered a robust net inflow of $144.0 million, bringing its total net inflow to a positive $14,460.3 billion.

First Inflow for ARKB, Strong Day for HODL

Ark Invest’s ARKB ETF also recorded its first net inflow since March 28th, adding $12.0 million to its total net inflow of $2,233.5 billion. Similarly, VanEck’s HODL ETF witnessed its strongest net inflow since March 28th, with $15.5 million in new investments. This brings its total net inflow to $461.7 million.

Overall Positive Trend for Bitcoin ETFs

Despite the outflow from Grayscale, the combined net inflow across all Bitcoin ETFs now stands at a positive $12,303.6 billion. This data reflects the continued positive momentum in the digital asset market, with investor interest shifting towards newer Bitcoin ETF offerings.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.