A crypto analyst warned that Bitcoin’s price could experience volatility if the U.S. Bitcoin Strategic Reserve bill is passed.

The analyst also cautioned that if Senator Lummis’ proposal for the U.S. government to acquire 5% of Bitcoin’s supply is approved, price volatility could increase in the short term.

Ben Simpson, founder and CEO of Collective Shift, said:

“I expect it to be quite volatile, especially if the strategic Bitcoin reserve gets approved; I think Bitcoin will pump and then rotate back.”

Bitcoin Dominance Will “start to fall.”

After Trump won the presidential election on November 5, Wyoming Senator Cynthia Lummis, a Trump supporter, Republican, and crypto advocate, announced that she would prepare a bill for the U.S. government to purchase 1 million BTC and hold it for at least 20 years.

Regarding the current market situation, Simpson believes that Bitcoin dominance, which is a measure of how much of the total crypto market value belongs to BTC, will “start to fall.” He thinks the “rotation into altcoins has actually begun” as BTC “started consolidating around $100,000” and altcoins “began to rise.”

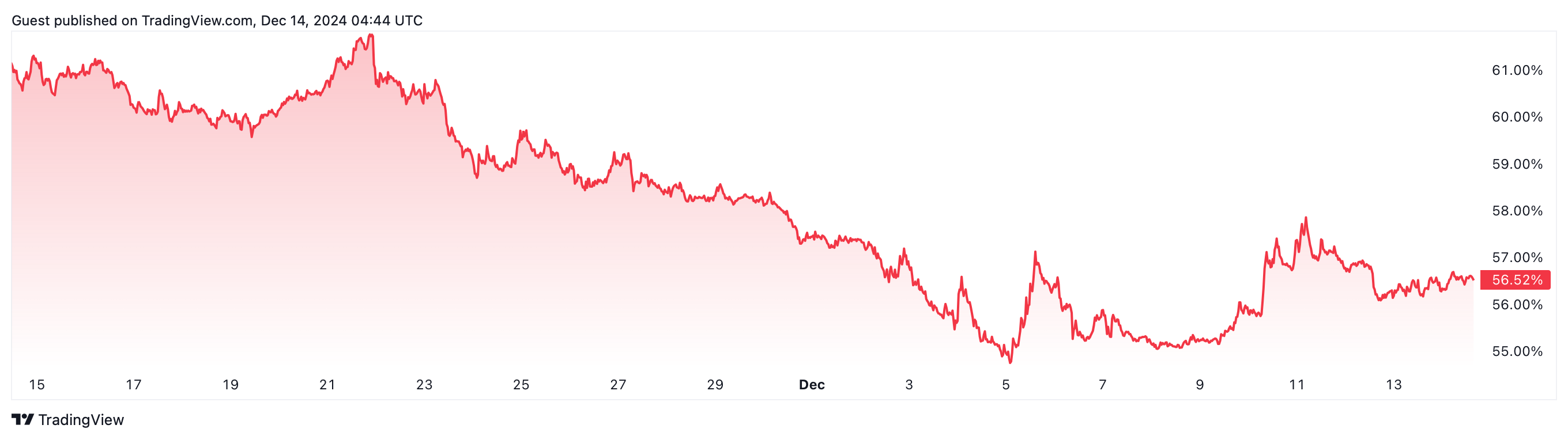

At the time of publication, according to TradingView data, Bitcoin dominance is 56.63%, showing a 7.20% decrease over the past 30 days.

Bitcoin Dominance Has Dropped 7.39% Over The Past 30 Days

Crypto trader Momin told his 140,000 X followers on December 13:

“I expect this downtrend in dominance to continue, and we could see altcoins run pretty hard in the coming week.”

However, Simpson believes the transition into altcoin season won’t be so straightforward.

“I think it will be quite volatile; I don’t think it will be a direct transition into altcoin season,” he added.

Bitcoin Will Continue To Be “part of the portfolio” For Institutions

Meanwhile, Bitfinex analysts stated that, based on returns, many altcoins have not yet surpassed new all-time highs against Bitcoin, “proving that Bitcoin has always been a fruitful and competitive investment, even when compared to Altcoins.”

They added, “In our view, even after any pullbacks, Bitcoin will continue to be part of major institutions’ portfolios, and interest in Bitcoin will keep growing.”

Bitfinex analysts also noted that, with Bitcoin now reaching six-figure prices, as long as strong demand continues, any upcoming dips will be short-term and could present buying opportunities for investors:

“At the 100K level, there has been enough spot buying to sustain this level, and leverage levels are reasonable, so even if a dip occurs, which wouldn’t be surprising during the holiday season, the price trend remains healthy, and any dip could be viewed as a buying opportunity.”

They added, “Believers in Bitcoin are becoming more adamant about the asset being a perfect substitute for gold and a true store of value.”

On November 23, global investment manager VanEck reissued its $180,000 price target for Bitcoin at the current cycle’s peak.

VanEck digital asset analysts Nathan Frankovitz and Matthew Sigel stated that the next phase of the crypto bull market is “just beginning.”

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.