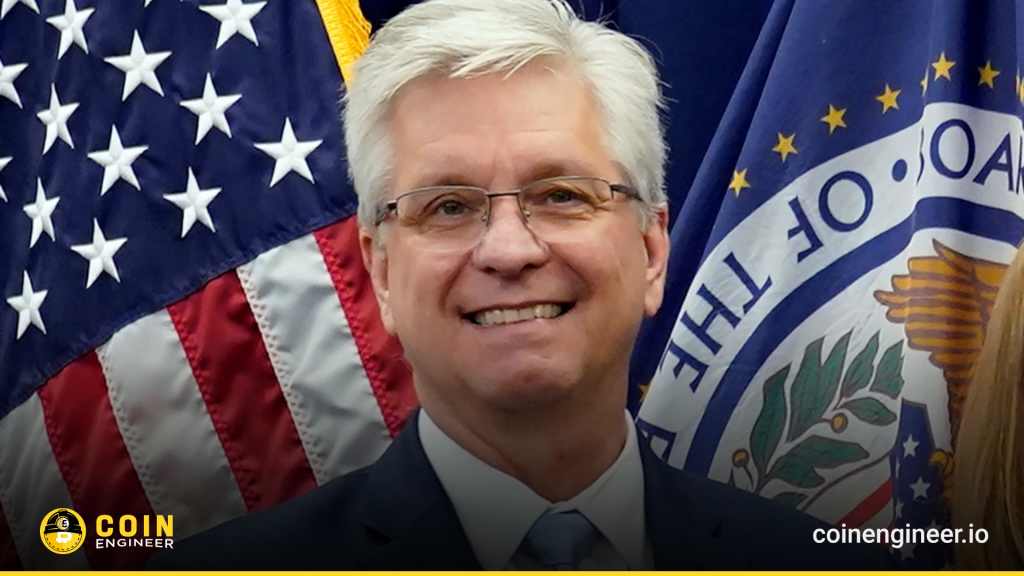

Recently, the markets have been carefully following the statements of the US Federal Reserve (Fed) officials regarding interest rate cuts. In his statements, Fed member Christopher Waller displayed a cautious approach regarding interest rate cuts. Waller pointed out that uncertainties in the economy continue and emphasized the need to be careful against possible fluctuations in the markets.

Waller stated that the timing and size of interest rate cuts should be carefully evaluated. Especially in an environment where inflation is not declining, sudden interest rate cuts may have undesirable consequences. This situation poses risks for the future of the economy.

Waller also pointed out that the Fed’s interest rate policies should be consistent with the broader economic outlook. If high inflation persists, there should be no rush to cut rates, he said. She emphasized that the Fed should carefully monitor developments in the economy and inflation rates.

On the other hand, while some economists find Waller’s statements positive, others think that the Fed may need to cut rates further. However, Waller emphasized the importance of being cautious on this issue and stated that the markets should take this situation into consideration.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.