Is a Bitcoin spot ETF approval coming? Why Did It Rise? As we know, Bitcoin has been in a price accumulation process for a long time. Therefore, no significant rise was seen in the market during this period. However, after the closing for the month of September last night, Bitcoin began to rise sharply. Rumors then began to circulate. These rumors, as you would expect, were related to the approval of spot Bitcoin ETF by the US Securities and Exchange Commission (SEC).

Was It Really Approved?

I want to start this part of the article with an answer: No, it was not approved! The earliest period for the SEC to approve or reject the companies applying for the Spot Bitcoin ETF right starts from October 16th. Then, these decisions will be announced on October 17 and 18. Decisions for the ETF prior to these dates will all be for Ethereum.

It seems that they are trying to spread a FUD in the market. Typically in these situations, they force small investors in the market to buy with news like this. After people make purchases, large volume decreases begin to come. Thus, they harm people by liquidating on both spot and derivative side. So, how do we understand this? How do we defend ourselves from such situations?!

What Was the Reason for the Rise?

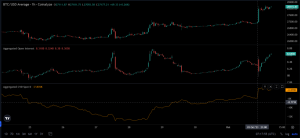

When answering this question, I will use two on-chain metrics. The first of these is the Coin-Destroyed Days (CDD) data. With this data, we can see that investors have made large moves to exchanges in Bitcoin. But this data may not yield definite results. Because generally CDD takes transfers into account and this increases not only from wallets to exchanges but also when transfers come to other wallets. Generally, when CDD rises, we can see a sale coming.

We will use the second metric to confirm this data, the Exchange Inflows CDD (eiCDD) metric. This only and only provides us with high-volume transfers made to exchanges. If both data support each other, it is an indicator that sales will come.

As understood from the image above, such large amounts of Bitcoin have not entered the spot exchanges for a long time. But you said this will be a sale, but the price rose, how can we believe this graph? You’re right, but there is an important point you missed, such drops do not come instantly, as I mentioned above, they first motivate people to buy. The rise also stems from this.

You might like:SBF Offered 5 Billion Dollars to Trump!

In this chart, you see that the CVD Spot data increased first, meaning that the amount of Bitcoin held in spot exchanges increased immediately after the transfer, but the sale did not come right after, people were started to be given “confidence” by keeping the price here. Then as you see, sales started to come in proportions. Therefore, examining the data and being able to use them is the best way not to be a prey to the whales in this market.

How Can We Be More Careful Investors?

First of all, I should say that it always wins to trade against the majority, especially in the cryptocurrency market. Sure, there must be small exceptions here too. But proportionally, an investor who behaves like this succeeds in two out of three transactions. This is a gigantic success rate of 75%. If you have such a rate, you would be more successful than an ordinary Wall Street broker.

Congratulations! Now you can enjoy your new job in your own corner reserved for you on Wall Street!

Let’s put aside Wall Street dreams and focus on reality! If you want to read the market, the only thing you need to do is to read the data that the market presents to you, which is open to everyone but at the same time ignored by everyone. So, what are these data? Which ones did we use?

The first is, Cumulative Volume Delta (CVD). This data will never mislead you, because the purchases made in the market are immediately reflected here. Another is CDD and eiCDD. Just considering these metrics alone will greatly positively affect your success rate.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates instantly.