According to crypto analyst Markus Thielen, there is one important indicator that shows whether there is institutional interest in Bitcoin and it is not currently showing positive signals.

The stablecoin minting rate, in particular, is considered one of the clearest indicators of Bitcoin buyer activity. However, this indicator has cooled significantly in the last seven days.

“Institutions that channel fiat money into crypto via the Circle benefited from the drop below $55,000 but do not seem very keen to enter the market at current levels,” Markus Thielen, research director at 10x Research, said in a report published on August 16.

Institutional Investors Expect a Bitcoin Price Drop

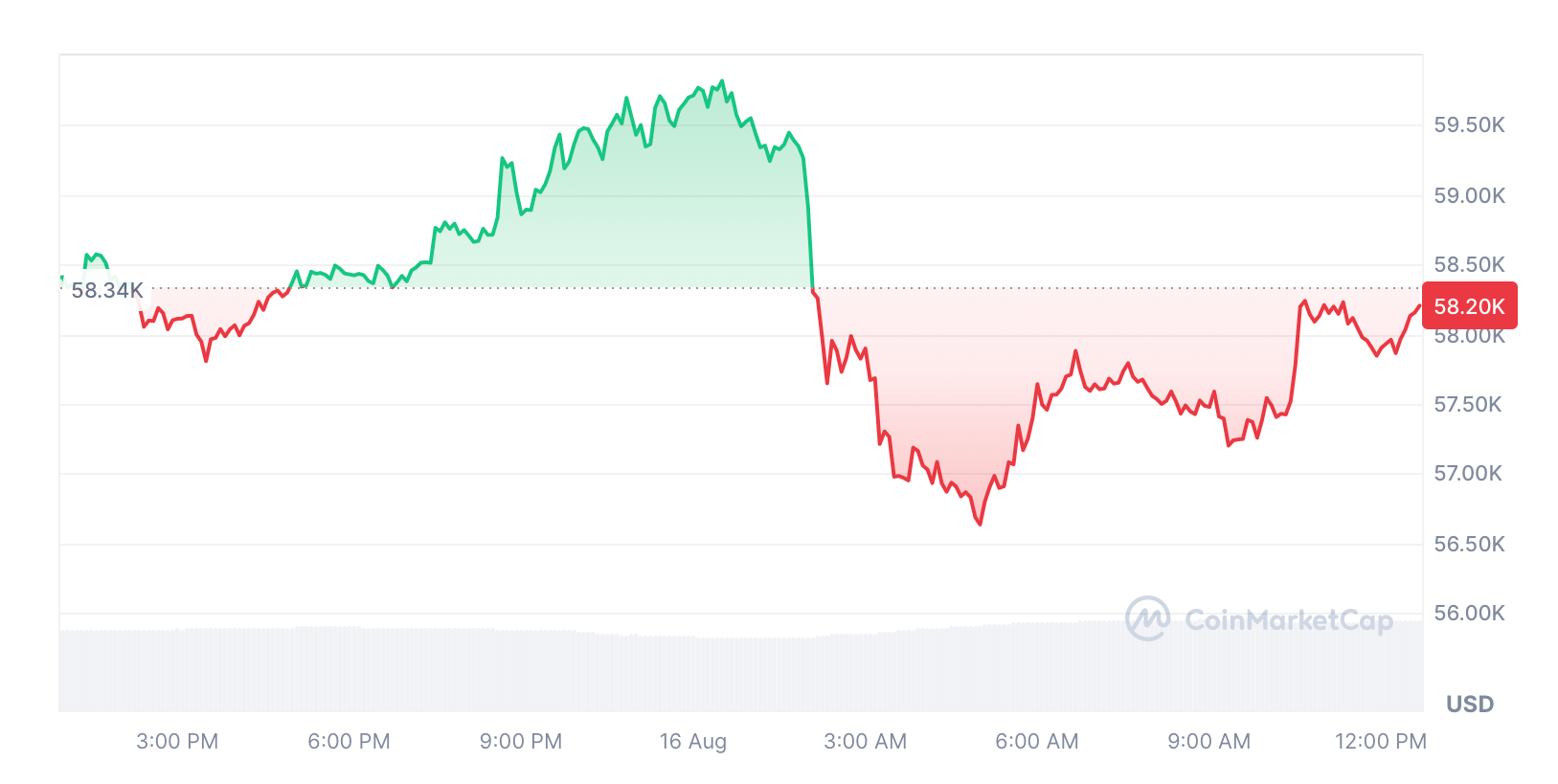

Bitcoin has been trading below $60,000 for the past 24 hours. The indicator measures the creation and issuance of new stablecoins, indicating how much US dollars are being converted into crypto.

Thielen noted that stablecoin inflows are a significant sign that fiat money is being converted into crypto, often into coins like BTC or ETH.

Might interest you: Bitcoin Sell Pressure Could Test $56K Support as Options Expiry Nears

The situation was different in early August when Bitcoin fell to $49,472. Thielen noted that this metric saw a sharp increase to $2.7 billion on August 6, but has since fallen to $1.4 billion, with Bitcoin still trading below the critical $60,000 level.

Currently, Bitcoin is trading at $58,149, down 0.35% over the past 24 hours. Meanwhile, futures traders see potential for further price declines in the asset, with the long-to-short ratio slightly tilted toward short positions at 50.88% over the past 24 hours.

The Crypto Fear and Greed Index dropped to a “Fear” score of 27 at the time of publication.

Despite the recent correction to five-month lows, the Bitcoin bull run is expected to last another year. Based on Bitcoin’s rates in previous cycles, the bull run is estimated to last until the third quarter of 2025, according to a report released by Bybit and BlockScholes.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.