Quantum computing raises discussions about the security of Satoshi Nakamoto’s 1 million bitcoin and the potential freezing of assets.

Concerns over the security of Bitcoin’s earliest transaction formats have reignited discussions about the fate of Satoshi Nakamoto’s 1 million BTC. Advancements in quantum computing pose potential threats to the cryptocurrency.

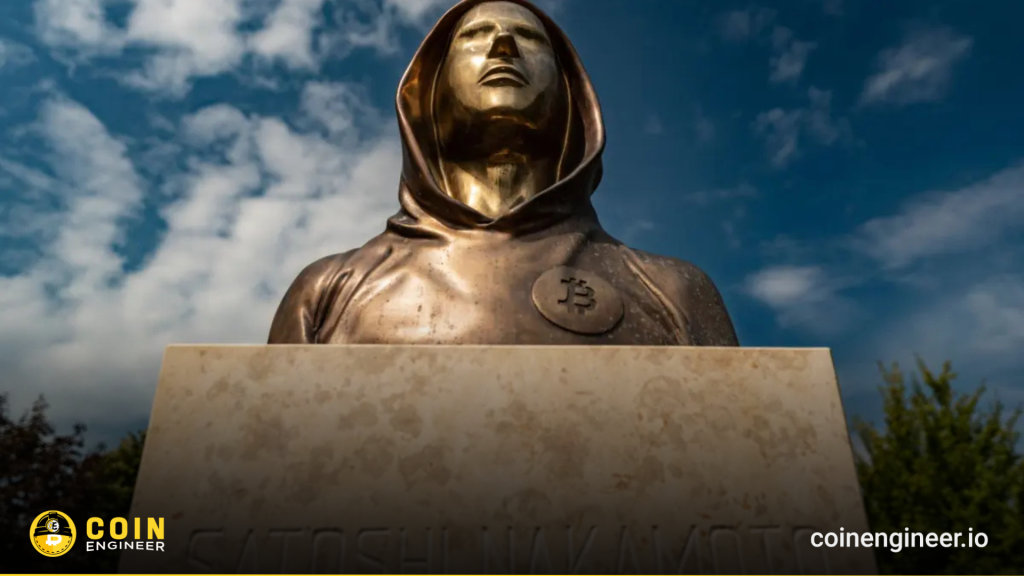

Should Satoshi’s 1 Million Bitcoin Be Frozen?

A segment of the crypto community is increasingly raising this question as quantum computing continues to develop. The concerns stem from the vulnerability of Bitcoin’s earliest transaction format, which includes public keys (P2PK) that are exposed on the blockchain.

According to Emir Sirer, founder and CEO of Ava Labs, unlike modern pay-to-public-key-hash (P2PKH) outputs, older P2PK transactions could potentially be exploited by quantum computers capable of deriving private keys from public keys.

While some view freezing Satoshi’s coins as a necessary precaution, others argue that it would go against BTC’s principles of decentralization and immutability. Regardless, Satoshi’s 1 million BTC remains a high-value target for quantum attackers that could potentially disrupt the market.

Are The Coins Vulnerable?

Satoshi’s BTC are stored in the earliest P2PK outputs, which are no longer commonly used and expose the owner’s public key.

With the introduction of P2PKH, which hides public keys behind a hash until the coins are spent, attacking using quantum computing became significantly more complex compared to targeting an unprotected public key.

While P2PK outputs’ vulnerability to quantum threats isn’t an issue yet, advancements in quantum computing and the potential for such attacks to become feasible could pose a threat in the future

Freezing Satoshi’s 1 Million BTC

The ability to freeze Satoshi’s holdings would require changing Bitcoin’s consensus rules to make specific unspent transaction outputs (UTXOs) unspendable. This process involves developers drafting a Bitcoin Improvement Proposal (BIP), clearly identifying Satoshi’s vulnerable P2PK outputs, and obtaining approval to enforce the freeze.

If approved, the freeze function could be implemented via a soft fork, which is optional for nodes but driven by consensus, or through a hard fork that would completely overhaul the underlying code of the BTC blockchain. While technically possible, freezing the coins associated with Satoshi would require broad community consensus, which has historically been a challenging issue for BTC.

What Could Happen If It Is Frozen?

Freezing Satoshi’s assets raises an important issue that questions the fundamental philosophy behind the creation of cryptocurrencies.

- Bitcoin was designed as an immutable ledger where no entity can alter the network’s history. However, this principle would be contradicted if assets were frozen through a fork, potentially exposing the Bitcoin blockchain to future interventions and the risk of collapsing decentralization.

- Proponents argue that Satoshi’s coins could be an exceptional case due to their public key exposure and the potential impact on the wider crypto market.

- Given the advancements in quantum computers and the potential for quantum attacks on the 1 million BTC cache, could such an event force Satoshi to reveal their identity?

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.