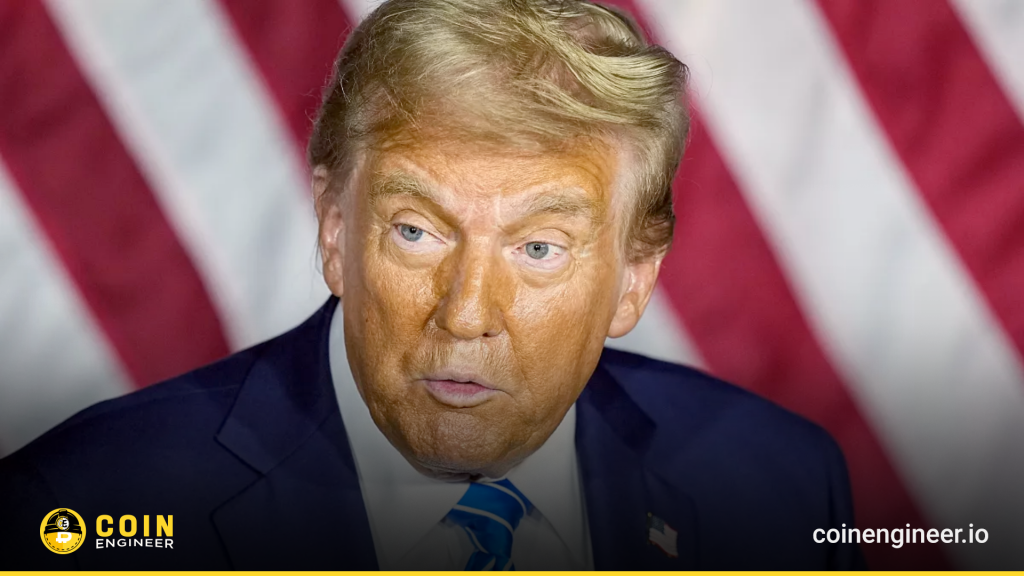

Kain Warwick, founder of Infinex, recently commented on the underwhelming performance of the Trump-linked World Liberty Financial token sale, attributing it to a shift in the crypto market from initial coin offerings (ICOs) to memecoins. Speaking about how the landscape has changed since 2017, Warwick suggested that if Trump had launched World Liberty Financial during the ICO boom, it might have raised $1 billion. He explained that the current crypto market meta has moved away from traditional token sales and that the sale’s one-year token lock-up might have further deterred investors, especially during a period where memecoins dominate, often with much shorter holding periods.

Warwick also discussed the ongoing “DeFi renaissance,” pointing out that DeFi developers are energized, but he emphasized that the industry still faces a high barrier to entry. His new project, Infinex, aims to simplify the user experience by breaking down complex aspects of DeFi, such as gas fees and private keys, which he feels deter everyday users. Warwick sees Infinex as a platform that could significantly lower these barriers and make decentralized finance more accessible to a broader audience.

Might interest you: What is BabyDoge?

Looking ahead, Warwick expressed excitement about 2024, predicting that it will be a pivotal year for crypto, potentially fueled by the upcoming U.S. presidential election and the growing mainstream attention on cryptocurrencies. He also voiced hope for a shift in U.S. political leadership that could lead to regulatory changes, such as the dismissal of SEC Chair Gary Gensler, who has been critical of the crypto industry.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.