Perp, which delighted investors with an increase of approximately 180% in December, managed to make it to the list of the most gainers by starting the week with an increase of approximately 45%. Is a rally coming soon for Perp? Here are the key levels for Perp!

You might also like: Bitcoin Skyrockets: Surpasses $45,000 on ETF Hopes!

Perpetual Protocol, founded by Yenwen Feng and Shao-Kang Lee in 2018, is a decentralized exchange that facilitates crypto trading with perpetual contracts on the Ethereum network and allows users to keep their transaction costs low thanks to the xDai technology.

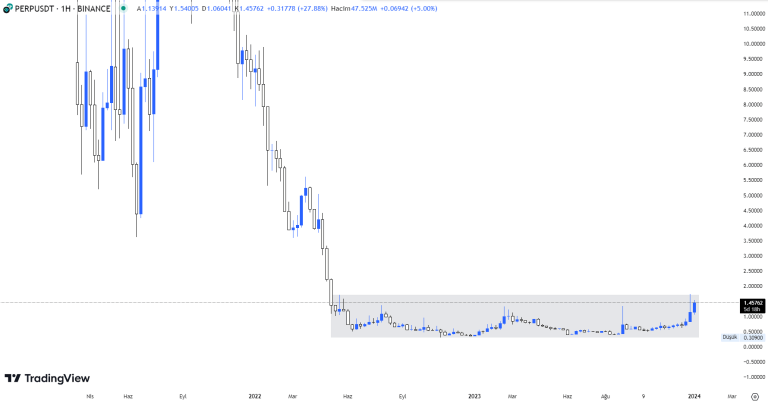

Perp, the native token of Perpetual Protocol, an important project in the DeFi category, showed a performance of approximately 330% from September 2023 to today. Perp, which started the first week of 2024 with an increase, continues to delight investors.

Is the Perp Rally Starting Soon?

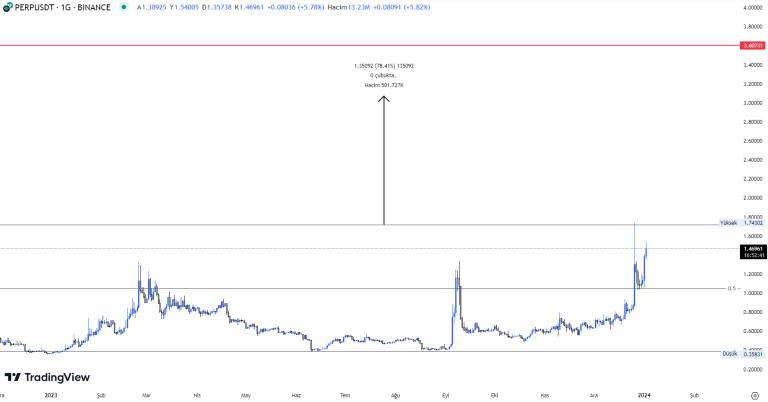

Perp experienced a pullback to $1.0328 after being rejected at the $1.72 level, the upper resistance point of the price range where it accumulated significantly on the weekly chart. Later, with Bitcoin continuing its upward movement, the price gained momentum again and approached the resistance area.

The price, which moved again with the pullback movement it made to the EQ (equilibrium) region of the daily range structure after receiving a rejection from the $1.72 resistance level, is currently trading at $1.47. It can be said that the price is positive as long as it does not lose the intermediate support region of $1.334.

If the upper resistance zone of $1.72 is broken with volume support and then, with the daily closings to come, this resistance level turns into an S&R Flip zone and turns into a support point, a rally is possible for $PERP.

The first area where profits can be taken is the $3.08 level, which is the area where the price may want to go as far as the channel length. Then, the $3.6 level catches the eye as an important resistance area that could hold the price. It is worth reminding that it is important to see high-volume closings and check the market structure before taking a trade.