Grayscale‘s Bitcoin spot Exchange Traded Fund (ETF) slowed down on the third consecutive trading day after net outflows. While the total ETFs reached the peak of the highest net inflows in two weeks, it dropped down to a record low of $22.4 million.

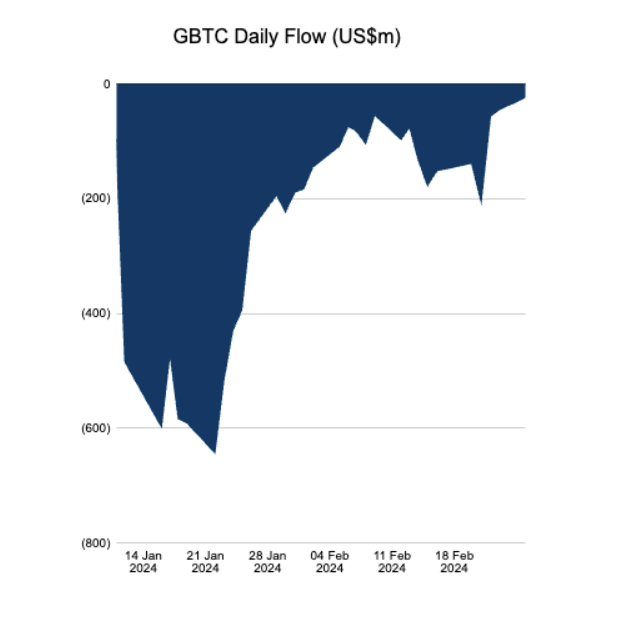

According to data from Farside Investor, a slowdown in net outflows occurred in Grayscale Bitcoin Trust’s (GBTC) on February 22, 23, and 26. On Friday, daily net outflows were recorded at $44.2 million, but outflows further decreased in half on February 26. However, after Grayscale’s transformation into an ETF, an outflow trend continued for 31 consecutive trading days since January 11, totaling $7.47 billion. Bitcoin technology company

Blockstream CEO Adam Back, stated on February 26;

“I’m eagerly waiting for the day GBTC will enter. But he emphasized that enough premium would be required to direct investors to arbitrate at the ETF. Apollo Crypto’s chief investment officer Henrik Andersson shared the same view and said it would be a “mega signal to the market” when Grayscale’s fund makes its first net inflow.

Meanwhile, on February 26, according to Farside’s data, the total net inflows of all Bitcoin ETFs, including companies like Invesco and Galaxy, reached $515.5 million, which was the highest level in two weeks. ETFs, which reached $631.3 million in total net inflows on February 13, have lost momentum since then; even relatively larger outflows were experienced from GBTC and fewer inflows were received into other funds, a net outflow of $35.6 million was seen on February 21.

Fidelity’s ETF, which saw a significant portion of the inflows at over $243 million on February 26, making up almost half of the day’s net total. This was also FBTC’s second highest entry day after January 17. The other half came along with the BlackRock ETF and from funds like ARK Invest and 21Shares; about $112 million and over $130.5 million were invested in these funds.